Research Methodology on Exterior Wall System Market

The research methodology of this report is based on the empirical research conducted through primary and secondary sources to estimate a holistic view of the exterior wall system market. Primary sources such as experts from related industries, industry associations and company executives have been interviewed to obtain and validate the information. The survey includes a detailed range of questions related to the topic of the exterior wall system market. Secondary sources include Factiva, Bloomberg, Hoovers, etc. In addition, government publications, annual reports, company websites, press releases, and related publications have been considered in our survey.

Market Definition

Exterior wall systems include the components necessary to form a protective and decorative coating on the external walls of houses and other buildings. Such systems protect the building from external elements such as wind, rain, snow, and other weather conditions. Exterior walls are generally composed of three distinct layers: the weather-resistant layer, the insulation layer, and the inner layer. The outer layer of the exterior wall is the weather-resistant layer, which is lined with cladding (such as stone, brick, vinyl, wood, etc.), which is designed to protect the house from rain, wind, and other weather conditions. The insulation layer is usually composed of a layer of insulation, such as mineral wool or polystyrene, to provide thermal insulation. The inner layer is usually composed of drywall, plasterboard, or other suitable material.

Market scope

The scope of this report covers the exterior wall system market in terms of material, insulation, applications, region, end use, and construction type. A complete overview of the current market trend has been included. Moreover, the market size of the exterior wall system market in the next seven years has been estimated based on the market trend. The growth rate of this market has been calculated by considering the historic data and current market dynamics. The competitive landscape of the market has been discussed, which includes the current market position of major players.

Market segmentation

With an objective to provide a complete view of the global exterior wall system market, this report segments it based on the material type, insulation, applications, region, end use, and construction type.

- By Material Type: Wood, Steel, Cement, Glass, Others

- By Insulation: Glass Mineral Wool, Polyurethane Foam, XPS, Others

- By Application: Residential, Commercial, Industrial

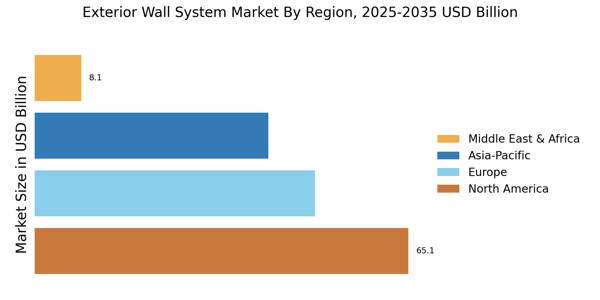

- By Region: North America, Europe, Asia Pacific, and the Rest of the World

- By End Use: Paint & Coatings, Sheet Metal Products, Insulation Products, Construction Services

6. By Construction Type: New Construction, Renovation

Data collection and sampling

Data collection and sampling methods were adopted to obtain the data used in the analysis. Data were collected through primary and secondary sources. The primary data were collected through detailed interviews conducted with industry experts, industry associations, and channel partners. After the initial data had been collected, data cleaning and standardization were carried out to ensure the accuracy and consistency of data sets. The secondary data were collected through websites, books, magazines, newspapers, etc.

Data analysis

The collected data was analyzed using various research techniques and tools such as Porter’s Five Forces Model, SWOT Analysis, Market Attractiveness Model, etc. Further, the market size estimation and assessment of market dynamics were carried out using SPSS and Microsoft Excel. The data were analyzed to arrive at the market size and potential growth opportunities.

Market forecasting

Market forecasting is based on the analysis of the data collected and the subsequent recommendations. The market forecast includes both short-term and long-term estimates, in terms of value and volume. The forecasting has been done using the SPSS software. Furthermore, market forecasting is done by taking into consideration various factors such as trends, industry analysis, business strategies of the key players, and risk factors. The forecast period is from 2023 to 2030.