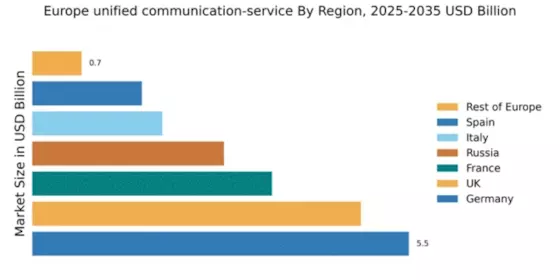

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 5.5% market share in the unified communication-service sector, valued at approximately €2.5 billion. Key growth drivers include a robust digital transformation agenda, increased remote work adoption, and significant investments in IT infrastructure. Regulatory support from the German government, particularly in data protection and cybersecurity, fosters a conducive environment for market expansion. The demand for integrated communication solutions is rising, driven by the need for seamless collaboration across industries.

UK : Innovation and Competition Fuel Growth

The UK boasts a 4.8% market share in the unified communication-service market, valued at around €2.2 billion. Growth is propelled by a strong emphasis on innovation, with businesses increasingly adopting cloud-based solutions. The UK government has initiated several digital initiatives aimed at enhancing connectivity and supporting tech startups. The demand for flexible communication tools is evident, particularly in sectors like finance and education, where remote collaboration is essential.

France : Diverse Industries Drive Market Demand

France captures a 3.5% market share in the unified communication-service market, valued at approximately €1.6 billion. The growth is driven by the increasing need for digital collaboration tools across various sectors, including healthcare and retail. Government initiatives promoting digital innovation and infrastructure improvements are pivotal in shaping the market landscape. The demand for user-friendly and secure communication platforms is on the rise, reflecting changing consumer preferences.

Russia : Regulatory Landscape Influences Growth

Russia holds a 2.8% market share in the unified communication-service market, valued at about €1.3 billion. Key growth drivers include the increasing adoption of digital communication tools in both public and private sectors. However, regulatory challenges and data localization laws impact market dynamics. The demand for secure and compliant communication solutions is rising, particularly in industries like finance and government, where data security is paramount.

Italy : Cultural Shifts Enhance Market Potential

Italy accounts for a 1.9% market share in the unified communication-service market, valued at approximately €900 million. Growth is driven by cultural shifts towards remote work and digital collaboration, particularly in sectors like manufacturing and tourism. Government initiatives aimed at enhancing digital infrastructure are crucial for market development. The demand for integrated communication solutions is increasing, reflecting the need for efficiency and productivity in business operations.

Spain : Digital Transformation Fuels Demand

Spain has a 1.6% market share in the unified communication-service market, valued at around €700 million. The market is evolving rapidly, driven by digital transformation initiatives across various sectors, including education and healthcare. Government support for technology adoption and infrastructure development plays a significant role in market growth. The demand for collaborative tools is increasing, particularly among SMEs looking to enhance operational efficiency.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe holds a 0.72% market share in the unified communication-service market, valued at approximately €300 million. This fragmented market presents diverse needs and growth opportunities across different countries. Key growth drivers include varying levels of digital adoption and government initiatives aimed at enhancing connectivity. The demand for tailored communication solutions is evident, particularly in emerging markets where businesses are transitioning to digital platforms.