Emergence of 5G Technology

The advent of 5G technology is poised to transform the Telecom Service Assurance Market dramatically. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable a plethora of new applications, including IoT and smart city initiatives. However, the complexity of 5G networks necessitates advanced service assurance solutions to ensure seamless connectivity and performance. Telecom operators are likely to face challenges in managing the increased volume of data traffic and maintaining service quality. As a result, investments in service assurance technologies that can provide real-time insights and proactive management are anticipated to rise. This shift could lead to a market expansion, with projections indicating a potential increase in service assurance spending by telecom operators as they adapt to the 5G landscape.

Regulatory Compliance and Standards

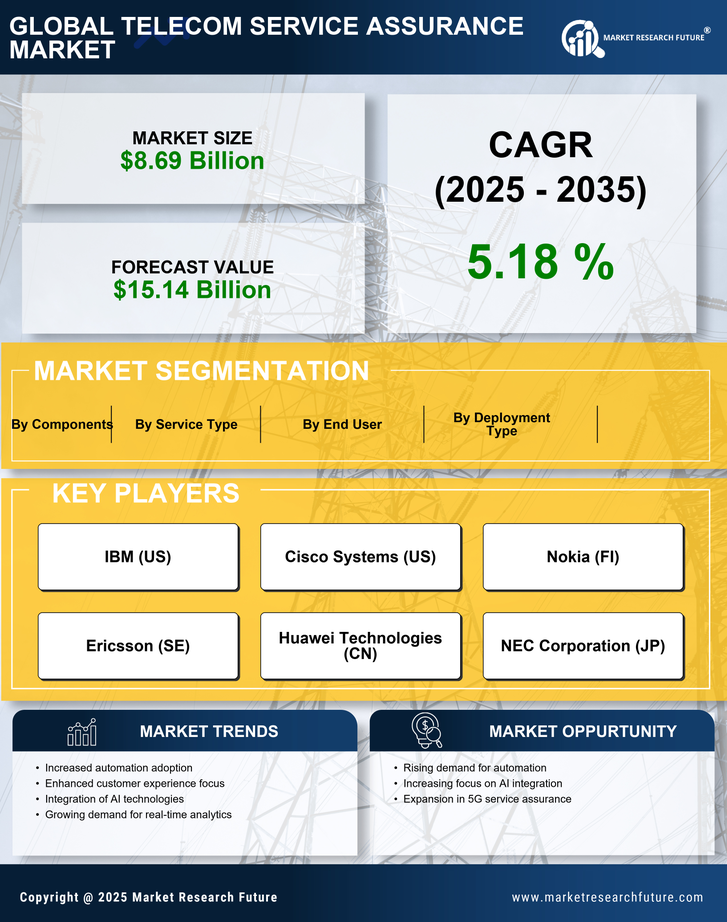

The Telecom Service Assurance Market is significantly influenced by the need for regulatory compliance and adherence to industry standards. Telecommunications operators are increasingly required to meet stringent regulations regarding service quality, data privacy, and security. For instance, regulatory bodies are mandating that operators maintain specific service level agreements (SLAs) to protect consumer interests. This regulatory landscape compels telecom companies to invest in comprehensive service assurance solutions that can monitor compliance and generate necessary reports. As a result, the market for service assurance tools is expected to grow, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This focus on compliance not only enhances service reliability but also fosters consumer trust.

Rising Demand for Enhanced Network Performance

The Telecom Service Assurance Market is experiencing a notable surge in demand for enhanced network performance. As telecommunications networks become increasingly complex, operators are compelled to ensure optimal service delivery. This demand is driven by the proliferation of data-intensive applications and the growing reliance on mobile connectivity. According to recent data, the number of mobile subscribers is projected to reach 5.7 billion by 2025, necessitating robust service assurance mechanisms. Consequently, telecom operators are investing in advanced monitoring and analytics tools to preemptively identify and resolve network issues, thereby improving overall service quality. This trend underscores the critical role of service assurance in maintaining competitive advantage in a saturated market.

Adoption of Advanced Analytics and AI Solutions

The integration of advanced analytics and artificial intelligence (AI) solutions is reshaping the Telecom Service Assurance Market. Operators are increasingly leveraging these technologies to gain deeper insights into network performance and customer behavior. AI-driven analytics can facilitate predictive maintenance, enabling telecom companies to identify potential issues before they escalate into service disruptions. This proactive approach not only enhances service reliability but also optimizes operational efficiency. Market data suggests that the adoption of AI in telecom service assurance is expected to grow significantly, with forecasts indicating a potential market size increase of over 15% by 2026. This trend highlights the critical role of technology in driving innovation and improving service assurance outcomes.

Growing Importance of Customer Experience Management

In the Telecom Service Assurance Market, the growing emphasis on customer experience management is becoming increasingly apparent. As competition intensifies, telecom operators recognize that delivering superior customer experiences is essential for retention and brand loyalty. Service assurance plays a pivotal role in this context, as it enables operators to monitor service quality from the end-user perspective. By leveraging analytics and feedback mechanisms, telecom companies can identify pain points and address them proactively. This focus on customer experience is reflected in market trends, with a significant portion of telecom budgets now allocated to enhancing service assurance capabilities. Consequently, the market is likely to witness a shift towards solutions that prioritize customer satisfaction and engagement.