Flash Chromatography Market Summary

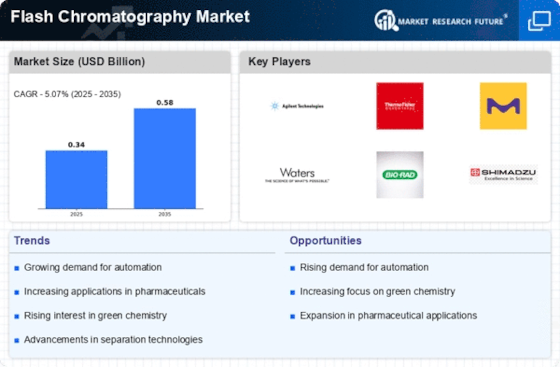

As per MRFR analysis, the Flash Chromatography Market Size was estimated at 0.3366 USD Billion in 2024. The Flash Chromatography industry is projected to grow from 0.3537 in 2025 to 0.5801 by 2035, exhibiting a compound annual growth rate (CAGR) of 5.07 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Flash Chromatography Market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

- Technological advancements are enhancing the efficiency and effectiveness of flash chromatography systems.

- The pharmaceutical and biotechnology industries represent the largest segment, reflecting a robust demand for purification processes.

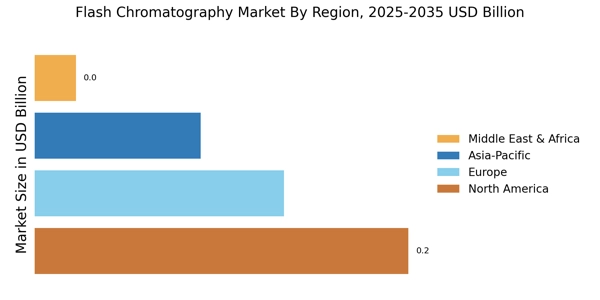

- Asia-Pacific emerges as the fastest-growing region, driven by rising research activities and investments in laboratory infrastructure.

- Key market drivers include the growing demand in pharmaceuticals and a focus on environmental sustainability, which are shaping industry dynamics.

Market Size & Forecast

| 2024 Market Size | 0.3366 (USD Billion) |

| 2035 Market Size | 0.5801 (USD Billion) |

| CAGR (2025 - 2035) | 5.07% |

Major Players

Agilent Technologies (US), Thermo Fisher Scientific (US), Merck KGaA (DE), Waters Corporation (US), Bio-Rad Laboratories (US), Shimadzu Corporation (JP), PerkinElmer (US), Sartorius AG (DE), Jasco, Inc. (JP)

Leave a Comment