Market Analysis

In-depth Analysis of Foam Insulation Market Industry Landscape

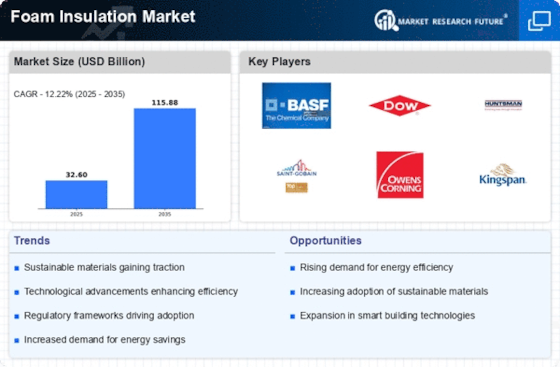

The foam insulation market is experiencing significant growth due to various market dynamics. One of the key drivers of this growth is the increasing demand for energy-efficient solutions in both residential and commercial construction. Foam insulation, such as expanded polystyrene (EPS), extruded polystyrene (XPS), and polyurethane (PUR), offers superior thermal resistance compared to traditional insulation materials like fiberglass and cellulose. As regulations and building codes continue to emphasize energy efficiency, builders and homeowners are turning to foam insulation to meet these requirements.

Additionally, the construction industry's shift towards sustainable and environmentally friendly practices has fueled the demand for foam insulation. Many foam insulation products are manufactured using recycled materials and are themselves recyclable at the end of their lifecycle. This appeals to environmentally conscious consumers and businesses looking to reduce their carbon footprint. Moreover, foam insulation helps reduce greenhouse gas emissions by improving a building's energy efficiency, thereby lowering its overall energy consumption.

Another factor driving the foam insulation market is the growing awareness of the benefits of insulation in improving indoor comfort and air quality. Foam insulation creates a continuous air barrier that helps prevent air leakage and infiltration, reducing drafts and hot or cold spots within a building. By maintaining a consistent indoor temperature, foam insulation can enhance occupant comfort and reduce the need for heating and cooling, leading to lower energy bills. Additionally, foam insulation can help reduce moisture infiltration, preventing mold and mildew growth and improving indoor air quality.

The global Foam Insulation Market might get hampered due to the increasing cost of foam insulations as compared to the cost of loose-fill insulations. These major restraints might bring huge losses to the global market for the forecast period.

The rise of retrofitting and renovation projects in existing buildings is also contributing to the growth of the foam insulation market. As building owners seek to upgrade their properties to improve energy efficiency and comply with building codes, foam insulation offers a cost-effective solution. Its lightweight and easy-to-install nature make it suitable for retrofitting applications, allowing builders to upgrade insulation levels without extensive renovations or disruptions to occupants.

Furthermore, technological advancements in foam insulation products are driving market growth by enhancing their performance and versatility. Manufacturers are developing innovative formulations and production techniques to improve the thermal resistance, fire resistance, and durability of foam insulation. Additionally, the introduction of spray foam insulation has revolutionized the industry by providing a seamless and customizable insulation solution that can conform to irregular surfaces and hard-to-reach areas, further expanding the market potential.

However, despite the numerous drivers propelling the growth of the foam insulation market, there are also some challenges and limitations to consider. One such challenge is the higher upfront cost of foam insulation compared to traditional insulation materials. While foam insulation offers long-term savings through energy efficiency and durability, the initial investment may deter some consumers, particularly in markets with lower awareness or stringent budget constraints.

Moreover, concerns about the environmental impact of certain foam insulation products, particularly those containing blowing agents with high global warming potential (GWP), have led to calls for more sustainable alternatives. Manufacturers are actively researching and developing new formulations with lower environmental impact, such as water-blown or bio-based foam insulation, to address these concerns and meet evolving regulatory requirements.

Leave a Comment