Focus on Infection Control

The focus on infection control within healthcare settings is a crucial driver for the urinary catheters market. In South Korea, healthcare facilities are increasingly implementing stringent protocols to minimize the risk of catheter-associated urinary tract infections (CAUTIs). This emphasis on infection prevention is leading to the adoption of advanced urinary catheters designed to reduce infection rates. For instance, antimicrobial catheters are gaining traction as they are believed to lower the incidence of CAUTIs. The urinary catheters market is likely to benefit from this trend, as healthcare providers prioritize products that enhance patient safety and reduce hospital-acquired infections. As awareness of infection control continues to grow, the demand for specialized urinary catheters is expected to rise.

Rising Geriatric Population

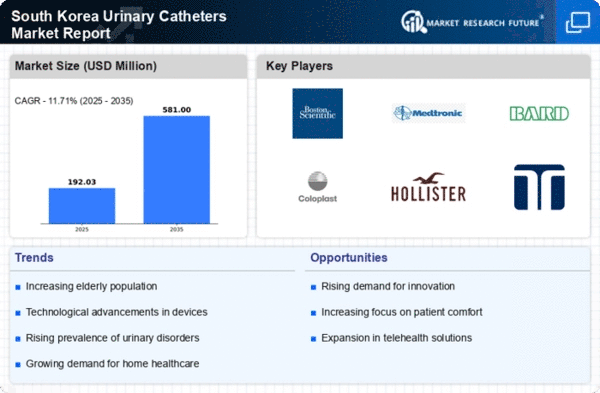

The increasing geriatric population in South Korea is a pivotal driver for the urinary catheters market. As the population ages, the prevalence of urinary incontinence and other related health issues rises, necessitating the use of urinary catheters. According to recent statistics, approximately 14% of the South Korean population is aged 65 and older, a figure projected to increase significantly in the coming years. This demographic shift is likely to create a higher demand for urinary catheters, as older adults often require assistance with urinary management. Furthermore, healthcare providers are increasingly focusing on improving the quality of life for elderly patients, which may further drive the adoption of urinary catheters. The urinary catheters market is thus positioned to benefit from this demographic trend, as it aligns with the growing need for effective urinary management solutions.

Increased Healthcare Expenditure

Increased healthcare expenditure in South Korea is a significant driver for the urinary catheters market. The South Korean government has been investing heavily in healthcare infrastructure and services, aiming to enhance the quality of care provided to patients. This investment has led to improved access to medical supplies, including urinary catheters. According to government reports, healthcare spending is projected to reach approximately 9% of GDP by 2026. This increase in funding is likely to facilitate the procurement of advanced urinary catheters, thereby expanding the market. Additionally, as healthcare facilities upgrade their equipment and supplies, the urinary catheters market stands to benefit from enhanced demand for high-quality products that meet the evolving needs of patients.

Growing Incidence of Chronic Diseases

The growing incidence of chronic diseases in South Korea is contributing to the expansion of the urinary catheters market. Conditions such as diabetes, neurological disorders, and prostate issues often lead to urinary complications, necessitating the use of catheters. Recent studies indicate that chronic diseases affect over 30% of the South Korean population, a figure that is expected to rise. This trend is likely to increase the demand for urinary catheters as healthcare providers seek effective solutions for managing urinary incontinence and related issues. The urinary catheters market is thus positioned to grow in response to the rising prevalence of these chronic conditions, as patients require reliable and efficient urinary management options.

Technological Innovations in Catheter Design

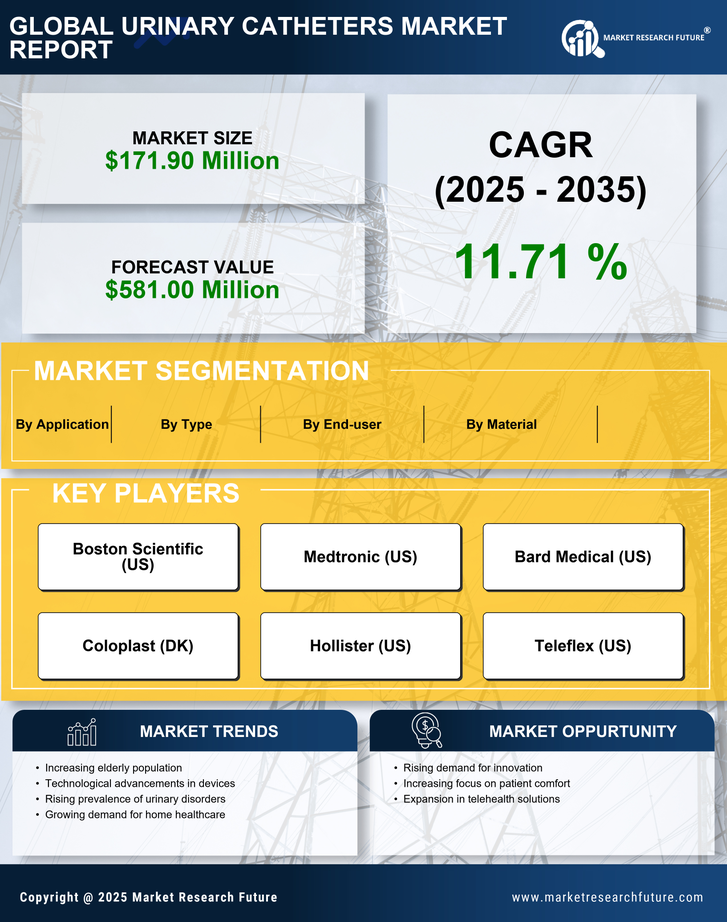

Technological innovations in catheter design are transforming the urinary catheters market. Recent advancements have led to the development of catheters that are more comfortable, easier to use, and less prone to complications such as infections. For instance, the introduction of hydrophilic-coated catheters has been shown to reduce friction and enhance patient comfort. In South Korea, the market for these advanced catheters is expected to grow, with estimates suggesting a CAGR of around 6% over the next five years. These innovations not only improve patient outcomes but also encourage healthcare providers to adopt newer technologies, thereby expanding the urinary catheters market. As hospitals and clinics increasingly prioritize patient-centered care, the demand for technologically advanced urinary catheters is likely to rise.