Increased Investment in Drone Startups

Investment in the France drones market is witnessing a notable surge, particularly in startups focused on innovative drone solutions. Venture capitalists and government initiatives are channeling funds into research and development, fostering a vibrant ecosystem for drone technology. In 2025, investments in French drone startups reached approximately 200 million euros, reflecting a growing confidence in the market's potential. This influx of capital is likely to accelerate the development of new applications, such as urban air mobility and drone-based logistics, thereby expanding the overall market landscape. As these startups emerge, they contribute to a competitive environment that drives innovation and enhances service offerings.

Rising Adoption of Drones in Agriculture

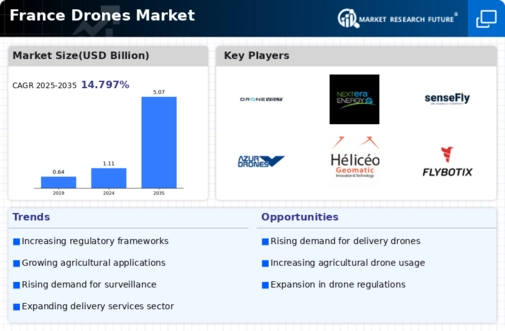

The France drones market is witnessing a significant rise in the adoption of drones within the agricultural sector. Farmers are increasingly utilizing drones for crop monitoring, precision farming, and livestock management. This trend is driven by the need for improved efficiency and productivity in agriculture. In 2025, the agricultural drone market in France was valued at approximately 100 million euros, highlighting its growing importance. Drones enable farmers to gather real-time data, optimize resource usage, and enhance yield quality. As the agricultural sector continues to embrace technological advancements, the demand for drones is expected to increase, further propelling the growth of the France drones market.

Expansion of Drone Regulations and Frameworks

The France drones market is benefiting from the establishment of comprehensive regulatory frameworks that govern drone operations. The French Civil Aviation Authority has implemented regulations that promote safe and responsible drone usage while encouraging innovation. These regulations provide clarity for businesses and operators, fostering a conducive environment for growth. In 2025, the number of registered commercial drones in France surpassed 50,000, reflecting the positive impact of regulatory support. As regulations evolve, they are likely to facilitate the integration of drones into various sectors, including transportation and agriculture, thereby enhancing the overall market landscape.

Technological Advancements in Drone Capabilities

The France drones market is experiencing rapid technological advancements that enhance drone capabilities. Innovations in battery life, payload capacity, and autonomous navigation systems are driving the market forward. For instance, the introduction of AI-driven analytics allows drones to perform complex tasks such as precision agriculture and infrastructure inspection. According to recent data, the market for commercial drones in France is projected to grow at a CAGR of 15% over the next five years, indicating a robust demand for advanced drone technologies. These advancements not only improve operational efficiency but also expand the range of applications for drones, making them indispensable tools across various sectors.

Growing Demand for Surveillance and Security Solutions

The France drones market is increasingly driven by the demand for surveillance and security solutions. Drones are being deployed for various applications, including border control, public safety, and event monitoring. The French government has recognized the potential of drones in enhancing national security and has implemented policies to facilitate their use in law enforcement. In 2025, the market for security drones in France was estimated to be worth over 150 million euros, indicating a strong growth trajectory. This trend suggests that as security concerns rise, the adoption of drones for surveillance purposes will likely continue to expand, further solidifying their role in the market.