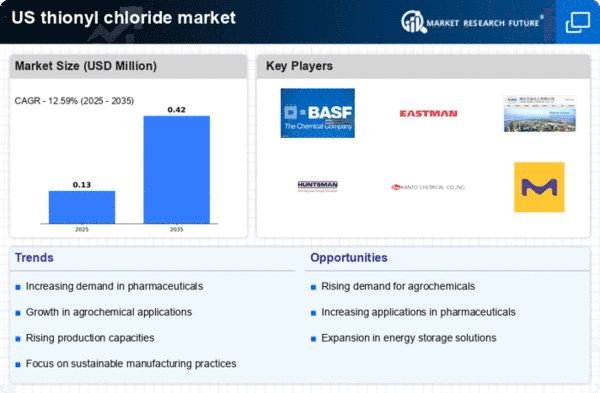

The thionyl chloride market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by increasing demand in various applications such as pharmaceuticals, agrochemicals, and specialty chemicals. Key growth drivers include the rising need for efficient chemical synthesis and the expansion of end-user industries. Major companies like BASF SE (Germany), Eastman Chemical Company (US), and Huntsman Corporation (US) are strategically positioned to leverage their extensive product portfolios and innovation capabilities. Their operational focus on sustainability and digital transformation appears to be shaping the competitive environment, fostering a landscape where technological advancements and eco-friendly practices are becoming paramount.In terms of business tactics, companies are increasingly localizing manufacturing to enhance supply chain efficiency and reduce operational costs. The market structure is moderately fragmented, with a mix of large multinational corporations and smaller regional players. This fragmentation allows for diverse competitive strategies, where key players influence market dynamics through strategic partnerships and collaborations, thereby enhancing their market presence and operational capabilities.

In October BASF SE (Germany) announced the launch of a new production facility aimed at increasing its thionyl chloride output by 30%. This strategic move is expected to bolster its market share and meet the growing demand from the pharmaceutical sector. The investment reflects BASF's commitment to innovation and operational excellence, positioning the company to capitalize on emerging market opportunities.

In September Eastman Chemical Company (US) entered into a strategic partnership with a leading agrochemical firm to develop sustainable thionyl chloride derivatives. This collaboration is likely to enhance Eastman's product offerings and align with the increasing regulatory focus on environmentally friendly chemicals. The partnership underscores the importance of innovation in maintaining competitive advantage in a rapidly evolving market.

In August Huntsman Corporation (US) expanded its thionyl chloride production capacity in response to rising demand from the specialty chemicals sector. This expansion is indicative of Huntsman's proactive approach to market dynamics, allowing the company to strengthen its supply chain and improve service delivery to its customers. Such strategic actions are essential for maintaining competitiveness in a market that is increasingly driven by customer-centric solutions.

As of November current competitive trends in the thionyl chloride market are heavily influenced by digitalization, sustainability initiatives, and the integration of AI technologies. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to drive innovation. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological advancements, sustainability, and supply chain reliability, suggesting a transformative shift in how companies position themselves in the market.