2-Feburary-2024: Saint-Gobain acquired the business assets of International Cellulose Corporation (ICC), a privately owned manufacturer of commercial specialty insulation products, including spray-on thermal and acoustic finishing systems. With approximately 50 Copyright © 2025 Market Research Future 185 employees at its manufacturing site in Houston, Texas, the acquisition of ICC will allow Saint-Gobain to establish its Commercial Building and Infrastructure (CBI) business as a leader in cementitious fireproofing and sprayed acoustic insulation, complementing Saint-Gobain's steel fireproofing solutions and offering contractor offering.

ICC’s product portfolio complements existing Saint- obtain insulation solutions such as CP’s fireproofing products, acquired by Saint- obtain in 2022, and CertainTeed’s interior insulation portfolio.

20-June-2024: Dow has signed an agreement to acquire Circulus, a leading recycler of plastic waste into post-consumer resin (PCR). This transaction includes two facilities, one in Ardmore, Oklahoma, and another in Arab, Alabama, with a total capacity of 50,000 metric tons per year. Dow's expertise in materials science and high-performance resins combined with Circulus' mechanical film recycling capability will allow Dow to enhance its offerings in applications, such as collation shrink packaging, stretch film, liners and select food packaging, to a wider range of applications in the industrial, consumer, and transportation markets.

1-August-2023: DuPont acquired Spectrum Plastics Group “Spectrum”, a recognized leader in specialty medical devices and components markets. With a global workforce of approximately 2,200 employees and annual revenue of about $500 million, Spectrum will become part of the Industrial Solutions line of business within the Electronics & Industrial segment. Spectrum’s strategic focus on key, fast-growing therapeutics areas such as structural heart, electrophysiology, surgical robotics and cardiovascular complements DuPont’s existing offerings for biopharma and DuPont’s pharma processing, medical devices and packaging, including Liveo®silicone solutions and Tyvek® Medical Pac aging.

The combination with Spectrum increases DuPont’s existing revenue to high-growth healthcare markets to approximately 10 percent of its portfolio.

15-January-2021: Huntsman Corporation completed the acquisition of Gabriel Performance Products (Gabriel), a North American specialty chemical manufacturer of specialty additives and epoxy curing agents for the coatings, adhesives, sealants and composite end markets, from Audax Private Equity. Huntsman paid $250 million, subject to customary closing adjustments, in an all-cash transaction funded from available liquidity. Gabriel had 2019 revenues of approximately $106 million with three manufacturing facilities located in Ashtabula, Ohio, Harrison City, Pennsylvania and Rock Hill, South Carolina.

Foam Insulation Market Segmentation

Foam Insulation Market by Product Type Outlook

Foam Insulation Market by Product Type Outlook

- Polyurethane Foam

- Polystyrene Foam

- Polyolefin Foam

- Phenolic Foam

- Elastomeric Foam

- Others

Foam Insulation Market by End-Use Industry Outlook

- Building & Construction

- Automotive & Transportation

- Electricals & Electronics

- Packaging

- Others

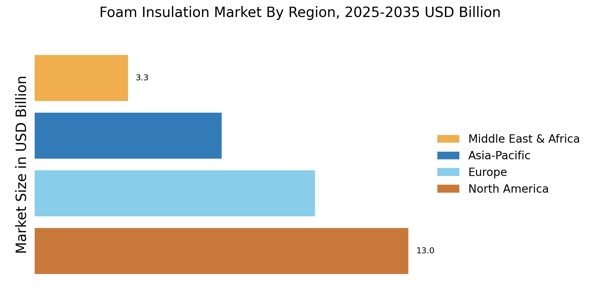

Foam Insulation Market Regional Outlook

- North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Finland

- Poland

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa