Increasing Healthcare Expenditure

The upward trend in healthcare expenditure across Europe is a significant driver for the urinary catheters market. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of medical devices such as urinary catheters. In 2025, healthcare spending in Europe is projected to reach approximately €2.5 trillion, reflecting a growth rate of around 4% annually. This increase in funding allows for better access to advanced medical technologies and improved patient care. As healthcare facilities expand their services and enhance their capabilities, the demand for urinary catheters is likely to rise. Consequently, the urinary catheters market stands to benefit from this increased investment in healthcare services and technologies.

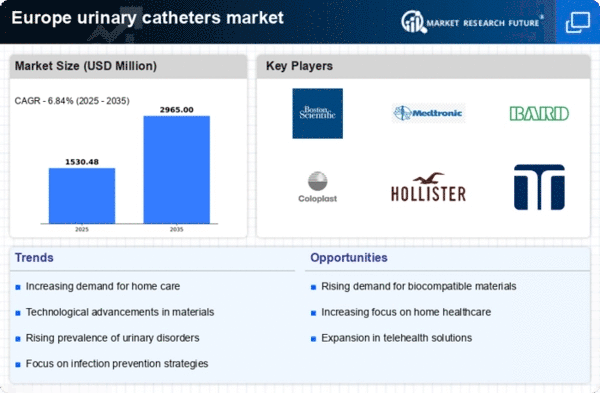

Rising Incidence of Urinary Disorders

The increasing prevalence of urinary disorders in Europe is a primary driver for the urinary catheters market. Conditions such as urinary incontinence, benign prostatic hyperplasia, and urinary tract infections are becoming more common, particularly among the aging population. According to recent estimates, approximately 30% of adults over 65 experience some form of urinary incontinence, which necessitates the use of catheters. This growing patient demographic is likely to propel demand for urinary catheters, as healthcare providers seek effective solutions to manage these conditions. Furthermore, the rising awareness of treatment options and the importance of maintaining quality of life for patients are expected to contribute to market growth. As a result, the urinary catheters market is poised for expansion in response to these increasing healthcare needs.

Growing Awareness of Infection Control

The heightened focus on infection control in healthcare settings is driving the urinary catheters market. With the rising incidence of catheter-associated urinary tract infections (CAUTIs), healthcare providers are prioritizing the use of catheters that minimize infection risks. Educational initiatives aimed at healthcare professionals and patients are promoting best practices in catheter use and maintenance. As a result, there is a growing demand for antimicrobial catheters and other infection-prevention technologies. The market for urinary catheters in Europe is likely to expand as healthcare facilities adopt these advanced products to enhance patient safety and reduce healthcare costs associated with infections. This trend underscores the importance of infection control measures in shaping the urinary catheters market.

Regulatory Support for Medical Devices

Regulatory frameworks in Europe are increasingly supportive of innovations in the medical device sector, including the urinary catheters market. The European Medicines Agency (EMA) and other regulatory bodies are streamlining approval processes for new catheter technologies, which encourages manufacturers to invest in research and development. This supportive environment is likely to lead to the introduction of safer and more effective urinary catheters in the market. Furthermore, compliance with stringent safety standards enhances consumer confidence in these products. As regulatory support continues to evolve, the urinary catheters market is expected to experience growth driven by the introduction of innovative solutions that meet the needs of healthcare providers and patients.

Technological Innovations in Catheter Design

Innovations in catheter technology are significantly influencing the urinary catheters market. Manufacturers are increasingly focusing on developing advanced catheters that enhance patient comfort and reduce the risk of complications. For instance, the introduction of hydrophilic-coated catheters has been shown to decrease friction and improve ease of use, which is particularly beneficial for patients with limited mobility. Additionally, smart catheters equipped with sensors for monitoring urinary output and detecting infections are emerging in the market. These advancements not only improve patient outcomes but also align with the growing trend towards personalized healthcare solutions. The market for urinary catheters in Europe is expected to witness substantial growth as these innovative products gain traction among healthcare providers and patients alike.