Market Share

Foam Insulation Market Share Analysis

In the ever-evolving landscape of the foam insulation market, companies employ various strategies to position themselves and capture a larger market share. One prominent approach is differentiation, where companies focus on unique product features or benefits to stand out amidst competitors. For instance, some companies may emphasize the superior insulating properties of their foam insulation, highlighting energy efficiency and cost savings for customers. Others might differentiate through environmental sustainability, promoting foam insulation products made from recycled materials or boasting low emissions during production and installation.

Another key strategy is pricing. In a competitive market like foam insulation, pricing can significantly impact market share. Some companies opt for a penetration pricing strategy, setting initially low prices to quickly gain market share and establish their brand. This approach can be particularly effective in attracting price-sensitive customers and securing a foothold in the market. Conversely, premium pricing strategies target customers seeking higher quality or premium features, allowing companies to position themselves as premium providers and capture a niche market segment willing to pay a premium for superior products.

Distribution channels play a crucial role in market share positioning as well. Companies must strategically select distribution channels that align with their target market and business objectives. Direct sales channels, such as company-owned stores or online platforms, offer greater control over branding and customer experience but may require significant investment in infrastructure and marketing. Alternatively, companies may opt for indirect channels like distributors or retailers to leverage existing networks and reach a broader customer base more efficiently.

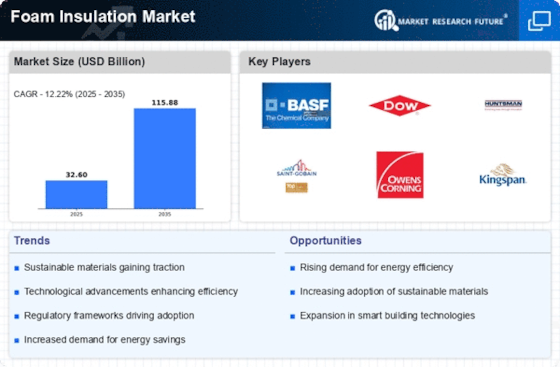

The global Foam Insulation Market has brought more opportunities due to the increasing automotive and transportation industry demand. The demand is increasing because it is maintaining the inside temperature in the vehicles of storage transit like reefer trailers and trucks.

Brand positioning is another vital aspect of market share strategy in the foam insulation market. Building a strong brand identity helps companies differentiate themselves and build customer loyalty. Companies may focus on positioning their brand as an industry leader known for innovation, reliability, or exceptional customer service. By consistently delivering on their brand promise and cultivating a positive reputation, companies can attract and retain customers, ultimately increasing their market share.

Innovation is paramount in the foam insulation market, where technological advancements drive product differentiation and competitive advantage. Companies that invest in research and development to continuously improve their products or develop innovative solutions gain a significant edge in the market. Whether it's developing new materials with enhanced insulation properties, introducing novel application techniques for easier installation, or incorporating smart technology for energy management, innovation is key to staying ahead of competitors and capturing market share.

Furthermore, partnerships and collaborations can be instrumental in expanding market reach and gaining a competitive edge. Strategic alliances with manufacturers, contractors, or industry associations can provide access to new markets, technologies, or resources that companies may not have on their own. By leveraging complementary strengths and resources through partnerships, companies can enhance their market position and capitalize on new growth opportunities.

Lastly, effective marketing and branding strategies are essential for market share positioning in the foam insulation market. Companies must tailor their marketing efforts to resonate with their target audience and effectively communicate their value proposition. This may involve utilizing digital marketing channels, such as social media and content marketing, to engage with customers and showcase product benefits. Additionally, investing in promotional activities, such as trade shows, demonstrations, or advertising campaigns, can raise awareness and generate demand for foam insulation products, ultimately driving market share growth. In conclusion, successful market share positioning in the foam insulation market requires a multifaceted approach encompassing differentiation, pricing, distribution, branding, innovation, partnerships, and marketing strategies tailored to meet the evolving needs and preferences of customers in the industry.

Leave a Comment