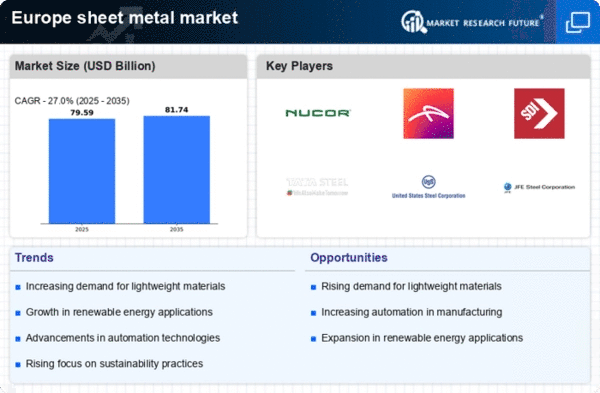

Growth in Renewable Energy Sector

The renewable energy sector in Europe is witnessing substantial growth, which is positively impacting the sheet metal market. As countries strive to meet their renewable energy targets, investments in solar, wind, and other renewable technologies are increasing. In 2025, the renewable energy sector is projected to account for around 20% of the total demand for sheet metal products. This growth is driven by the need for durable and efficient materials that can withstand harsh environmental conditions. Sheet metal is essential in the construction of solar panels, wind turbines, and other renewable energy infrastructures. The ongoing transition towards cleaner energy sources is likely to create new opportunities for manufacturers in the sheet metal market, as they adapt their offerings to meet the specific requirements of this evolving sector.

Rising Demand in Automotive Sector

The automotive sector in Europe is experiencing a notable surge in demand for lightweight materials, particularly in the sheet metal market. This trend is driven by the need for improved fuel efficiency and reduced emissions, as manufacturers strive to meet stringent environmental regulations. In 2025, the automotive industry is projected to account for approximately 30% of the total demand for sheet metal products in Europe. As electric vehicles gain traction, the requirement for advanced sheet metal components is likely to increase, further propelling market growth. The shift towards electric mobility necessitates innovative designs and materials, which could lead to increased investments in the sheet metal market. Consequently, manufacturers are expected to adapt their production processes to cater to this evolving demand, ensuring they remain competitive in a rapidly changing landscape.

Regulatory Compliance and Standards

Regulatory compliance and standards are becoming increasingly critical for the sheet metal market in Europe. Stricter regulations regarding environmental impact, safety, and quality are prompting manufacturers to enhance their processes and products. In 2025, it is expected that compliance with these regulations will drive a 10% increase in the demand for high-quality sheet metal materials. Companies that prioritize adherence to these standards are likely to gain a competitive edge, as customers increasingly seek reliable and sustainable solutions. Additionally, the emphasis on quality assurance and certification may lead to the development of new products and innovations within the sheet metal market. As the regulatory landscape continues to evolve, manufacturers must remain agile and responsive to maintain compliance and capitalize on emerging opportunities.

Infrastructure Development Initiatives

Infrastructure development initiatives across Europe are significantly influencing the sheet metal market. Governments are investing heavily in upgrading transportation networks, energy facilities, and public buildings, which in turn drives the demand for sheet metal products. In 2025, it is estimated that infrastructure projects will contribute to a 25% increase in the consumption of sheet metal materials. The focus on sustainable construction practices is also prompting the use of high-quality, durable sheet metal solutions. As urbanization continues to rise, the need for robust infrastructure is likely to escalate, creating further opportunities for growth within the sheet metal market. Additionally, the integration of smart technologies in construction projects may lead to innovative applications of sheet metal, enhancing its appeal and functionality in modern infrastructure.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the sheet metal market in Europe. Advancements such as automation, robotics, and digitalization are enhancing production efficiency and reducing costs. In 2025, it is anticipated that the adoption of Industry 4.0 technologies will lead to a 15% increase in productivity within the sheet metal sector. These innovations enable manufacturers to produce high-quality products with greater precision and speed, catering to the diverse needs of various industries. Furthermore, the integration of smart technologies allows for real-time monitoring and data analysis, facilitating better decision-making and resource management. As manufacturers embrace these technological advancements, the sheet metal market is likely to experience increased competitiveness and growth opportunities.