Supportive Regulatory Framework

A supportive regulatory framework is a vital driver for the electric vehicle-charging-station market. France has implemented various regulations and standards that facilitate the development and operation of charging stations. For instance, the government mandates that all new buildings include EV charging infrastructure, which is expected to significantly increase the number of available charging points. Additionally, local authorities are encouraged to create favorable zoning laws that promote the installation of charging stations in public and private spaces. This regulatory support not only enhances the market's attractiveness to investors but also ensures that the necessary infrastructure keeps pace with the growing demand for electric vehicles. As regulations evolve, they are likely to further stimulate the electric vehicle-charging-station market, fostering a more robust ecosystem for EV users.

Consumer Awareness and Education

Consumer awareness and education play a pivotal role in driving the electric vehicle-charging-station market. As more individuals become informed about the benefits of electric vehicles, including lower operating costs and environmental advantages, the demand for charging infrastructure is expected to rise. Educational campaigns by both government and private organizations aim to demystify electric vehicle ownership and highlight the convenience of charging options available. This increased awareness is crucial in addressing misconceptions and encouraging potential buyers to consider electric vehicles as a viable alternative. Furthermore, as consumers become more knowledgeable about the charging process and available technologies, they are likely to advocate for more charging stations in their communities. This grassroots demand can significantly influence the expansion of the electric vehicle-charging-station market.

Rising Electric Vehicle Adoption

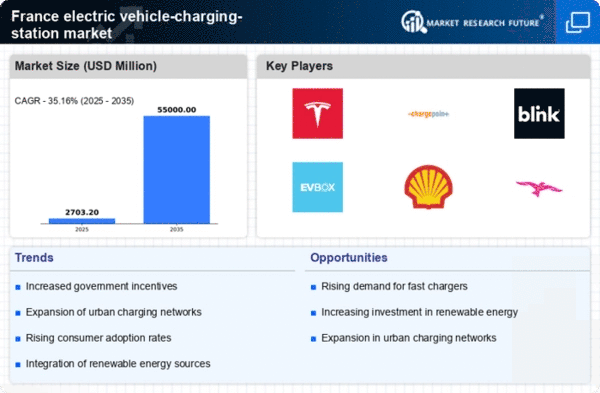

The increasing adoption of electric vehicles (EVs) in France is a primary driver for the electric vehicle-charging-station market. As of 2025, approximately 20% of new car sales in France are electric, reflecting a growing consumer preference for sustainable transportation. This trend is bolstered by government initiatives aimed at reducing carbon emissions and promoting cleaner alternatives. The rise in EV ownership necessitates a corresponding expansion in charging infrastructure, as consumers seek convenient access to charging stations. The electric vehicle-charging-station market is thus positioned to benefit from this surge in demand, with projections indicating a potential market growth of over 30% by 2030. This dynamic creates opportunities for both public and private investments in charging networks, enhancing the overall accessibility and convenience of EV usage.

Investment in Charging Infrastructure

Investment in charging infrastructure is a crucial driver for the electric vehicle-charging-station market. The French government has committed to investing €7 billion in EV infrastructure by 2030, aiming to install 100,000 charging points across the country. This ambitious plan is designed to alleviate range anxiety among potential EV buyers and to support the growing number of electric vehicles on the road. Furthermore, private sector investments are also on the rise, with companies recognizing the profitability of establishing charging stations in strategic locations. The collaboration between public and private entities is likely to accelerate the deployment of charging stations, thereby enhancing the electric vehicle-charging-station market's growth trajectory. As infrastructure expands, it is expected that consumer confidence in electric vehicles will increase, further driving market demand.

Technological Innovations in Charging Solutions

Technological innovations in charging solutions are significantly influencing the electric vehicle-charging-station market. Advances in fast-charging technology, such as ultra-fast chargers that can deliver up to 350 kW, are making it feasible for EVs to recharge in a matter of minutes. This rapid charging capability is essential for enhancing the user experience and encouraging more drivers to transition to electric vehicles. Additionally, the integration of smart charging systems, which optimize energy use and reduce costs, is becoming increasingly prevalent. These innovations not only improve the efficiency of charging stations but also align with France's commitment to sustainability. As technology continues to evolve, the electric vehicle-charging-station market is likely to see increased investment and consumer interest, further propelling its growth.