Rising E-commerce Demand

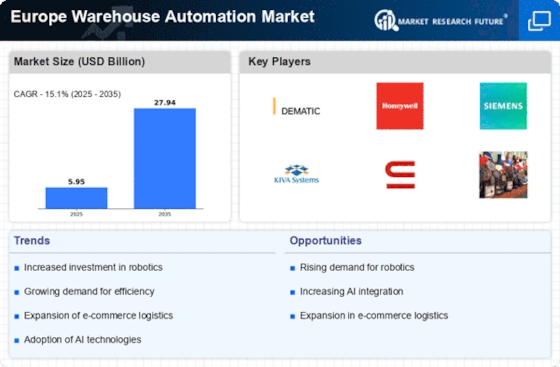

The surge in e-commerce activities across Europe is a primary driver for the Europe Warehouse Automation Market. As online shopping continues to gain traction, retailers are compelled to enhance their logistics and supply chain operations. This shift necessitates the adoption of automated systems to manage increased order volumes efficiently. According to recent data, the e-commerce sector in Europe is projected to grow at a compound annual growth rate of approximately 10% over the next few years. Consequently, warehouses are increasingly integrating automation technologies to streamline operations, reduce lead times, and improve order accuracy. This trend not only addresses the immediate demands of consumers but also positions companies competitively in a rapidly evolving market landscape.

Labor Shortages and Workforce Challenges

Labor shortages in Europe are becoming increasingly pronounced, significantly impacting the Europe Warehouse Automation Market. Many sectors are experiencing difficulties in attracting and retaining skilled labor, which has led to a pressing need for automation solutions. The logistics and warehousing sectors are particularly affected, as they require a workforce capable of managing complex operations. Automation technologies, such as robotics and automated guided vehicles, are being deployed to mitigate these challenges. By automating repetitive tasks, companies can maintain productivity levels while addressing workforce constraints. This trend is expected to continue, with many organizations viewing automation as a strategic investment to ensure operational resilience and efficiency.

Technological Advancements in Automation

Technological advancements are playing a pivotal role in shaping the Europe Warehouse Automation Market. Innovations in robotics, artificial intelligence, and machine learning are enabling warehouses to operate with greater efficiency and accuracy. For instance, the integration of AI-driven systems allows for real-time inventory management and predictive analytics, which can optimize supply chain operations. Furthermore, the development of collaborative robots, or cobots, is enhancing human-robot interaction, making automation more accessible to various warehouse environments. As these technologies evolve, they are likely to drive further investment in automation solutions, with many companies recognizing the potential for increased productivity and reduced operational costs.

Increased Focus on Supply Chain Resilience

The emphasis on supply chain resilience is a critical driver for the Europe Warehouse Automation Market. Recent disruptions in global supply chains have highlighted the need for more robust and adaptable logistics solutions. Companies are increasingly investing in automation technologies to enhance their supply chain agility and responsiveness. By implementing automated systems, businesses can better manage fluctuations in demand and supply, ensuring continuity of operations. This focus on resilience is expected to drive significant growth in the automation sector, as organizations seek to build more flexible and responsive supply chains capable of withstanding future challenges.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Europe Warehouse Automation Market. As governments implement stricter regulations regarding workplace safety and environmental sustainability, companies are compelled to adopt automated solutions that meet these requirements. Automation technologies can enhance safety by reducing the risk of human error and minimizing workplace accidents. Additionally, automated systems can help organizations comply with environmental regulations by optimizing energy usage and reducing waste. This alignment with regulatory frameworks not only mitigates risks but also enhances corporate reputation, making automation an attractive option for businesses aiming to maintain compliance while improving operational efficiency.