Increasing Vehicle Production

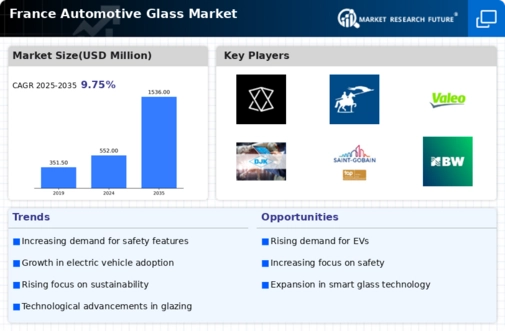

The automotive glass market in France is experiencing growth due to the rising production of vehicles. In recent years, the automotive sector has seen a notable increase in output, with production levels reaching approximately 1.5 million units annually. This surge in vehicle manufacturing directly correlates with the demand for automotive glass, as each vehicle requires multiple glass components, including windshields, side windows, and rear windows. As manufacturers strive to meet consumer demand for new vehicles, the automotive glass market benefits from this upward trend. Furthermore, the introduction of electric vehicles (EVs) is likely to further stimulate production, as these vehicles often utilize advanced glass technologies for improved aerodynamics and energy efficiency. Consequently, the automotive glass market is poised for continued expansion as vehicle production remains robust.

Growth of Aftermarket Services

The growth of aftermarket services in the automotive sector is contributing to the expansion of the automotive glass market in France. As vehicles age, the need for replacement glass components increases, creating opportunities for aftermarket suppliers. The trend towards vehicle customization and repair also plays a role, as consumers seek to enhance their vehicles with upgraded glass features. The automotive glass market is likely to see a rise in demand for replacement windshields and windows, driven by factors such as accidents, wear and tear, and aesthetic preferences. Furthermore, the increasing availability of mobile repair services and online ordering platforms is making it easier for consumers to access replacement glass, thereby supporting market growth.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting the automotive sector are influencing the automotive glass market in France. Policies that encourage the adoption of electric vehicles and sustainable practices are likely to drive demand for innovative glass solutions. For instance, subsidies for EV purchases and investments in charging infrastructure are expected to boost the production of electric vehicles, which often utilize specialized glass technologies. Additionally, regulations promoting energy efficiency and emissions reduction may lead to increased demand for lightweight glass options. As a result, the automotive glass market is positioned to benefit from these governmental efforts, as manufacturers align their products with evolving regulations and consumer preferences.

Rising Consumer Awareness of Safety Features

Consumer awareness regarding safety features in vehicles is a driving force for the automotive glass market in France. As safety becomes a paramount concern for buyers, the demand for high-quality automotive glass that meets stringent safety standards is increasing. Windshields and windows are critical components that contribute to the overall safety of a vehicle, and consumers are increasingly seeking products that offer enhanced protection against impacts and accidents. The automotive glass market is responding to this trend by developing products that comply with safety regulations and provide superior performance. Furthermore, the market is likely to see a rise in demand for advanced driver-assistance systems (ADAS) that rely on high-quality glass for functionality, further propelling growth in the sector.

Technological Advancements in Glass Manufacturing

Technological innovations in glass manufacturing are significantly impacting the automotive glass market in France. The introduction of lightweight and high-strength glass materials enhances vehicle performance and safety. For instance, the use of laminated glass not only improves structural integrity but also provides better sound insulation and UV protection. Additionally, advancements in manufacturing processes, such as automated production lines and precision cutting techniques, have led to increased efficiency and reduced costs. The automotive glass market is likely to benefit from these technological advancements, as manufacturers seek to incorporate state-of-the-art glass solutions into their vehicles. Moreover, the integration of smart glass technologies, which can adjust transparency and provide heads-up displays, is expected to create new opportunities for growth within the market.