Health and Wellness Trends

The Global Food Coating Ingredients Industry is influenced by the increasing focus on health and wellness among consumers. There is a noticeable shift towards healthier eating habits, prompting manufacturers to develop coatings that are lower in fat and sugar while still providing desirable taste and texture. For instance, the introduction of plant-based coatings aligns with this trend, catering to the growing vegan and vegetarian populations. This shift not only meets consumer demands but also positions companies favorably in a competitive market. As health-conscious choices become more prevalent, the Global Food Coating Ingredients Market Industry is likely to adapt and innovate accordingly.

Rising Demand for Convenience Foods

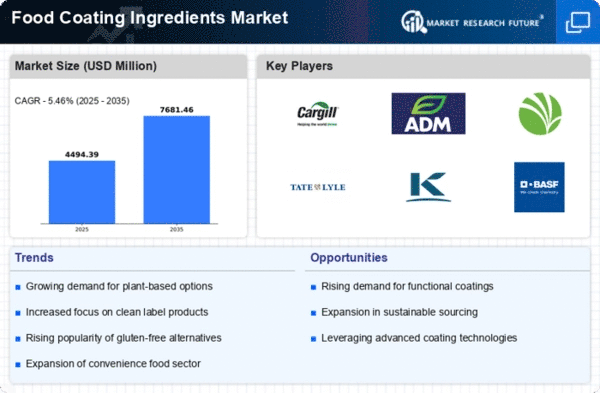

The Global Food Coating Ingredients Market Industry experiences a surge in demand for convenience foods, driven by changing consumer lifestyles. As more individuals seek quick meal solutions, the need for coated products, such as frozen snacks and ready-to-eat meals, increases. This trend is evident in the projected market value of 3500 USD Million in 2024, reflecting a growing preference for products that require minimal preparation. Manufacturers are responding by innovating with various coatings that enhance flavor and texture, thereby appealing to health-conscious consumers. The convenience food sector is expected to significantly contribute to the overall growth of the Global Food Coating Ingredients Market Industry.

Expansion of the Food Processing Industry

The Global Food Coating Ingredients Market Industry benefits from the expansion of the food processing industry, which is experiencing robust growth globally. As food processing companies seek to enhance the appeal of their products, the demand for innovative coating solutions rises. This trend is particularly evident in emerging markets, where urbanization and rising disposable incomes lead to increased consumption of processed foods. The market is projected to reach 6500 USD Million by 2035, indicating a sustained interest in food coatings. The expansion of food processing capabilities is likely to create new opportunities for growth within the Global Food Coating Ingredients Market Industry.

Consumer Preference for Flavor Enhancement

Consumer preference for flavor enhancement significantly impacts the Global Food Coating Ingredients Market Industry. As taste remains a primary factor in food choices, manufacturers are increasingly focusing on developing coatings that enhance the sensory experience of their products. This includes the use of spices, herbs, and other flavoring agents in coatings to create unique taste profiles. The growing trend of gourmet and artisanal foods further emphasizes the importance of flavor in consumer decision-making. As the market evolves, the ability to offer diverse and appealing flavors will likely be a key driver of growth in the Global Food Coating Ingredients Market Industry.

Technological Advancements in Coating Processes

Technological advancements play a crucial role in shaping the Global Food Coating Ingredients Market Industry. Innovations in coating techniques, such as electrostatic coating and spray drying, enhance the efficiency and quality of food coatings. These technologies allow for better adhesion and uniformity, which are essential for product consistency. Additionally, advancements in equipment and machinery contribute to reduced production costs and increased output. As a result, manufacturers can offer a wider range of coated products, catering to diverse consumer preferences. The ongoing evolution of coating technologies is expected to drive growth in the Global Food Coating Ingredients Market Industry.