Rising Awareness of Personalized Medicine

The increasing awareness of personalized medicine is reshaping the flavors for pharmaceutical and healthcare application Market. As healthcare shifts towards tailored treatments, there is a growing need for flavoring solutions that cater to individual patient preferences. Personalized medicine often involves customized formulations, which can benefit from the inclusion of flavors that enhance patient experience. This trend is particularly relevant in chronic disease management, where long-term adherence to medication is crucial. By offering flavors that align with patient preferences, pharmaceutical companies can potentially improve compliance rates. The focus on personalized approaches is likely to drive innovation in flavor development, thereby influencing the Flavors for Pharmaceutical and Healthcare Application Market.

Regulatory Support for Flavoring Innovations

Regulatory bodies are increasingly recognizing the importance of flavoring in pharmaceutical formulations, which is positively impacting the Flavors for Pharmaceutical and Healthcare Application Market. Guidelines that support the use of flavors in medications are being established, facilitating the incorporation of flavoring agents in various formulations. This regulatory support is crucial for manufacturers as it provides a framework for the safe use of flavors, ensuring that they meet safety and efficacy standards. Furthermore, the approval of new flavoring agents can lead to a broader range of products, enhancing market competitiveness. As regulations evolve, they are likely to encourage innovation and investment in flavoring technologies, thereby expanding the Flavors for Pharmaceutical and Healthcare Application Market.

Growth of Nutraceuticals and Functional Foods

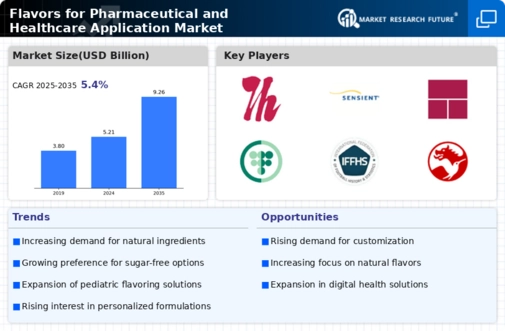

The rise of nutraceuticals and functional foods is significantly influencing the Flavors for Pharmaceutical and Healthcare Application Market. As consumers become more health-conscious, there is a growing demand for products that offer health benefits alongside flavor. This trend is prompting pharmaceutical companies to explore flavoring options that enhance the appeal of nutraceuticals, making them more attractive to consumers. Market data suggests that the nutraceutical sector is projected to grow at a compound annual growth rate of over 7% in the coming years. This growth is likely to drive the demand for innovative flavors that can complement the health benefits of these products, thereby expanding the Flavors for Pharmaceutical and Healthcare Application Market.

Technological Advancements in Flavor Delivery Systems

Technological advancements in flavor delivery systems are playing a pivotal role in the Flavors for Pharmaceutical and Healthcare Application Market. Innovations such as microencapsulation and flavor release technologies are enabling manufacturers to create more effective and appealing flavor profiles. These advancements allow for the precise control of flavor release, enhancing the overall sensory experience of pharmaceutical products. As a result, companies are better equipped to mask undesirable tastes and improve patient compliance. The integration of these technologies is expected to lead to the development of new flavor formulations that cater to diverse consumer needs. Consequently, the Flavors for Pharmaceutical and Healthcare Application Market is likely to witness significant growth driven by these technological innovations.

Increasing Consumer Preference for Palatable Medications

The Flavors for Pharmaceutical and Healthcare Application Market is experiencing a notable shift as consumers increasingly favor palatable medications. This trend is particularly pronounced in pediatric and geriatric segments, where taste can significantly influence adherence to treatment regimens. Research indicates that flavored formulations can enhance patient compliance by up to 30%, thereby improving health outcomes. As a result, pharmaceutical companies are investing in flavoring technologies to create more appealing products. The demand for flavors that mask unpleasant tastes is driving innovation in the industry, leading to the development of new flavor profiles that cater to diverse consumer preferences. This growing emphasis on palatability is likely to shape product development strategies in the Flavors for Pharmaceutical and Healthcare Application Market.