Aging Population

France's demographic shift towards an aging population is significantly impacting the generic pharmaceuticals market. As the proportion of elderly individuals increases, the prevalence of chronic diseases rises, leading to higher medication consumption. By 2025, it is projected that over 20% of the French population will be aged 65 and older, necessitating a greater reliance on affordable medication options. This demographic trend suggests that the demand for generic drugs will continue to grow, as they provide a cost-effective solution for managing chronic conditions prevalent in older adults. The generic pharmaceuticals market is likely to benefit from this demographic change, as healthcare providers increasingly prescribe generics to manage the healthcare needs of the aging population, thereby enhancing market penetration and acceptance.

Increasing Healthcare Costs

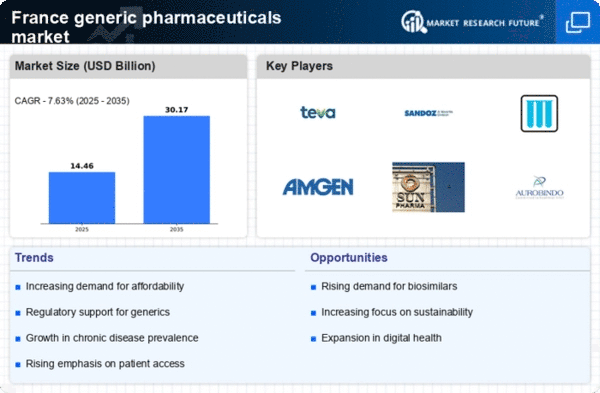

The rising costs associated with healthcare in France are driving the demand for the generic pharmaceuticals market. As patients and healthcare providers seek cost-effective alternatives to branded medications, the market for generics is expanding. In 2024, the expenditure on pharmaceuticals in France reached approximately €40 billion, with generics accounting for about 30% of this total. This trend indicates a growing acceptance of generic drugs among healthcare professionals and patients alike. The increasing financial burden on the healthcare system is likely to propel further growth in the generic pharmaceuticals market, as stakeholders prioritize affordability without compromising on quality. Consequently, the market is expected to witness a compound annual growth rate (CAGR) of around 5% over the next few years, reflecting the ongoing shift towards generics as a viable solution to rising healthcare costs.

Government Initiatives and Policies

The French government has implemented various initiatives aimed at promoting the use of generic medications, which is positively influencing the generic pharmaceuticals market. Policies such as the '100% Santé' initiative, which aims to improve access to healthcare and reduce out-of-pocket expenses for patients, have encouraged the adoption of generics. In 2023, the government reported that the share of generics in the total pharmaceutical market had increased to 35%, reflecting the effectiveness of these policies. Furthermore, the government is actively working to streamline the approval process for generics, ensuring that they reach the market more quickly. These supportive measures are likely to enhance the competitiveness of the generic pharmaceuticals market, fostering an environment conducive to growth and innovation.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of generic pharmaceuticals are playing a crucial role in shaping the market landscape in France. Innovations such as continuous manufacturing and advanced quality control systems are enhancing production efficiency and reducing costs. In 2025, it is estimated that the adoption of these technologies could lower production costs by up to 15%, making generics even more competitive against branded drugs. This trend indicates a shift towards more sustainable and efficient manufacturing practices, which could lead to increased availability of generics in the market. As manufacturers invest in technology, the generic pharmaceuticals market is likely to experience improved product quality and faster time-to-market, ultimately benefiting consumers and healthcare providers.

Rising Awareness Among Healthcare Professionals

There is a growing awareness among healthcare professionals regarding the benefits of prescribing generic medications, which is positively impacting the generic pharmaceuticals market. As physicians and pharmacists become more educated about the efficacy and safety of generics, they are increasingly recommending these alternatives to patients. Surveys indicate that approximately 70% of healthcare providers in France now express confidence in the quality of generic drugs, a notable increase from previous years. This shift in perception is likely to enhance patient acceptance and adherence to generic prescriptions, further driving market growth. The generic pharmaceuticals market is expected to capitalize on this trend, as healthcare professionals play a pivotal role in influencing patient choices and promoting the use of generics as a viable option for treatment.