Regulatory Support

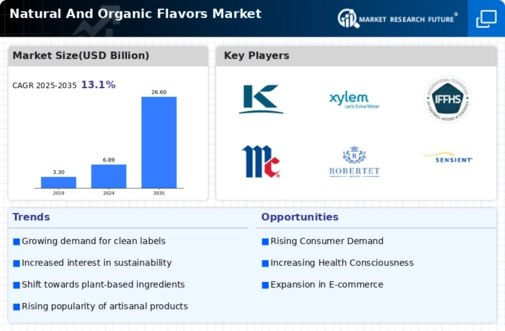

Regulatory frameworks promoting the use of natural and organic ingredients are emerging as a crucial driver for the Natural And Organic Flavors Market. Governments and regulatory bodies are increasingly implementing policies that encourage the use of natural flavors over synthetic alternatives. This regulatory support is often accompanied by incentives for companies that adhere to organic certification standards. As a result, manufacturers are more inclined to invest in natural flavor solutions, knowing that compliance can enhance their marketability. The presence of such regulations is likely to foster a more robust market environment, potentially leading to a projected increase in market size by 10% over the next few years within the Natural And Organic Flavors Market.

Health and Wellness Trends

The rising trend towards health and wellness is significantly influencing the Natural And Organic Flavors Market. As consumers increasingly prioritize their health, there is a marked shift towards natural and organic ingredients in food and beverage products. This trend is supported by data indicating that nearly 60% of consumers are willing to pay a premium for products that contain natural flavors. The demand for clean label products, which are perceived as healthier and more transparent, is driving manufacturers to reformulate their offerings. This focus on health not only caters to consumer preferences but also positions companies favorably within the competitive landscape of the Natural And Organic Flavors Market.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Natural And Organic Flavors Market. Consumers are becoming more aware of the environmental impact of their choices, leading to a surge in demand for products that are sustainably sourced and produced. This trend is reflected in the growing number of companies adopting eco-friendly practices, such as using renewable resources and minimizing waste. According to recent data, the market for sustainable flavors is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This shift not only aligns with consumer preferences but also encourages manufacturers to innovate in their sourcing and production methods, thereby enhancing their competitive edge in the Natural And Organic Flavors Market.

Innovation in Flavor Technology

Innovation in flavor technology is emerging as a significant driver for the Natural And Organic Flavors Market. Advances in extraction and processing techniques are enabling manufacturers to create more diverse and complex flavor profiles from natural sources. This technological progress not only enhances the quality of natural flavors but also expands the range of applications across various food and beverage sectors. As companies invest in research and development, the ability to produce unique flavor combinations is likely to attract a broader consumer base. This trend suggests a potential increase in market share for innovative companies within the Natural And Organic Flavors Market, as they capitalize on the growing demand for unique and high-quality flavor experiences.

Consumer Education and Awareness

The growing consumer education and awareness regarding the benefits of natural and organic flavors are driving the Natural And Organic Flavors Market. As consumers become more informed about the potential health risks associated with artificial flavors, there is a noticeable shift towards products that emphasize natural ingredients. This trend is further supported by various campaigns and initiatives aimed at educating the public about the advantages of organic consumption. The increase in awareness is likely to result in a sustained demand for natural flavors, as consumers actively seek out products that align with their values. This shift in consumer behavior is expected to contribute to a steady growth trajectory for the Natural And Organic Flavors Market.

.png)