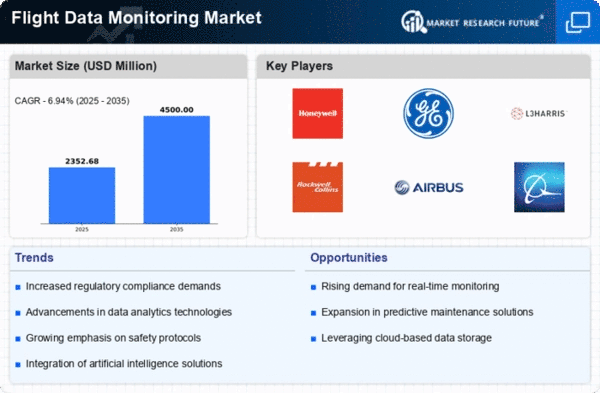

Market Growth Projections

The Global Flight Data Monitoring Market Industry is poised for substantial growth, with projections indicating a market size of 2.9 USD Billion in 2024 and an anticipated increase to 3.78 USD Billion by 2035. This growth trajectory reflects a CAGR of 2.43% from 2025 to 2035, driven by various factors such as technological advancements, regulatory compliance, and the increasing focus on safety and operational efficiency. The market's expansion is indicative of the aviation industry's commitment to leveraging data monitoring solutions to enhance flight safety and operational performance.

Growing Focus on Operational Efficiency

A growing focus on operational efficiency is a key driver in the Global Flight Data Monitoring Market Industry. Airlines are under constant pressure to reduce operational costs while maintaining high safety standards. Flight data monitoring systems provide insights into fuel consumption, flight paths, and maintenance needs, allowing operators to optimize their operations. This trend is particularly relevant as airlines seek to enhance profitability in a competitive landscape. By leveraging data-driven insights, airlines can make informed decisions that lead to improved efficiency and cost savings, thereby driving the demand for advanced monitoring solutions.

Increasing Demand for Safety and Compliance

The Global Flight Data Monitoring Market Industry experiences heightened demand for safety and compliance measures in aviation. Regulatory bodies worldwide, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), emphasize the importance of data monitoring to enhance flight safety. This trend is driven by the need to analyze flight data for incident prevention and operational efficiency. As a result, the market is projected to reach 2.9 USD Billion in 2024, reflecting the industry's commitment to adopting advanced monitoring systems that ensure adherence to safety regulations and improve overall flight operations.

Integration of Real-Time Monitoring Systems

The integration of real-time monitoring systems significantly influences the Global Flight Data Monitoring Market Industry. Airlines and operators are increasingly adopting real-time data monitoring solutions to enhance situational awareness and decision-making during flights. These systems provide immediate access to critical flight parameters, enabling timely interventions in case of anomalies. As the industry evolves, the demand for such systems is likely to rise, contributing to the overall market growth. The ability to monitor flights in real-time not only improves safety but also optimizes operational efficiency, making it a crucial driver in the market.

Technological Advancements in Data Analytics

Technological advancements in data analytics play a pivotal role in shaping the Global Flight Data Monitoring Market Industry. Innovations in artificial intelligence and machine learning enable airlines to process vast amounts of flight data efficiently. These technologies facilitate predictive maintenance, allowing operators to anticipate potential issues before they escalate. Consequently, the market is expected to grow at a CAGR of 2.43% from 2025 to 2035, reaching an estimated 3.78 USD Billion by 2035. This growth underscores the increasing reliance on sophisticated data analytics tools that enhance operational efficiency and safety in aviation.

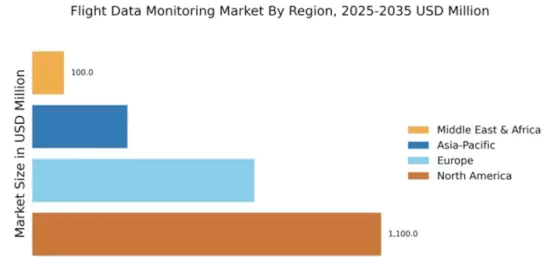

Expansion of Aviation Industry in Emerging Markets

The expansion of the aviation industry in emerging markets significantly impacts the Global Flight Data Monitoring Market Industry. Countries in regions such as Asia-Pacific and Latin America are witnessing rapid growth in air travel, leading to increased investments in aviation infrastructure and technology. As new airlines enter the market, the demand for flight data monitoring solutions rises to ensure compliance with international safety standards. This trend is expected to drive market growth as emerging economies prioritize safety and operational efficiency in their expanding aviation sectors.