Rising Demand for E-commerce Solutions

The commerce as-a-service market in France experiences a notable surge in demand for e-commerce solutions. This trend is driven by the increasing number of consumers opting for online shopping, which has been bolstered by advancements in technology and changing consumer behaviors. In 2025, e-commerce sales in France are projected to reach approximately €150 billion, indicating a growth rate of around 10% annually. This rising demand compels businesses to adopt commerce as-a-service models to streamline their operations and enhance customer engagement. As companies seek to remain competitive, the integration of comprehensive e-commerce platforms becomes essential, allowing them to offer seamless shopping experiences. Consequently, the commerce as-a-service market is likely to expand as businesses invest in scalable solutions that cater to the evolving needs of consumers.

Emphasis on Data-Driven Decision Making

In the commerce as-a-service market, the emphasis on data-driven decision making is becoming increasingly pronounced in France. Businesses are recognizing the value of data analytics in understanding consumer behavior and preferences. By leveraging data, companies can tailor their offerings and marketing strategies to better meet customer needs. In 2025, it is projected that over 60% of businesses in the commerce sector will utilize advanced analytics tools to inform their decisions. This trend not only enhances operational efficiency but also fosters innovation within the commerce as-a-service market. As organizations seek to optimize their performance, the demand for integrated data solutions within commerce as-a-service platforms is likely to rise, enabling businesses to harness insights that drive growth and improve customer satisfaction.

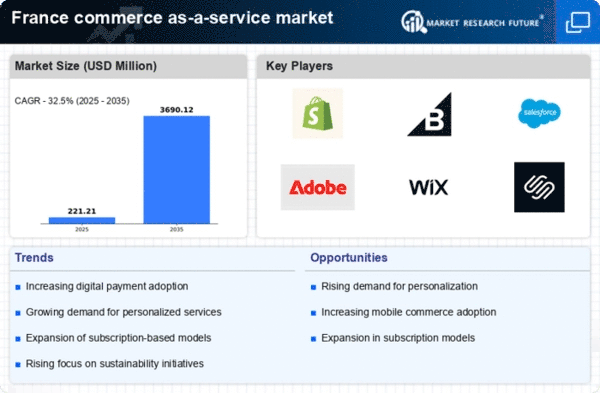

Shift Towards Subscription-Based Models

The commerce as-a-service market in France is witnessing a significant shift towards subscription-based models. This transformation is largely influenced by consumer preferences for convenience and flexibility in purchasing. Subscription services, which provide customers with regular deliveries of products or services, have gained traction across various sectors, including food, fashion, and digital content. In 2025, it is estimated that subscription-based revenue models could account for up to 30% of total e-commerce sales in France. This trend encourages businesses to adopt commerce as-a-service solutions that facilitate the management of subscriptions, billing, and customer relationships. As a result, companies are increasingly leveraging these models to enhance customer loyalty and drive recurring revenue, thereby contributing to the growth of the commerce as-a-service market.

Increased Focus on Sustainability Practices

The commerce as-a-service market in France is experiencing an increased focus on sustainability practices. As consumers become more environmentally conscious, businesses are compelled to adopt sustainable practices in their operations. This trend is reflected in the growing demand for eco-friendly products and services, with a significant portion of consumers willing to pay a premium for sustainable options. In 2025, it is estimated that the market for sustainable goods in France could reach €50 billion, representing a substantial opportunity for businesses. Consequently, the commerce as-a-service market is likely to expand as companies seek solutions that enable them to implement sustainable practices, such as reducing waste and optimizing supply chains. This focus on sustainability not only aligns with consumer values but also enhances brand reputation, further driving growth in the commerce as-a-service market.

Growing Importance of Omnichannel Strategies

The commerce as-a-service market in France is increasingly influenced by the growing importance of omnichannel strategies. As consumers engage with brands across multiple touchpoints, businesses are compelled to create cohesive shopping experiences that integrate online and offline channels. In 2025, it is anticipated that nearly 75% of consumers will expect a seamless transition between different shopping environments. This shift necessitates the adoption of commerce as-a-service solutions that support omnichannel capabilities, allowing businesses to manage inventory, customer data, and sales across various platforms. By implementing these strategies, companies can enhance customer engagement and satisfaction, ultimately driving sales growth. The commerce as-a-service market is likely to benefit from this trend as businesses invest in technologies that facilitate a unified customer journey.