Seasonal Demand Fluctuations

The swimming pool-treatment-chemicals market experiences notable seasonal demand fluctuations, particularly during the warmer months. In Europe, the peak swimming season typically spans from May to September, resulting in increased sales of treatment chemicals during this period. Data indicates that sales can surge by as much as 40% during peak months compared to off-peak seasons. This seasonal pattern necessitates strategic planning by manufacturers and distributors to ensure adequate supply and meet the heightened demand. Understanding these fluctuations is crucial for stakeholders aiming to optimize their market strategies.

Health and Wellness Awareness

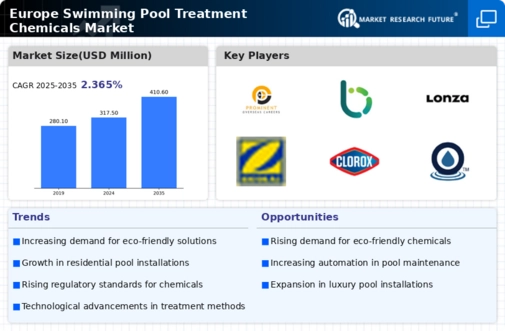

There is a growing awareness of health and wellness among European consumers, which is influencing the swimming pool-treatment-chemicals market. As more people recognize the benefits of swimming for physical fitness and mental well-being, the demand for clean and safe swimming environments increases. This heightened focus on health has led to a rise in the use of advanced treatment chemicals that ensure water quality and safety. Market data indicates that the health and wellness sector is projected to grow by 10% annually, further propelling the need for effective pool treatment solutions.

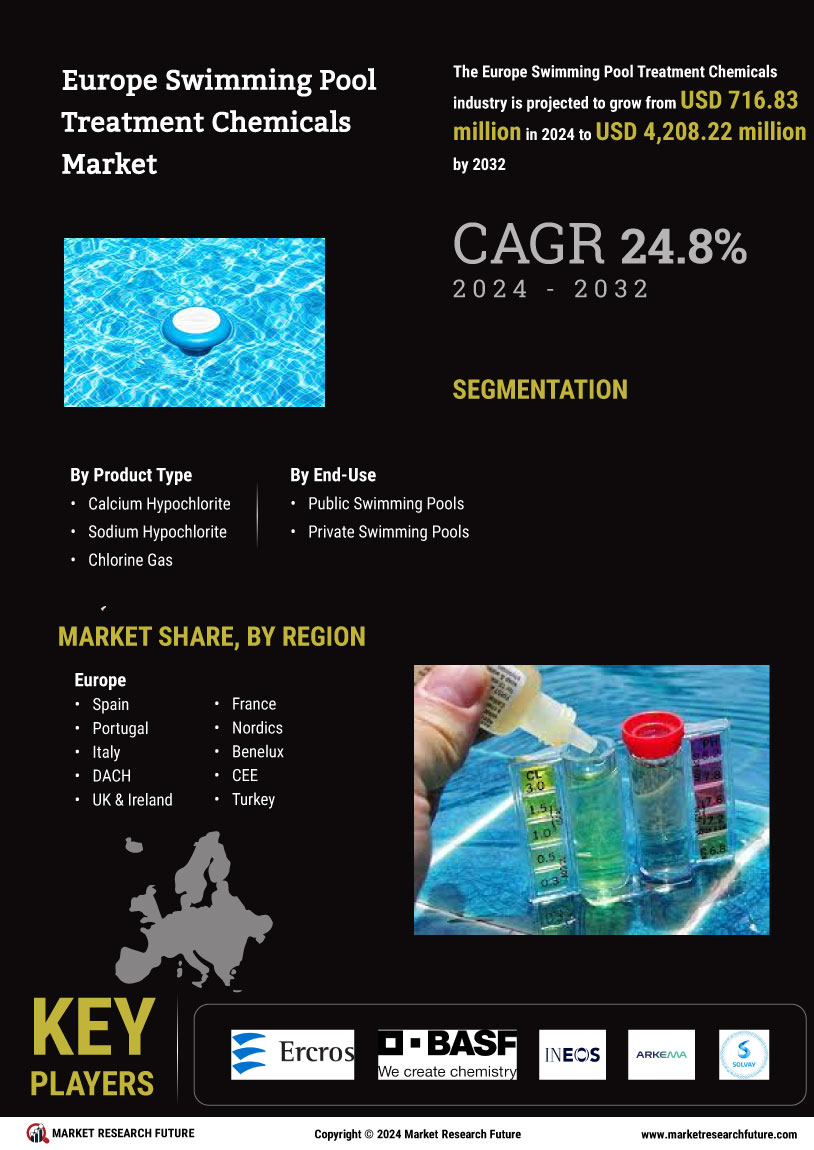

Rising Demand for Residential Pools

The increasing trend of homeownership in Europe has led to a notable rise in the construction of residential swimming pools. This surge in demand for private pools is driving the swimming pool-treatment-chemicals market, as homeowners seek to maintain clean and safe water. According to recent data, the number of residential pools in Europe has grown by approximately 15% over the past five years. Consequently, the need for effective treatment chemicals, such as chlorine and algaecides, has escalated. This trend is likely to continue, as more individuals invest in their properties, thereby enhancing the market's growth potential.

Environmental Regulations and Standards

The implementation of stringent environmental regulations in Europe is shaping the swimming pool-treatment-chemicals market. Regulatory bodies are increasingly focusing on the environmental impact of pool chemicals, leading to a demand for eco-friendly alternatives. This shift is prompting manufacturers to innovate and develop sustainable treatment solutions that comply with new regulations. Market analysis suggests that the eco-friendly segment of the swimming pool-treatment-chemicals market is expected to grow by 20% over the next five years, as consumers and businesses alike seek to minimize their ecological footprint.

Technological Advancements in Pool Maintenance

Innovations in pool maintenance technology are significantly impacting the swimming pool-treatment-chemicals market. The introduction of automated systems and smart pool technologies has streamlined the process of water treatment and monitoring. These advancements not only enhance efficiency but also reduce the amount of chemicals required for effective treatment. For instance, the use of automated chemical dispensers can optimize chemical usage by up to 30%, leading to cost savings for pool owners. As these technologies become more prevalent, they are likely to drive the demand for specialized treatment chemicals that cater to automated systems.