Technological Innovations in Equipment

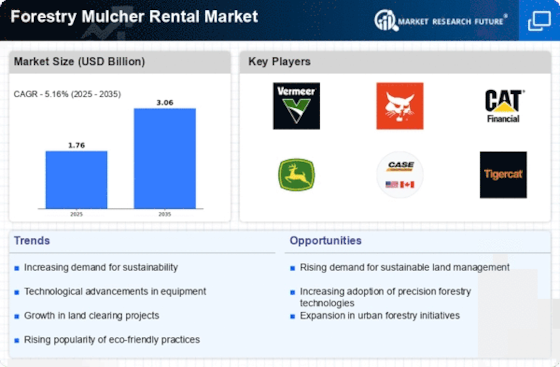

Technological advancements play a crucial role in shaping the Forestry Mulcher Rental Market. The introduction of more efficient and versatile forestry mulchers has transformed the landscape of land management. Innovations such as improved cutting technology and enhanced fuel efficiency are making these machines more appealing to rental customers. In 2025, the market is projected to benefit from these advancements, as rental companies invest in the latest models to meet customer demands. This not only enhances operational efficiency but also reduces the environmental footprint associated with land clearing activities. As a result, the Forestry Mulcher Rental Market is likely to experience growth driven by the increasing availability of advanced equipment that meets the evolving needs of various sectors.

Economic Factors Favoring Rental Models

Economic considerations are increasingly favoring rental models within the Forestry Mulcher Rental Market. As businesses face fluctuating economic conditions, the preference for renting equipment rather than purchasing it outright is becoming more pronounced. This trend is particularly evident in industries such as construction and agriculture, where capital expenditures can be substantial. In 2025, it is anticipated that the market will continue to grow as companies seek to optimize their budgets by utilizing rental services. This approach allows for flexibility and access to high-quality machinery without the burden of ownership costs. Consequently, the Forestry Mulcher Rental Market is well-positioned to capitalize on this economic shift, as it aligns with the financial strategies of various enterprises.

Rising Awareness of Sustainable Practices

The Forestry Mulcher Rental Market is witnessing a surge in interest due to the rising awareness of sustainable land management practices. As environmental concerns become more pronounced, businesses and individuals are increasingly seeking methods that minimize ecological impact. Forestry mulchers, known for their efficiency in clearing land while preserving soil integrity, are gaining traction. In 2025, the market is expected to expand as more stakeholders recognize the benefits of utilizing rental services to access these machines. This trend aligns with the broader movement towards sustainability, where renting equipment is seen as a more responsible choice compared to ownership. Consequently, the Forestry Mulcher Rental Market stands to gain from this shift in consumer behavior, as it caters to the growing demand for environmentally friendly solutions.

Increased Demand for Land Management Services

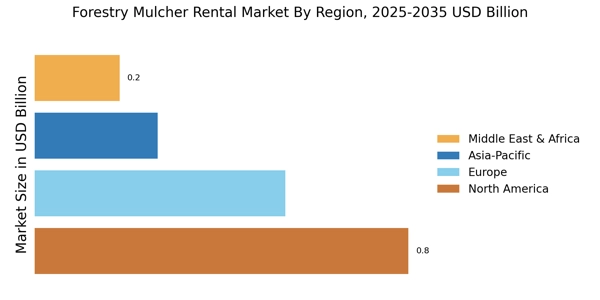

The Forestry Mulcher Rental Market experiences heightened demand due to the growing need for effective land management services. As urbanization expands, the necessity for clearing land for development projects becomes paramount. This trend is reflected in the increasing number of municipalities and private contractors seeking rental solutions for forestry mulchers. In 2025, the market is projected to grow by approximately 8% as more entities recognize the efficiency and cost-effectiveness of renting over purchasing equipment. This shift not only alleviates financial burdens but also allows for access to the latest technology without the long-term commitment of ownership. Consequently, the Forestry Mulcher Rental Market is poised to benefit from this trend, as it aligns with the operational needs of various sectors, including construction, agriculture, and environmental management.

Regulatory Support for Environmental Conservation

The Forestry Mulcher Rental Market is significantly influenced by regulatory frameworks aimed at environmental conservation. Governments worldwide are implementing stricter regulations regarding land clearing and forest management practices. These regulations often necessitate the use of specialized equipment, such as forestry mulchers, to ensure compliance with environmental standards. As a result, rental services are becoming increasingly attractive to businesses that require these machines for short-term projects. In 2025, it is anticipated that the market will see a surge in demand as companies seek to adhere to these regulations while minimizing their capital expenditures. This regulatory support not only fosters a more sustainable approach to land management but also enhances the growth prospects of the Forestry Mulcher Rental Market.