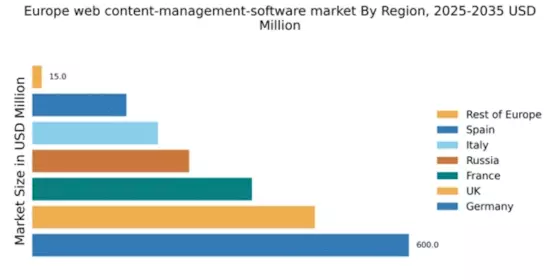

Germany : Robust Growth and Innovation Hub

Germany holds a dominant position in the European web content management software market, with a market value of $600.0 million, accounting for approximately 30% of the total market share. Key growth drivers include a strong digital economy, increasing demand for personalized content, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing data protection and cybersecurity, fostering a conducive atmosphere for tech investments. Infrastructure development, particularly in urban centers, further bolsters market growth.

UK : Innovation and User-Centric Solutions

Key markets include London, Manchester, and Birmingham, where a vibrant tech ecosystem thrives. Major players like Adobe and WordPress have a significant presence, competing with local firms. The competitive landscape is characterized by a mix of established brands and agile startups, fostering a dynamic business environment. Industries such as retail and media are particularly active in adopting CMS solutions.

France : Growth Driven by E-Commerce Trends

Key markets include Paris, Lyon, and Marseille, where tech startups and established companies coexist. Major players like Sitecore and Acquia are prominent, alongside local firms. The competitive landscape is vibrant, with a focus on tailored solutions for sectors such as retail, tourism, and media. The business environment is supportive, encouraging collaboration between tech companies and traditional industries.

Russia : Digital Transformation in Progress

Key markets include Moscow and St. Petersburg, where a burgeoning tech scene is evident. Major players like Joomla and Drupal are gaining traction, competing with local solutions. The competitive landscape is characterized by a mix of international and domestic firms, with a focus on sectors such as e-commerce and education. The business environment is improving, with increasing investments in digital infrastructure.

Italy : Focus on Localized Solutions

Key markets include Milan, Rome, and Turin, where a mix of traditional and digital businesses thrive. Major players like Wix and Joomla are present, alongside local startups. The competitive landscape is diverse, with a focus on tailored solutions for sectors such as fashion, tourism, and manufacturing. The business environment is evolving, with increasing collaboration between tech firms and traditional industries.

Spain : Growth in E-Commerce and Media

Key markets include Madrid and Barcelona, where a vibrant startup ecosystem is emerging. Major players like WordPress and Acquia are active, competing with local firms. The competitive landscape is characterized by a mix of established brands and agile startups, fostering innovation. Industries such as retail and media are particularly active in adopting CMS solutions.

Rest of Europe : Diverse Needs Across Regions

Key markets include smaller nations and regions with unique digital needs. The competitive landscape is fragmented, with local players often dominating. Major international firms have a limited presence, focusing on niche applications. The business environment varies widely, with some regions experiencing rapid digital adoption while others lag behind.