Growing Demand for Home Cooking

The food blender and mixer equipment Market is witnessing a notable increase in demand driven by a resurgence in home cooking. As more individuals embrace culinary activities at home, the need for efficient and reliable blending and mixing equipment has escalated. Recent surveys indicate that approximately 70% of consumers are cooking at home more frequently than in previous years, leading to a heightened interest in kitchen appliances that facilitate meal preparation. This trend is further supported by the rise of social media platforms where home-cooked meals are showcased, inspiring others to invest in quality food preparation equipment. Consequently, manufacturers are responding by expanding their product lines to include versatile blenders and mixers that cater to diverse cooking styles and preferences.

Expansion of E-commerce Platforms

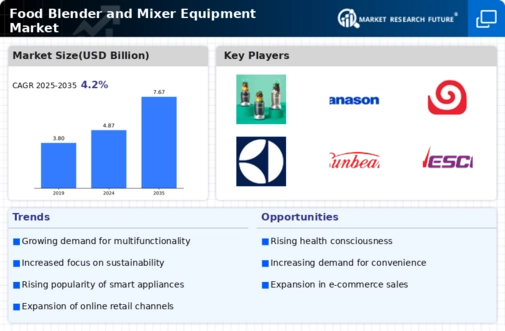

The Food Blender and Mixer Equipment Market is benefiting from the rapid expansion of e-commerce platforms, which provide consumers with greater access to a wide range of products. Online shopping has transformed the way consumers purchase kitchen appliances, allowing for convenient comparisons and reviews. Recent statistics indicate that online sales of kitchen appliances have increased by approximately 30% in the last year alone. This trend is particularly advantageous for smaller brands that may not have a strong presence in physical retail locations. As e-commerce continues to grow, manufacturers are increasingly focusing on digital marketing strategies to reach potential customers, thereby enhancing their visibility and sales opportunities in the Food Blender and Mixer Equipment Market.

Increased Focus on Health and Nutrition

The Food Blender and Mixer Equipment Market is significantly influenced by the growing focus on health and nutrition among consumers. As individuals become more aware of the importance of healthy eating, there is a rising demand for appliances that support the preparation of nutritious meals and beverages. Data suggests that the market for health-oriented kitchen appliances is expected to grow by over 15% in the coming years. This shift is prompting manufacturers to design blenders and mixers that can efficiently handle a variety of ingredients, including fruits, vegetables, and superfoods, to create smoothies, soups, and other health-conscious recipes. The emphasis on wellness is likely to drive innovation in product features, such as enhanced blending capabilities and ease of cleaning, further propelling the market forward.

Rising Interest in Culinary Arts and Cooking Classes

The Food Blender and Mixer Equipment Market is experiencing growth due to the rising interest in culinary arts and cooking classes. As more individuals seek to enhance their cooking skills, there is a corresponding demand for high-quality kitchen appliances that facilitate learning and experimentation. Recent trends indicate that cooking classes, both in-person and online, have gained popularity, leading to an increased need for reliable blending and mixing equipment. This interest not only encourages consumers to invest in better appliances but also drives manufacturers to create products that cater to aspiring chefs. The focus on culinary education is likely to sustain demand for food blenders and mixers, as these tools are essential for mastering various cooking techniques.

Technological Advancements in Food Blender and Mixer Equipment

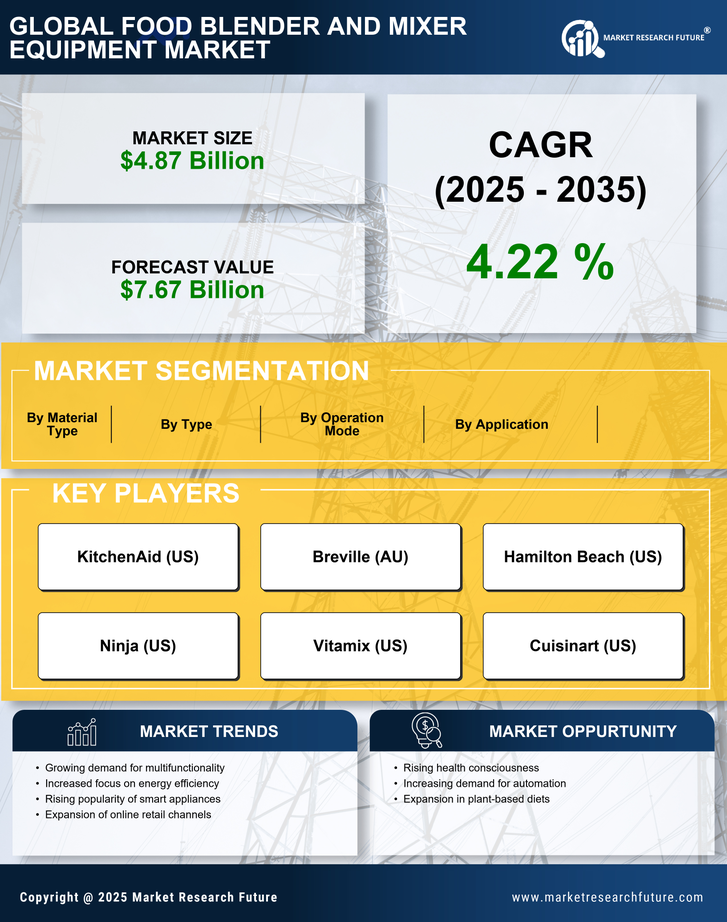

The Food Blender and Mixer Equipment Market is experiencing a surge in technological advancements, which enhances the functionality and efficiency of these appliances. Innovations such as smart technology integration, which allows for remote operation and recipe guidance, are becoming increasingly prevalent. According to recent data, the market for smart kitchen appliances is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This trend indicates a shift towards more sophisticated equipment that not only meets basic blending and mixing needs but also offers additional features that cater to modern culinary demands. As consumers seek convenience and versatility, manufacturers are compelled to invest in research and development to create cutting-edge products that stand out in the competitive landscape.