Aging Population

The demographic shift towards an aging population in Europe is significantly influencing the vitamins minerals-supplement market. As the population ages, there is an increasing prevalence of age-related health issues, which drives the demand for supplements that support bone health, cognitive function, and cardiovascular health. Reports indicate that by 2030, nearly 25% of the European population will be over 65 years old, creating a substantial market for products tailored to this demographic. This trend suggests that companies focusing on formulations that cater to the specific needs of older adults may find lucrative opportunities. Additionally, the aging population is likely to seek preventive measures to maintain health, further enhancing the market for vitamins and minerals.

E-commerce Growth

The rapid expansion of e-commerce platforms is transforming the vitamins minerals-supplement market in Europe. With the convenience of online shopping, consumers are increasingly purchasing supplements through digital channels. This shift is evidenced by a reported 30% increase in online sales of dietary supplements in 2024. E-commerce allows for a wider variety of products, competitive pricing, and easy access to customer reviews, which can influence purchasing decisions. Additionally, the COVID-19 pandemic has accelerated this trend, as more consumers have turned to online shopping for health products. As e-commerce continues to evolve, it is likely to play a crucial role in shaping consumer behavior and preferences in the vitamins minerals-supplement market.

Increasing Health Awareness

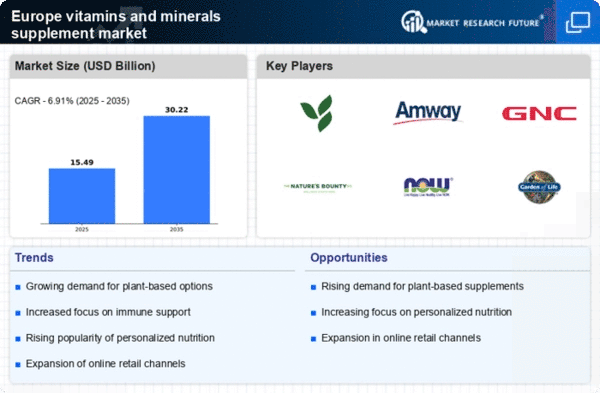

The growing awareness of health and wellness among consumers is a pivotal driver for the vitamins minerals-supplement market in Europe. As individuals become more informed about the benefits of vitamins and minerals, there is a noticeable shift towards preventive healthcare. This trend is reflected in the rising sales of dietary supplements, which reached approximately €10 billion in 2024. Consumers are increasingly seeking products that support their immune systems, enhance energy levels, and promote overall well-being. This heightened focus on health is likely to continue, as more people prioritize their nutritional intake, thereby propelling the demand for vitamins and minerals. Furthermore, educational campaigns and health initiatives by governments and organizations are expected to further bolster this trend, encouraging individuals to incorporate supplements into their daily routines.

Regulatory Support and Standards

Regulatory frameworks and standards are becoming increasingly important in the vitamins minerals-supplement market in Europe. Governments are implementing stricter regulations to ensure product safety, quality, and efficacy, which can enhance consumer trust. The European Food Safety Authority (EFSA) has established guidelines for health claims and nutrient levels, which are expected to shape product development and marketing strategies. This regulatory support may lead to a more transparent market, where consumers can make informed choices based on reliable information. Furthermore, companies that comply with these regulations may gain a competitive advantage, as consumers are likely to prefer products that meet high safety and quality standards. This trend indicates a growing emphasis on accountability and transparency within the industry.

Rising Interest in Plant-Based Diets

The shift towards plant-based diets is emerging as a significant driver for the vitamins minerals-supplement market in Europe. As more consumers adopt vegetarian and vegan lifestyles, there is a growing recognition of the need for supplementation to ensure adequate nutrient intake. For instance, deficiencies in Vitamin B12, iron, and omega-3 fatty acids are common among those following plant-based diets. This has led to an increase in the demand for supplements that provide these essential nutrients. Market data suggests that the plant-based supplement segment is expected to grow by over 15% annually through 2026, indicating a robust opportunity for brands that offer plant-derived vitamins and minerals. This trend not only reflects changing dietary preferences but also highlights the importance of nutritional education among consumers.