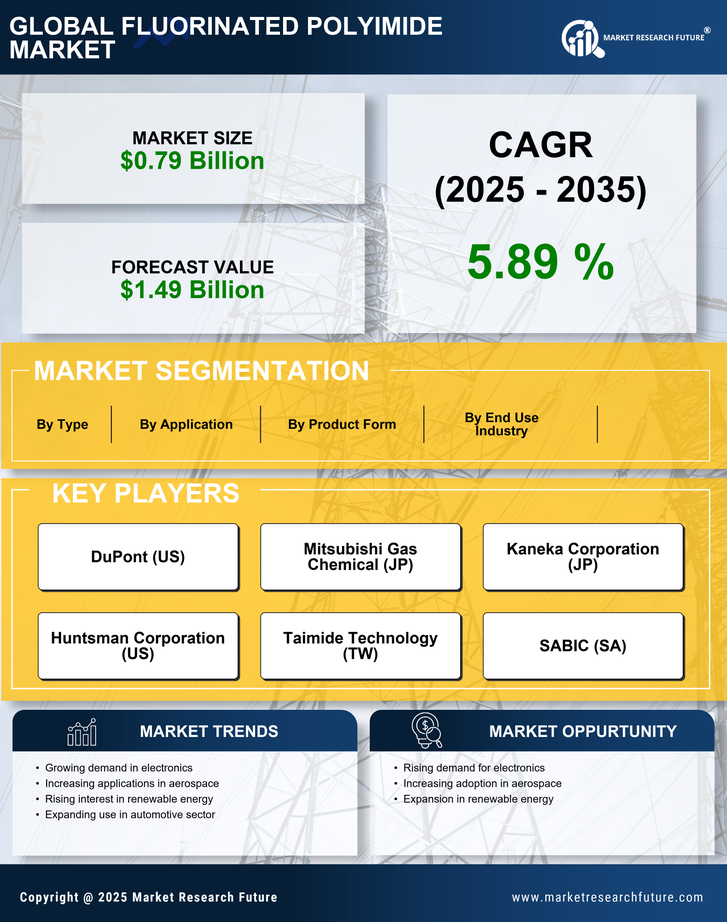

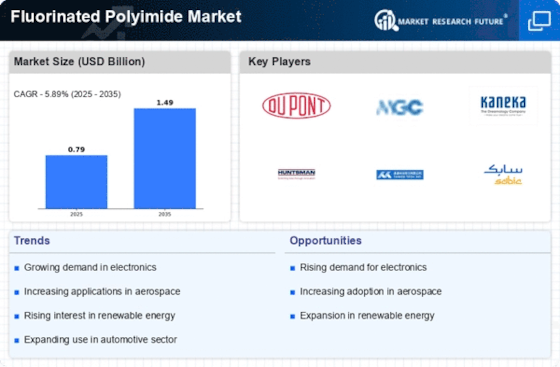

Rising Demand in Aerospace Sector

The aerospace sector is experiencing a notable increase in demand for lightweight and high-performance materials, which is likely to drive the Fluorinated Polyimide Market. Fluorinated polyimides are recognized for their exceptional thermal stability and chemical resistance, making them suitable for various aerospace applications, including insulation and structural components. As the aerospace industry continues to innovate and expand, the need for advanced materials that can withstand extreme conditions is becoming more pronounced. Reports indicate that the aerospace materials market is projected to grow significantly, with fluorinated polyimides playing a crucial role in meeting the stringent requirements of this sector. This trend suggests a robust growth trajectory for the Fluorinated Polyimide Market, as manufacturers seek to enhance performance and reduce weight in aerospace applications.

Advancements in Medical Technology

The medical technology sector is witnessing rapid advancements, with a growing emphasis on high-performance materials that can meet stringent regulatory standards. Fluorinated polyimides are gaining traction in medical applications, particularly in the development of medical devices and diagnostic equipment. Their biocompatibility and resistance to sterilization processes make them suitable for various healthcare applications. Market analysis suggests that the medical device market is expected to expand significantly, which could drive the demand for fluorinated polyimides. This growth in medical technology is likely to enhance the Fluorinated Polyimide Market, as manufacturers seek to innovate and improve the performance of medical devices.

Increased Focus on Renewable Energy

The shift towards renewable energy sources is influencing various industries, including the Fluorinated Polyimide Market. Fluorinated polyimides are increasingly utilized in the production of components for solar panels and wind turbines due to their excellent thermal and chemical resistance. As the world moves towards sustainable energy solutions, the demand for materials that can withstand harsh environmental conditions is growing. Reports suggest that the renewable energy sector is poised for significant growth, which may lead to increased consumption of fluorinated polyimides in energy applications. This trend indicates a promising outlook for the Fluorinated Polyimide Market, as manufacturers align their offerings with the sustainability goals of the energy sector.

Expansion in Electronics Applications

The electronics industry is undergoing rapid transformation, with an increasing focus on miniaturization and enhanced performance. Fluorinated polyimides are emerging as a preferred choice for various electronic applications, including flexible printed circuit boards and semiconductor packaging. The demand for high-frequency and high-temperature applications is driving the adoption of these materials, as they offer superior dielectric properties and thermal stability. Market data indicates that the electronics segment is expected to witness substantial growth, with fluorinated polyimides being integral to the development of next-generation electronic devices. This expansion in electronics applications is likely to bolster the Fluorinated Polyimide Market, as manufacturers strive to meet the evolving needs of the technology sector.

Regulatory Support for Advanced Materials

Regulatory bodies are increasingly recognizing the importance of advanced materials in various industries, which may positively impact the Fluorinated Polyimide Market. Supportive regulations and standards are being established to promote the use of high-performance materials in sectors such as aerospace, electronics, and healthcare. This regulatory environment is likely to encourage manufacturers to invest in the development and application of fluorinated polyimides. As industries strive to comply with evolving regulations, the demand for materials that meet these standards is expected to rise. This trend suggests a favorable outlook for the Fluorinated Polyimide Market, as regulatory support may drive innovation and adoption of these advanced materials.