Regulatory Support

The France CBCT dental imaging market benefits from robust regulatory support that fosters innovation and ensures patient safety. The French government, through its health authorities, has established guidelines that promote the use of advanced imaging technologies in dental practices. These regulations not only facilitate the approval process for new devices but also encourage compliance with safety standards. Additionally, the European Union's Medical Device Regulation (MDR) provides a framework that enhances the quality and safety of medical devices, including dental imaging equipment. This regulatory environment is likely to instill confidence among practitioners and patients alike, thereby driving the adoption of CBCT technology in dental practices across France.

Technological Advancements

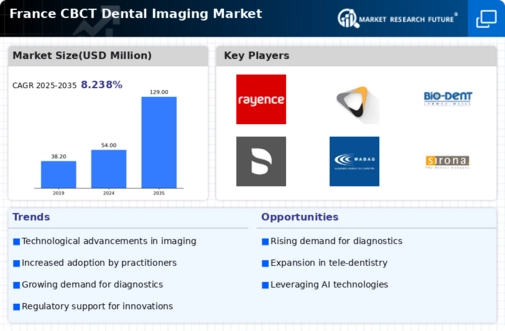

The France CBCT dental imaging market is experiencing rapid technological advancements that enhance diagnostic capabilities. Innovations in imaging software and hardware are leading to improved image quality and reduced radiation exposure. For instance, the introduction of high-resolution detectors and advanced reconstruction algorithms allows for more accurate assessments of dental conditions. This technological evolution is likely to drive adoption rates among dental practitioners, as they seek to provide better patient care. Furthermore, the integration of artificial intelligence in image analysis is expected to streamline workflows and improve diagnostic accuracy. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 8% over the next five years.

Growing Demand for Precision

There is a growing demand for precision in dental diagnostics within the France CBCT dental imaging market. Patients and practitioners are increasingly recognizing the importance of accurate imaging for treatment planning and outcomes. The ability of CBCT to provide three-dimensional views of dental structures allows for more precise assessments of conditions such as impacted teeth, bone density, and anatomical variations. This demand for precision is further fueled by the rise in complex dental procedures, including implants and orthodontics, which require detailed imaging for successful outcomes. As a result, the market is likely to see an increase in the adoption of CBCT systems, with projections indicating a potential market size expansion of over 15% in the coming years.

Rising Dental Care Expenditure

Rising dental care expenditure in France is positively impacting the CBCT dental imaging market. As individuals become more health-conscious and prioritize oral health, spending on dental services is increasing. According to recent statistics, dental care expenditure in France has seen a steady rise, with a significant portion allocated to advanced imaging technologies. This trend is indicative of a broader shift towards preventive care and early diagnosis, which are facilitated by the use of CBCT systems. Consequently, dental practices are more inclined to invest in CBCT technology to meet patient demands for high-quality care. This increase in expenditure is expected to drive market growth, with forecasts suggesting a potential increase in market value by 20% over the next few years.

Increased Awareness and Education

Increased awareness and education regarding the benefits of CBCT technology are driving growth in the France CBCT dental imaging market. Dental professionals are becoming more informed about the advantages of using CBCT over traditional imaging methods, such as panoramic radiography. Educational initiatives, workshops, and seminars are being organized to highlight the clinical benefits of CBCT, including enhanced diagnostic capabilities and improved patient outcomes. As dental schools incorporate CBCT training into their curricula, new practitioners are entering the workforce with a strong understanding of this technology. This heightened awareness is likely to lead to a broader acceptance of CBCT systems in dental practices, contributing to market growth.