Growth in Agrochemical Production

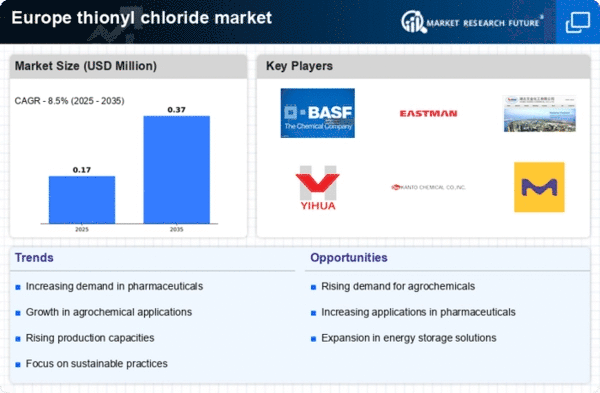

The thionyl chloride market in Europe is witnessing growth driven by the expanding agrochemical production sector. Thionyl chloride is utilized in the synthesis of various agrochemicals, including herbicides and insecticides, which are essential for modern agriculture. Recent statistics indicate that the agrochemical industry has seen a growth rate of approximately 10% annually, leading to increased demand for thionyl chloride as a key ingredient. This trend is further supported by the rising need for food security and sustainable agricultural practices across Europe. As the thionyl chloride market aligns itself with these agricultural advancements, it is likely to experience sustained growth, reflecting the compound's integral role in enhancing crop yields and pest management.

Rising Demand in Chemical Synthesis

The thionyl chloride market in Europe is experiencing a notable increase in demand due to its critical role in chemical synthesis processes. This compound is widely utilized in the production of various chemicals, including phosphonates and sulfides, which are essential in agrochemicals and pharmaceuticals. The market data indicates that the demand for thionyl chloride in chemical synthesis has surged by approximately 15% over the past year, driven by the growing need for efficient and effective chemical intermediates. As industries seek to enhance their production capabilities, the thionyl chloride market is poised for further growth, with projections suggesting a continued upward trajectory in the coming years. This trend underscores the importance of thionyl chloride as a key reagent in the chemical manufacturing sector.

Technological Innovations in Production

Technological advancements in the production processes of thionyl chloride are contributing to the market's growth in Europe. Innovations such as improved synthesis methods and enhanced safety protocols are making the production of thionyl chloride more efficient and cost-effective. Recent developments suggest that these technological improvements could reduce production costs by up to 20%, thereby making thionyl chloride more accessible to various industries. The thionyl chloride market is likely to benefit from these innovations, as they not only enhance production efficiency but also address safety and environmental concerns associated with chemical manufacturing. As a result, the market may see an influx of new players and increased competition, further stimulating growth.

Expansion of Pharmaceutical Applications

The pharmaceutical sector in Europe is increasingly relying on thionyl chloride for the synthesis of active pharmaceutical ingredients (APIs). This reliance is attributed to the compound's ability to facilitate the formation of complex molecular structures, which are often required in drug development. Recent market analysis reveals that the pharmaceutical industry accounts for nearly 30% of the total thionyl chloride consumption in Europe. As the demand for innovative therapies rises, the thionyl chloride market is expected to benefit significantly from this trend. Furthermore, the ongoing research and development activities in the pharmaceutical sector are likely to create new opportunities for thionyl chloride applications, thereby enhancing its market presence and driving growth in the coming years.

Increasing Regulatory Support for Chemical Industries

The regulatory landscape in Europe is becoming increasingly supportive of the chemical industries, which is positively impacting the thionyl chloride market. Recent policy changes aimed at promoting sustainable practices and reducing environmental impact are encouraging manufacturers to adopt safer and more efficient production methods. This regulatory support is expected to enhance the competitiveness of the thionyl chloride market, as companies that comply with these regulations may gain a significant market advantage. Furthermore, the alignment of industry practices with regulatory expectations could lead to increased investment in research and development, fostering innovation and growth within the thionyl chloride market. As such, the evolving regulatory framework is likely to play a crucial role in shaping the future of this market.