Rising Importance of Data Analytics

The workflow management-system market in Europe is increasingly influenced by the rising importance of data analytics. Organizations are recognizing the value of data-driven decision-making, which necessitates the integration of analytics capabilities within workflow management systems. Approximately 55% of European companies report that they utilize data analytics to enhance their operational processes. This trend suggests that businesses are seeking solutions that not only manage workflows but also provide insights into performance metrics and process efficiencies. As the demand for data analytics grows, workflow management system providers are likely to innovate their offerings, incorporating advanced analytics features that empower organizations to make informed decisions. This shift towards data-centric solutions is expected to drive growth in the market, as companies strive to leverage data for competitive advantage.

Rising Demand for Remote Work Solutions

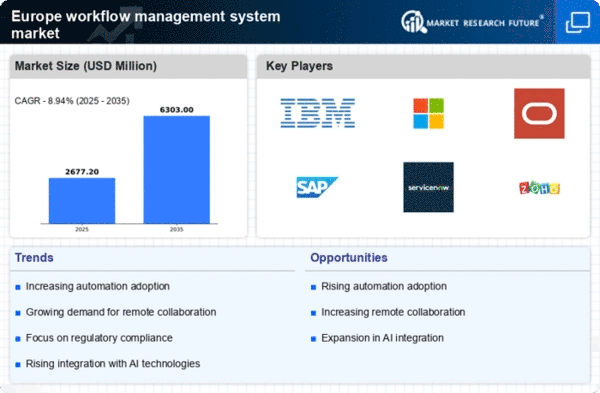

The workflow management-system market in Europe experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for efficient workflow management systems becomes paramount. According to recent data, approximately 60% of European companies have implemented remote work policies, driving the necessity for tools that facilitate collaboration and task management. This trend indicates a shift towards digital transformation, where businesses seek to enhance productivity and streamline operations. Consequently, the workflow management-system market is likely to expand as companies invest in technologies that support remote work, ensuring seamless communication and project tracking. The emphasis on remote work solutions is expected to shape the future landscape of the industry, fostering innovation and competition among providers.

Increased Focus on Operational Efficiency

The workflow management-system market in Europe is significantly influenced by the increasing focus on operational efficiency. Organizations are continuously seeking ways to optimize processes, reduce costs, and enhance productivity. Recent studies indicate that businesses that implement effective workflow management systems can achieve up to a 30% improvement in operational efficiency. This trend is particularly relevant in sectors such as manufacturing and logistics, where streamlined workflows can lead to substantial cost savings. As companies recognize the potential benefits of improved efficiency, the demand for advanced workflow management solutions is expected to rise. This shift not only drives market growth but also encourages the development of innovative features that cater to the evolving needs of businesses striving for operational excellence.

Growing Emphasis on Compliance and Regulation

In the context of the workflow management-system market in Europe, compliance with regulations is becoming increasingly critical. Organizations are under pressure to adhere to various legal and industry standards, which necessitates the implementation of robust workflow management systems. For instance, the General Data Protection Regulation (GDPR) has heightened the focus on data privacy and security, compelling businesses to adopt systems that ensure compliance. It is estimated that around 70% of European firms prioritize compliance-related features in their workflow management solutions. This growing emphasis on regulatory adherence not only drives demand for sophisticated systems but also encourages vendors to innovate and enhance their offerings. As a result, the workflow management-system market is likely to witness significant growth, as companies seek solutions that mitigate risks associated with non-compliance.

Technological Advancements in Software Solutions

Technological advancements play a pivotal role in shaping the workflow management-system market in Europe. The integration of cutting-edge technologies, such as cloud computing and mobile applications, enhances the functionality and accessibility of workflow management systems. Recent data suggests that the adoption of cloud-based solutions has increased by over 40% among European businesses, reflecting a shift towards more flexible and scalable systems. These advancements enable organizations to manage workflows more effectively, facilitating real-time collaboration and data sharing. As technology continues to evolve, the workflow management-system market is likely to benefit from innovations that improve user experience and system capabilities. This trend indicates a competitive landscape where providers must continuously adapt to technological changes to meet the demands of their clients.