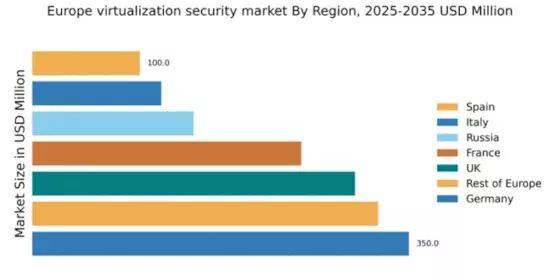

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European virtualization security market, accounting for 35% of the total market share with a value of $350.0 million. Key growth drivers include a robust industrial base, increasing cyber threats, and a strong emphasis on data protection regulations like the GDPR. The demand for virtualization security solutions is rising, particularly in sectors such as finance and manufacturing, where data integrity is paramount. Government initiatives promoting digital transformation further bolster market growth, supported by advanced infrastructure and a skilled workforce.

UK : Innovation and Regulatory Support

The UK virtualization security market is valued at $300.0 million, representing 30% of the European market. Growth is driven by increasing cloud adoption and stringent regulatory requirements, including the UK Data Protection Act. Demand is particularly strong in sectors like healthcare and finance, where data security is critical. The UK government has launched initiatives to enhance cybersecurity resilience, fostering a favorable environment for market expansion and innovation in security technologies.

France : Strong Regulatory Framework and Demand

France's virtualization security market is valued at $250.0 million, capturing 25% of the European market. Key growth drivers include a strong regulatory framework, particularly the French Data Protection Act, and increasing investments in digital transformation across various sectors. The demand for virtualization security solutions is growing in industries such as telecommunications and retail, where data protection is essential. Government initiatives aimed at enhancing cybersecurity infrastructure further support market growth.

Russia : Regulatory Landscape and Growth Potential

Russia's virtualization security market is valued at $150.0 million, accounting for 15% of the European market. Growth is driven by increasing cyber threats and a focus on national security, leading to regulatory changes that promote local solutions. Demand is particularly strong in sectors like energy and telecommunications, where data security is critical. The competitive landscape includes both local and international players, with a growing emphasis on compliance with Russian cybersecurity laws.

Italy : Focus on Digital Transformation

Italy's virtualization security market is valued at $120.0 million, representing 12% of the European market. Key growth drivers include a recovering economy and increasing investments in digital infrastructure. The demand for virtualization security solutions is rising in sectors such as manufacturing and finance, where data protection is crucial. Government initiatives aimed at enhancing cybersecurity capabilities further support market growth, creating a favorable business environment for local and international players.

Spain : Investment in Cybersecurity Solutions

Spain's virtualization security market is valued at $100.0 million, capturing 10% of the European market. Growth is driven by increasing awareness of cybersecurity threats and government initiatives promoting digital security. Demand is particularly strong in sectors like tourism and finance, where data protection is essential. The competitive landscape includes both local and international players, with a focus on innovative solutions to meet the evolving needs of businesses.

Rest of Europe : Regional Growth and Innovation Trends

The Rest of Europe virtualization security market is valued at $321.33 million, representing a diverse landscape with varying growth dynamics. Key growth drivers include increasing digitalization and regulatory frameworks that promote cybersecurity. Demand trends vary by country, with strong growth in sectors such as healthcare and finance. The competitive landscape features a mix of local and international players, each adapting to unique market conditions and regulatory environments.