Technological Advancements

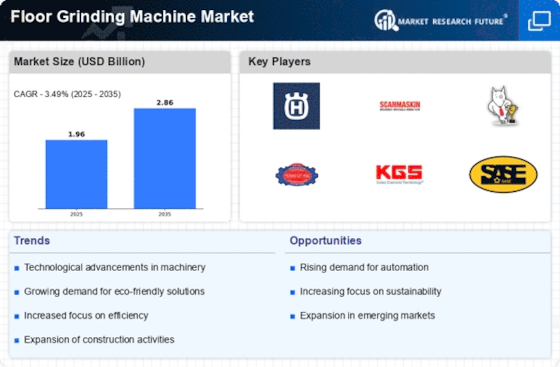

Technological advancements play a crucial role in shaping the Floor Grinding Machine Market. Innovations in machine design, automation, and efficiency are enhancing the performance of grinding machines. For instance, the introduction of advanced diamond grinding technology has improved the quality of floor finishes while reducing operational costs. In 2025, it is estimated that machines equipped with smart technology will account for a significant portion of the market, as they offer features such as real-time monitoring and predictive maintenance. These advancements not only increase productivity but also ensure better safety standards for operators. As manufacturers continue to invest in research and development, the Floor Grinding Machine Market is likely to witness a transformation that aligns with modern construction needs and sustainability goals.

Rising Construction Activities

The Floor Grinding Machine Market is experiencing a notable surge due to the increasing construction activities across various sectors. As urbanization accelerates, the demand for residential and commercial buildings rises, leading to a higher requirement for flooring solutions. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which directly influences the demand for floor grinding machines. These machines are essential for achieving smooth and durable surfaces, making them indispensable in new construction projects. Furthermore, the renovation and remodeling sector also contributes significantly to this growth, as older buildings require modern flooring solutions. This trend indicates a robust future for the Floor Grinding Machine Market, as construction activities are likely to remain a primary driver of demand.

Expansion of the Renovation Sector

The expansion of the renovation sector is a vital driver for the Floor Grinding Machine Market. As property owners increasingly invest in upgrading their spaces, the need for high-quality flooring solutions becomes paramount. In 2025, the renovation market is expected to grow at a rate of around 4.8%, which will directly impact the demand for floor grinding machines. These machines are essential for restoring and enhancing existing floors, making them a key component in renovation projects. Additionally, the trend towards open-concept living spaces and modern aesthetics further fuels the need for effective grinding solutions. This growth in the renovation sector suggests a promising outlook for the Floor Grinding Machine Market, as it adapts to meet the evolving needs of consumers.

Increased Focus on Safety and Compliance

In the Floor Grinding Machine Market, there is an increased focus on safety and compliance with industry standards. As regulations surrounding workplace safety become more stringent, manufacturers are compelled to design machines that prioritize operator safety. In 2025, it is anticipated that machines equipped with advanced safety features will dominate the market, as companies seek to mitigate risks associated with floor grinding operations. This trend not only enhances the safety of workers but also ensures compliance with local and international regulations. Furthermore, the emphasis on safety is likely to drive innovation in machine design, leading to the development of more efficient and user-friendly equipment. As a result, the Floor Grinding Machine Market is expected to benefit from this heightened awareness of safety and compliance.

Growing Demand for Eco-Friendly Solutions

The Floor Grinding Machine Market is increasingly influenced by the growing demand for eco-friendly solutions. As environmental concerns rise, construction companies are seeking sustainable flooring options that minimize ecological impact. Machines that utilize less energy and produce fewer emissions are becoming more popular. In 2025, it is projected that the market for eco-friendly floor grinding machines will expand significantly, driven by regulations and consumer preferences for sustainable practices. This shift not only aligns with global sustainability initiatives but also encourages manufacturers to innovate and develop greener technologies. Consequently, the Floor Grinding Machine Market is likely to evolve, focusing on environmentally responsible products that meet the expectations of both consumers and regulatory bodies.