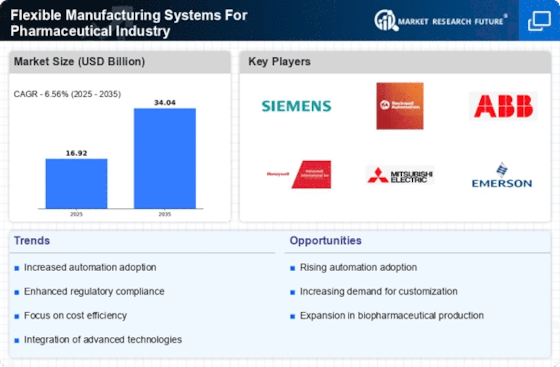

Rising Demand for Customization

The pharmaceutical industry is witnessing a rising demand for customized medications, which necessitates the adoption of Flexible Manufacturing Systems for the Pharmaceutical Industry. These systems enable manufacturers to swiftly adapt production lines to accommodate varying batch sizes and formulations. As personalized medicine gains traction, the ability to produce tailored drugs efficiently becomes paramount. According to industry reports, the market for personalized medicine is projected to reach USD 2.5 trillion by 2025, indicating a substantial opportunity for flexible manufacturing solutions. This adaptability not only enhances patient outcomes but also allows companies to respond to market fluctuations more effectively, thereby solidifying their competitive edge.

Cost Efficiency and Resource Optimization

Cost efficiency is a pivotal driver for the adoption of Flexible Manufacturing Systems for the Pharmaceutical Industry. These systems allow for the optimization of resources, including labor, materials, and time, which can lead to significant cost savings. By minimizing waste and maximizing output, manufacturers can improve their profit margins. Industry analyses indicate that companies implementing flexible manufacturing solutions can achieve up to a 30% reduction in operational costs. This financial incentive is particularly appealing in a competitive market where profit margins are often tight. As such, the pursuit of cost efficiency is likely to propel further investment in flexible manufacturing technologies.

Increased Focus on Supply Chain Resilience

The need for supply chain resilience is increasingly driving the adoption of Flexible Manufacturing Systems for the Pharmaceutical Industry. Disruptions in supply chains can have severe implications for drug availability and patient care. Flexible manufacturing systems enable companies to quickly pivot their production capabilities in response to supply chain challenges, such as raw material shortages or shifts in demand. By enhancing agility, these systems help mitigate risks associated with supply chain vulnerabilities. Market Research Future suggest that companies with flexible manufacturing capabilities are better equipped to maintain continuity in production, thereby ensuring that essential medications remain accessible to patients.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical driver for the Flexible Manufacturing Systems for the Pharmaceutical Industry. Stringent regulations imposed by health authorities necessitate that manufacturers maintain high standards of quality and safety. Flexible manufacturing systems can be designed to incorporate quality assurance protocols seamlessly, ensuring that products meet regulatory requirements without compromising efficiency. The increasing complexity of regulations, particularly in biologics and biosimilars, further emphasizes the need for adaptable manufacturing solutions. Companies that invest in flexible systems are better positioned to navigate these regulatory landscapes, potentially reducing the risk of costly recalls and enhancing their market reputation.

Technological Advancements in Manufacturing

Technological advancements are significantly influencing the Flexible Manufacturing Systems for the Pharmaceutical Industry. Innovations such as artificial intelligence, machine learning, and the Internet of Things are being integrated into manufacturing processes, enhancing efficiency and precision. These technologies facilitate real-time monitoring and predictive maintenance, which can reduce downtime and operational costs. Reports suggest that the adoption of smart manufacturing technologies could lead to a 20% increase in productivity within the pharmaceutical sector. As these advancements continue to evolve, they are likely to reshape production methodologies, making flexible systems more attractive to manufacturers seeking to optimize their operations.

.png)