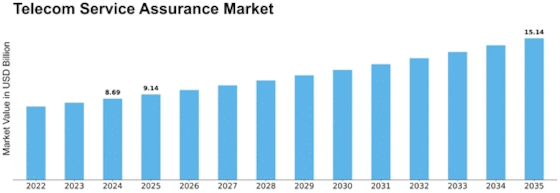

Telecom Service Assurance Size

Telecom Service Assurance Market Growth Projections and Opportunities

A fluctuating situation marks the telecom service assurance market because of the growing intricacy of telecommunication networks, the quest for excellent services, and the need to monitor problems proactively. The driving factors behind these dynamics are mainly perpetuated by the ever-increasing network infrastructure as well as variability in services offered by telecom operators. It has become imperative to offer superior customer experiences on the basis of its importance in shaping one of the main drivers of this market. Among others, 5G, IoT, and edge computing are new technologies that have been increasing at high rates and thus majorly affecting the dynamics of this market. With 5G networks being rolled out, challenges arise that are further complicated in terms of optimizing network performance and delivering quality service levels. Service assurance solutions play a key role in monitoring different elements of 5G networks like radio access, core network, and edge computing, among others, which help operators realize increased speeds, low latencies, and improved connectivity. The telecom service assurance market is made up of established vendors and niche players who provide diverse products for customers. As such, suppliers have always sought to improve their products for telecom carriers through analytics-based approaches using AI or ML algorithms embedded within their service assurance solutions. Another issue is how Telecommunication companies now focus more on network automation and virtualization due to some reasons behind them switching from traditional infrastructures towards virtualized network functions (VNF) and software-defined networking (SDN). The necessity lies in adapting service assurance solutions to virtualized or software-defined environments when moving into these next-generation network architectures. When it comes to regulatory compliance, the need for efficient resource use was also noted as a driving force behind the widespread adoption of telecommunication system management aids. Various legal requirements put stringent conditions concerning data privacy together with security standards that must be met before a company can be accredited to provide any form of communication over its platform. In summary, the telecom service assurance market can be expected to continue growing as telecom networks change and operators strive to meet the needs of a connected society that is data-driven. With AI and ML technologies being introduced, service assurance solutions will be more predictive and prescriptive, anticipating problems before they impact service quality. Finally, the demand for such robust products can further intensify with 5G technology still on its way and Internet of Things (IoT) devices being deployed in large numbers, thus requiring stronger assurance systems.

Leave a Comment