Rising Consumer Awareness

The food and beverage disinfection Market is experiencing a notable increase in consumer awareness regarding food safety and hygiene. As individuals become more informed about the potential health risks associated with contaminated food and beverages, the demand for effective disinfection solutions is likely to rise. This heightened awareness is reflected in market trends, with a reported increase in sales of disinfection products by approximately 15% over the past year. Consumers are actively seeking products that ensure the safety of their food, thereby driving growth in the industry. Furthermore, educational campaigns and public health initiatives are contributing to this trend, emphasizing the importance of proper disinfection practices in both commercial and domestic settings.

Focus on Sustainable Practices

The Food And Beverage Disinfection Market is increasingly influenced by the focus on sustainable practices within the food sector. As consumers and businesses alike become more environmentally conscious, there is a growing demand for eco-friendly disinfection solutions. Products that utilize biodegradable ingredients and sustainable packaging are gaining popularity, reflecting a shift towards greener practices. Market trends indicate that the demand for sustainable disinfection products has risen by approximately 20% in recent years. This shift not only aligns with consumer preferences but also encourages companies to innovate and develop products that meet these sustainability criteria. Consequently, the emphasis on sustainability is likely to drive growth in the food and beverage disinfection market.

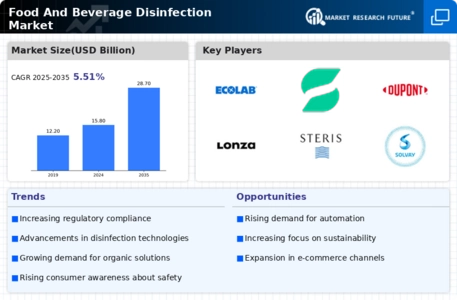

Increased Regulatory Standards

The Food And Beverage Disinfection Market is significantly shaped by the increasing regulatory standards imposed on food safety. Governments and health organizations are continuously updating guidelines to ensure that food and beverage products meet stringent hygiene requirements. This regulatory landscape compels businesses to adopt effective disinfection practices to avoid penalties and maintain their operational licenses. Recent reports indicate that compliance with these regulations has led to a surge in the demand for disinfection products, with a projected market growth of 8% in the coming years. As regulatory bodies emphasize the importance of food safety, companies are likely to invest more in disinfection solutions, thereby driving the market forward.

Expansion of Food Service Sector

The Food And Beverage Disinfection Market is significantly influenced by the expansion of the food service sector. As restaurants, cafes, and catering services proliferate, the need for stringent hygiene practices becomes paramount. This sector's growth has been accompanied by an increased focus on maintaining high standards of cleanliness, which directly impacts the demand for disinfection solutions. Recent data indicates that the food service industry has seen a growth rate of approximately 10% annually, leading to a corresponding rise in the adoption of disinfection technologies. Consequently, businesses are investing in advanced disinfection systems to ensure compliance with health regulations and to enhance customer trust, thereby propelling the market forward.

Technological Advancements in Disinfection

The Food And Beverage Disinfection Market is benefiting from rapid technological advancements in disinfection methods. Innovations such as ultraviolet (UV) light disinfection, ozone treatment, and electrochemical activation are gaining traction due to their effectiveness and efficiency. These technologies not only improve the disinfection process but also reduce the use of harmful chemicals, aligning with the growing demand for safer food handling practices. Market analysis suggests that the adoption of these advanced technologies could lead to a market growth rate of around 12% over the next five years. As businesses seek to enhance their operational efficiency and ensure compliance with health standards, the integration of these technologies is likely to become a key driver in the industry.

.png)