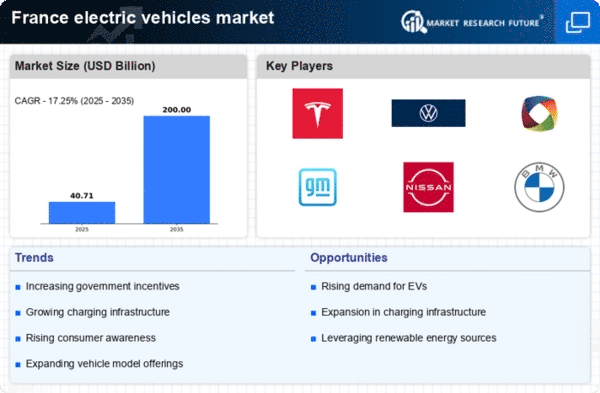

The electric vehicles market in France is characterized by a dynamic competitive landscape, driven by a confluence of technological advancements, regulatory support, and shifting consumer preferences towards sustainable mobility. Major players such as Tesla (US), Volkswagen (DE), and BYD (CN) are at the forefront, each adopting distinct strategies to enhance their market positioning. Tesla (US) continues to emphasize innovation, particularly in battery technology and autonomous driving features, while Volkswagen (DE) is focusing on expanding its electric vehicle (EV) portfolio through strategic partnerships and investments in local manufacturing. BYD (CN), on the other hand, is leveraging its extensive experience in battery production to offer competitively priced models, thereby appealing to a broader consumer base. Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological prowess and sustainability initiatives. Key business tactics within the market include localizing manufacturing and optimizing supply chains to mitigate costs and enhance efficiency. The competitive structure appears moderately fragmented, with several key players vying for market share while also facing competition from emerging startups. This fragmentation is indicative of a market that is still maturing, where established brands are increasingly challenged by innovative newcomers, thereby intensifying the competitive dynamics. In October 2025, Tesla (US) announced the opening of a new Gigafactory in France, aimed at significantly increasing its production capacity for electric vehicles. This strategic move is likely to bolster Tesla's presence in the European market, allowing for faster delivery times and reduced logistics costs. The establishment of local manufacturing capabilities may also enhance Tesla's ability to respond to regional demand fluctuations more effectively. In September 2025, Volkswagen (DE) unveiled its ambitious plan to invest €7 billion in electric vehicle infrastructure across France, which includes the development of charging stations and battery production facilities. This investment underscores Volkswagen's commitment to not only expanding its EV offerings but also ensuring that the necessary infrastructure is in place to support widespread adoption. Such initiatives are crucial for enhancing consumer confidence in electric mobility and could potentially position Volkswagen as a leader in the French market. In August 2025, BYD (CN) launched a new line of affordable electric vehicles specifically designed for the European market, with a focus on urban mobility solutions. This strategic introduction is indicative of BYD's intent to capture market share among cost-sensitive consumers, thereby diversifying its customer base. The emphasis on urban mobility aligns with broader trends towards sustainable transportation solutions in densely populated areas, suggesting that BYD is well-positioned to capitalize on this growing segment. As of November 2025, current competitive trends in the electric vehicles market are increasingly shaped by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are becoming more prevalent, facilitating knowledge sharing and resource pooling to enhance innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological innovation, supply chain reliability, and sustainability practices. This shift indicates a market that is not only maturing but also becoming more sophisticated in its approach to meeting consumer demands.