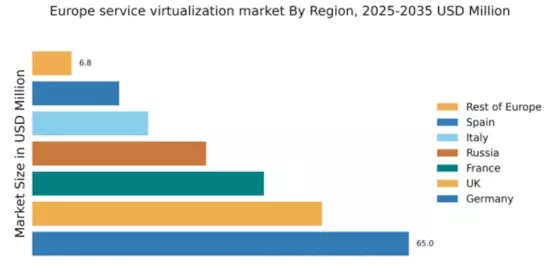

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 65.0% market share in the service virtualization sector, valued at approximately €1.3 billion. Key growth drivers include a robust IT infrastructure, increasing demand for cloud services, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing cybersecurity and data protection, fostering a conducive atmosphere for service virtualization adoption.

UK : Innovation and Investment at Forefront

The UK boasts a 50.0% market share in service virtualization, valued at around €800 million. Growth is driven by a surge in digital services, increased investment in IT infrastructure, and a strong focus on agile methodologies. The UK government supports innovation through various funding programs, while regulatory frameworks ensure compliance with data protection laws, enhancing consumer trust in virtualization solutions.

France : Strong Demand and Regulatory Support

France captures a 40.0% market share in the service virtualization market, valued at approximately €600 million. The growth is fueled by rising demand for automation in software testing and development processes. Government initiatives, such as the Digital France 2025 plan, aim to bolster the digital economy, while regulatory policies ensure data privacy and security, creating a favorable environment for service virtualization.

Russia : Regulatory Landscape Influences Growth

Russia holds a 30.0% market share in the service virtualization sector, valued at about €400 million. Key growth drivers include increasing investments in IT infrastructure and a push for digital transformation across industries. However, regulatory challenges, including data localization laws, impact market dynamics. The government is actively promoting technology adoption, which is essential for the sector's growth.

Italy : Focus on Digital Transformation Initiatives

Italy has a 20.0% market share in the service virtualization market, valued at approximately €300 million. Growth is driven by the increasing adoption of cloud technologies and digital transformation initiatives across various sectors. The Italian government supports innovation through funding programs, while regulatory frameworks ensure compliance with EU data protection standards, fostering a secure environment for service virtualization.

Spain : Investment in IT Infrastructure Rising

Spain captures a 15.0% market share in the service virtualization sector, valued at around €200 million. The market is driven by rising investments in IT infrastructure and a growing demand for agile software development practices. Government initiatives aimed at enhancing digital skills and promoting technology adoption are crucial for market growth, while regulatory policies ensure data protection and compliance.

Rest of Europe : Potential in Emerging Economies

The Rest of Europe holds a 6.8% market share in the service virtualization market, valued at approximately €100 million. Growth is uneven, with emerging economies showing potential due to increasing digitalization efforts. Regulatory frameworks vary significantly, impacting market dynamics. Local players are beginning to emerge, focusing on niche applications in sectors like finance and healthcare, which are critical for driving demand.