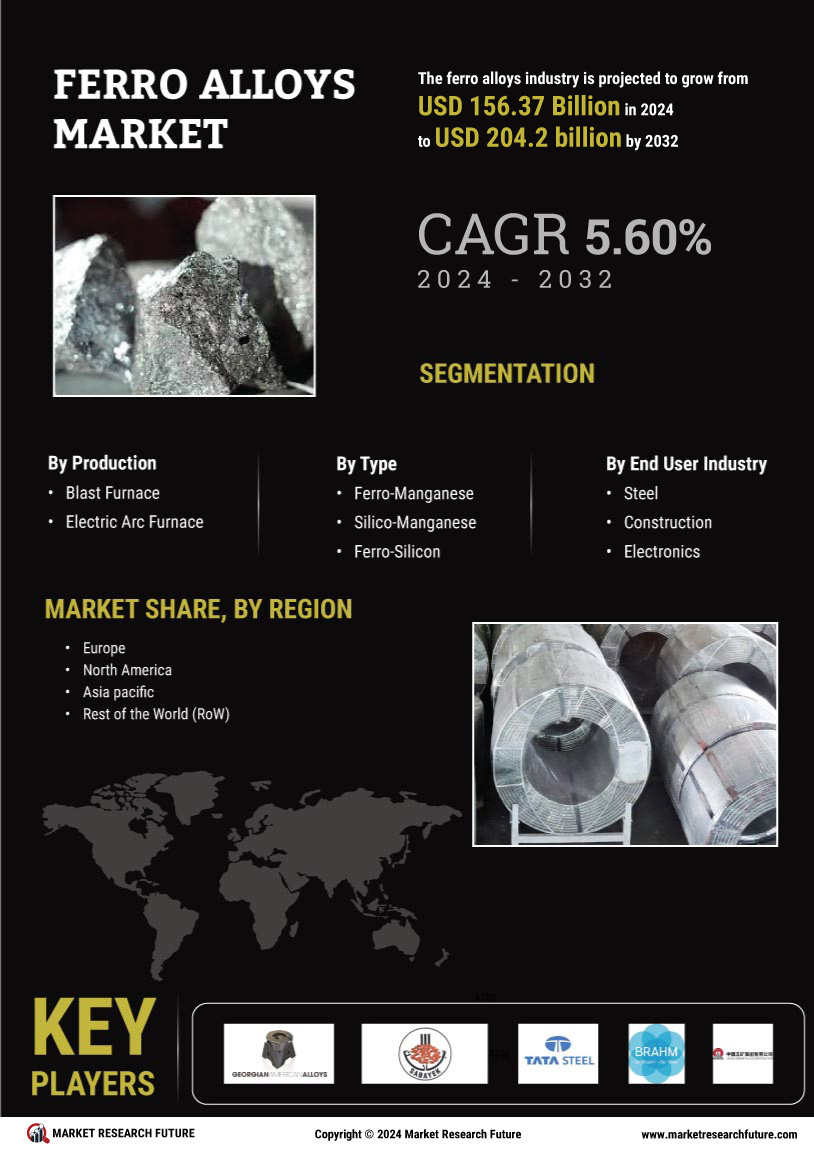

Rising Demand from Steel Industry

The Ferro Alloys Market is experiencing a notable surge in demand, primarily driven by the steel sector. As steel production continues to expand, the need for ferro alloys, which enhance the properties of steel, becomes increasingly critical. In 2025, the steel industry is projected to consume approximately 70% of the total ferro alloys produced. This trend is likely to persist, as infrastructure projects and construction activities ramp up, necessitating higher steel output. Furthermore, the increasing focus on high-strength steel, which requires specific ferro alloys for optimal performance, further propels this demand. Consequently, the growth of the steel industry directly correlates with the expansion of the ferro alloys market, indicating a robust future for this sector.

Government Initiatives and Investments

Government policies and investments play a pivotal role in shaping the Ferro Alloys Market. Many governments are implementing initiatives to boost domestic production of ferro alloys, aiming to reduce dependency on imports and enhance national security. In 2025, it is expected that several countries will increase funding for research and development in ferro alloys, fostering innovation and improving production capabilities. Additionally, infrastructure development projects funded by governments are likely to drive demand for ferro alloys, as these materials are essential for construction and engineering applications. The alignment of government policies with industry needs is expected to create a conducive environment for growth, potentially leading to increased production capacities and market expansion. Thus, government initiatives are a crucial driver of the ferro alloys market.

Technological Innovations in Production

Technological advancements within the Ferro Alloys Market are reshaping production processes, leading to enhanced efficiency and reduced costs. Innovations such as electric arc furnaces and advanced smelting techniques are being adopted to optimize the production of ferro alloys. These technologies not only improve yield but also minimize energy consumption, which is a significant factor in production costs. As of 2025, it is estimated that these innovations could reduce production costs by up to 15%, making ferro alloys more accessible to manufacturers. Additionally, the integration of automation and data analytics in production processes is likely to enhance quality control, ensuring that the ferro alloys meet stringent industry standards. This technological evolution is expected to bolster the competitiveness of the ferro alloys market, attracting new investments and fostering growth.

Increasing Focus on Sustainable Practices

The Ferro Alloys Market is witnessing a paradigm shift towards sustainability, driven by regulatory pressures and consumer preferences. Manufacturers are increasingly adopting eco-friendly practices, such as recycling scrap metal and utilizing renewable energy sources in production. In 2025, it is anticipated that around 30% of ferro alloys will be produced using sustainable methods, reflecting a growing commitment to reducing carbon footprints. This shift not only aligns with The Ferro Alloys Market appeal of ferro alloys, as industries seek to source materials that comply with environmental standards. Furthermore, companies that prioritize sustainability may gain a competitive edge, as they can attract environmentally conscious clients and investors. Thus, the emphasis on sustainable practices is likely to be a significant driver of growth within the ferro alloys market.

Expanding Applications in Emerging Industries

The Ferro Alloys Market is diversifying as new applications emerge in various sectors, including automotive, aerospace, and electronics. The increasing use of high-performance alloys in these industries is driving demand for specific ferro alloys that enhance material properties. For instance, the automotive sector is increasingly utilizing advanced high-strength steels, which require specialized ferro alloys for improved safety and performance. By 2025, it is projected that the automotive industry will account for a substantial share of ferro alloys consumption, further propelling market growth. Additionally, the aerospace sector's demand for lightweight and durable materials is likely to increase the consumption of ferro alloys, as manufacturers seek to optimize performance. This diversification of applications presents significant opportunities for the ferro alloys market, indicating a robust growth trajectory.