Growing Awareness and Education

The growing awareness and education regarding gastrointestinal health among the Japanese population is driving the endoscopic retrograde-cholangiopancreatography market. Public health campaigns and educational initiatives by healthcare organizations are informing individuals about the importance of early diagnosis and treatment of biliary disorders. This heightened awareness is leading to an increase in patient consultations and referrals for endoscopic procedures. Moreover, healthcare professionals are receiving enhanced training on the latest endoscopic techniques, which further promotes the adoption of endoscopic retrograde-cholangiopancreatography. As a result, the market is likely to experience growth as more patients seek these advanced diagnostic and therapeutic options.

Increased Healthcare Expenditure

Japan's rising healthcare expenditure is a significant driver for the endoscopic retrograde-cholangiopancreatography market. The government has been investing heavily in healthcare infrastructure, aiming to improve access to advanced medical technologies. In 2025, healthcare spending is expected to reach approximately $500 billion, with a substantial portion allocated to gastrointestinal procedures. This financial commitment facilitates the procurement of advanced endoscopic equipment and training for healthcare professionals, thereby enhancing the quality of care. As hospitals upgrade their facilities and expand their service offerings, the demand for endoscopic retrograde-cholangiopancreatography is likely to increase, reflecting a broader trend towards improved patient care in Japan.

Supportive Regulatory Environment

The regulatory environment in Japan is becoming increasingly supportive of advanced medical technologies, including those used in the endoscopic retrograde-cholangiopancreatography market. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined the approval process for innovative endoscopic devices, facilitating quicker access to the market. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of new and improved endoscopic technologies. As a result, healthcare providers are more likely to adopt these innovations, thereby driving the growth of the endoscopic retrograde-cholangiopancreatography market. The favorable regulatory landscape is expected to continue fostering advancements in this field, ultimately benefiting patient care.

Advancements in Endoscopic Technology

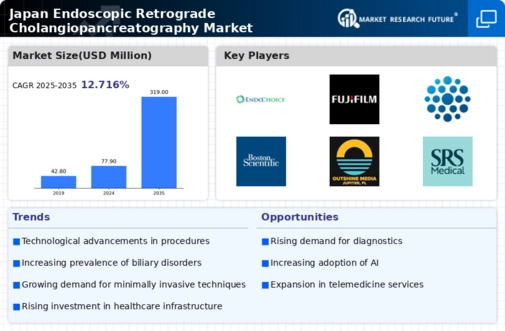

Technological innovations in endoscopic equipment are significantly influencing the endoscopic retrograde-cholangiopancreatography market. The introduction of high-definition imaging, improved endoscopes, and minimally invasive techniques has enhanced the precision and safety of procedures. For instance, the development of single-use endoscopes and advanced imaging modalities has been shown to reduce complications and improve patient outcomes. As hospitals and clinics in Japan increasingly invest in state-of-the-art technology, the demand for endoscopic retrograde-cholangiopancreatography is expected to rise. Market data indicates that the segment of advanced endoscopic devices is projected to grow at a CAGR of over 8% in the coming years, reflecting the trend towards more sophisticated medical interventions.

Rising Incidence of Biliary Disorders

The increasing prevalence of biliary disorders in Japan is a crucial driver for the endoscopic retrograde-cholangiopancreatography market. Conditions such as choledocholithiasis and cholangitis are becoming more common, leading to a higher demand for diagnostic and therapeutic procedures. According to recent health statistics, biliary disorders affect approximately 10% of the population in Japan, which translates to millions of individuals requiring intervention. This growing patient base necessitates advanced endoscopic techniques, thereby propelling the market forward. Furthermore, the rising awareness among healthcare providers regarding the efficacy of endoscopic retrograde-cholangiopancreatography in managing these conditions is likely to enhance its adoption in clinical settings, contributing to market growth.