Textile Manufacturing Industry Study Market Summary

As per Market Research Future analysis, the Textile Manufacturing Study was estimated at 1215.0 USD Billion in 2024. The textile manufacturing industry is projected to grow from 1257.77 USD Billion in 2025 to 1777.69 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.52% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The textile manufacturing industry is currently experiencing a transformative shift towards sustainability and technological innovation.

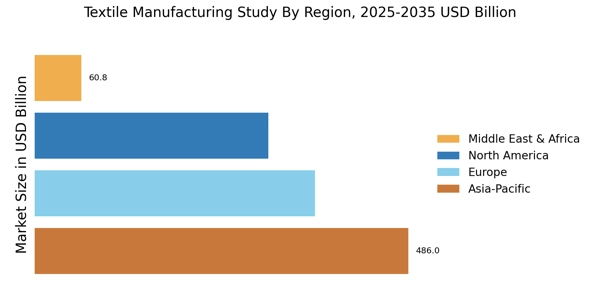

- The North American market remains the largest, driven by a strong demand for sustainable practices in textile production.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing consumer demand for customized textile solutions.

- The apparel segment continues to dominate the market, while medical textiles are witnessing rapid growth due to advancements in healthcare applications.

- Sustainability initiatives and technological innovations are key drivers propelling the industry's evolution towards eco-friendly and efficient production methods.

Market Size & Forecast

| 2024 Market Size | 1215.0 (USD Billion) |

| 2035 Market Size | 1777.69 (USD Billion) |

| CAGR (2025 - 2035) | 3.52% |

Major Players

Arvind Limited (IN), Toray Industries Inc (JP), Weiqiao Textile Company Limited (CN), Lenzing AG (AT), Hanesbrands Inc (US), Shenzhou International Group Holdings Limited (CN), Gildan Activewear Inc (CA), H&M Hennes & Mauritz AB (SE), Nike Inc (US)