Rising Awareness and Education

Rising awareness and education regarding gastrointestinal health are emerging as significant drivers for the endoscopic retrograde-cholangiopancreatography market. Public health campaigns and educational initiatives are informing patients about the importance of early diagnosis and treatment of biliary disorders. In France, healthcare organizations are actively promoting awareness about symptoms and risk factors associated with these conditions, leading to increased patient engagement and proactive healthcare-seeking behavior. This heightened awareness is likely to result in more patients opting for endoscopic retrograde-cholangiopancreatography as a diagnostic and therapeutic option. Consequently, the market is expected to experience growth as more individuals recognize the benefits of these procedures.

Supportive Healthcare Policies

Supportive healthcare policies in France are playing a pivotal role in the growth of the endoscopic retrograde-cholangiopancreatography market. The French government has implemented various initiatives aimed at improving access to advanced medical technologies and procedures. These policies include funding for healthcare facilities to acquire state-of-the-art endoscopic equipment and training programs for healthcare professionals. As a result, the market is witnessing increased investment in endoscopic services, which is expected to enhance the availability and quality of care. Furthermore, the government's focus on reducing healthcare disparities is likely to expand access to endoscopic retrograde-cholangiopancreatography, thereby driving market growth in the coming years.

Advancements in Endoscopic Technology

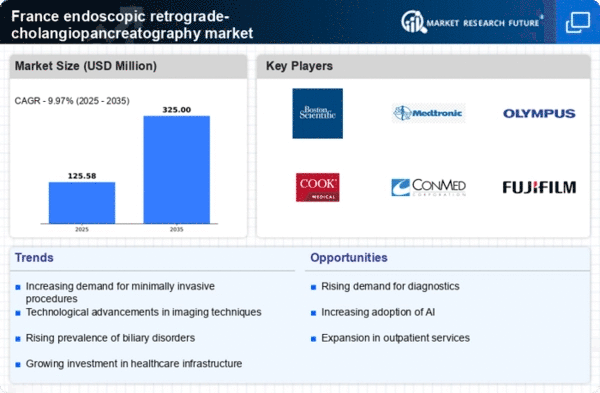

Technological innovations in endoscopic equipment are significantly influencing the endoscopic retrograde-cholangiopancreatography market. The introduction of high-definition imaging, improved endoscopes, and enhanced visualization techniques has transformed the capabilities of endoscopic procedures. These advancements not only improve diagnostic accuracy but also enhance patient outcomes, making procedures safer and more efficient. In France, the market for endoscopic devices is projected to grow at a CAGR of approximately 7% over the next five years, driven by these technological improvements. As healthcare providers increasingly adopt these advanced tools, the demand for endoscopic retrograde-cholangiopancreatography is expected to rise, reflecting a shift towards more sophisticated medical interventions.

Increasing Incidence of Biliary Disorders

The rising prevalence of biliary disorders in France is a crucial driver for the endoscopic retrograde-cholangiopancreatography market. Conditions such as cholangitis, choledocholithiasis, and pancreatitis are becoming more common, leading to a higher demand for diagnostic and therapeutic procedures. According to health statistics, biliary disorders account for a significant portion of gastrointestinal diseases, with an estimated incidence rate of 15-20 cases per 100,000 individuals annually. This growing patient population necessitates advanced endoscopic techniques, thereby propelling the market forward. Furthermore, as awareness of these conditions increases, more patients are seeking medical intervention, which is likely to further boost the demand for endoscopic retrograde-cholangiopancreatography services in the healthcare system.

Growing Preference for Outpatient Procedures

The trend towards outpatient procedures is reshaping the landscape of the endoscopic retrograde-cholangiopancreatography market. Patients and healthcare providers alike are increasingly favoring minimally invasive techniques that allow for quicker recovery times and reduced hospital stays. In France, outpatient endoscopic procedures have seen a rise of approximately 30% in recent years, as patients seek to minimize the disruption to their daily lives. This shift not only enhances patient satisfaction but also reduces healthcare costs, making it an attractive option for both patients and providers. Consequently, the endoscopic retrograde-cholangiopancreatography market is likely to benefit from this growing preference, as more patients opt for outpatient care.