Increasing Healthcare Costs

The health insurance market in France is experiencing upward pressure due to rising healthcare costs. Factors such as advanced medical technologies, increased demand for specialized treatments, and an aging population contribute to this trend. In 2025, healthcare expenditure in France is projected to reach approximately €300 billion, representing a growth of around 4% annually. This escalation in costs necessitates that health insurance providers adapt their offerings to ensure affordability and accessibility for consumers. As a result, insurers are likely to enhance their product portfolios, focusing on comprehensive coverage options that address the evolving needs of policyholders. This dynamic environment may lead to increased competition among insurers, ultimately benefiting consumers through improved service delivery and innovative health insurance solutions.

Impact of Demographic Changes

Demographic changes are significantly impacting the health insurance market in France. An aging population, coupled with increasing life expectancy, is leading to a higher prevalence of chronic diseases and long-term care needs. By 2025, it is projected that over 20% of the French population will be aged 65 and older, necessitating a shift in health insurance offerings to accommodate this demographic. Insurers may need to focus on developing products that provide comprehensive coverage for age-related health issues, including long-term care and rehabilitation services. Additionally, the influx of younger consumers into the market presents opportunities for insurers to innovate and attract this demographic through technology-driven solutions and flexible coverage options. Understanding these demographic trends is crucial for health insurance providers to remain relevant and competitive.

Regulatory Changes and Compliance

The health insurance market in France is significantly influenced by regulatory changes and compliance requirements. The French government has implemented various reforms aimed at enhancing the quality of healthcare services and ensuring equitable access for all citizens. For instance, the introduction of the 100% Health reform in 2019 aimed to eliminate out-of-pocket expenses for certain medical procedures. Such regulatory frameworks compel health insurance providers to align their policies with government mandates, which may lead to increased operational costs. However, compliance also presents opportunities for insurers to innovate and develop new products that cater to the changing landscape. As regulations evolve, the health insurance market must remain agile to adapt to these changes while maintaining competitive offerings.

Technological Advancements in Healthcare

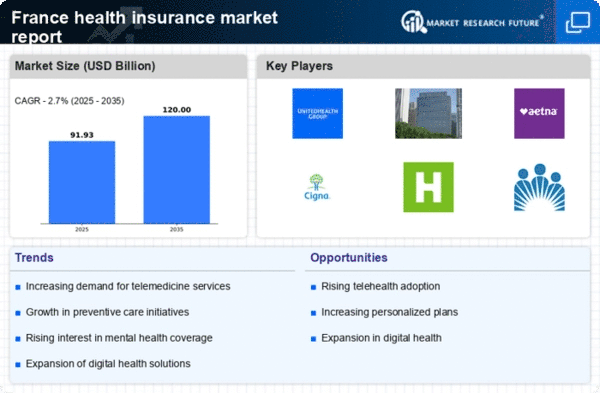

Technological advancements are reshaping the health insurance market in France, driving efficiency and improving customer experiences. Innovations such as telemedicine, artificial intelligence, and data analytics are becoming integral to health insurance operations. In 2025, it is estimated that over 30% of consultations in France will occur via telehealth platforms, reflecting a shift towards digital healthcare solutions. These technologies not only enhance service delivery but also enable insurers to better assess risk and tailor policies to individual needs. Consequently, health insurance providers are likely to invest in technology-driven solutions to streamline processes and improve customer engagement. This trend may lead to a more personalized approach in the health insurance market, ultimately benefiting both insurers and policyholders.

Growing Demand for Personalized Insurance Products

The health insurance market in France is witnessing a growing demand for personalized insurance products. Consumers are increasingly seeking coverage that aligns with their specific health needs and lifestyle choices. This shift is partly driven by a more health-conscious population that values tailored solutions over traditional one-size-fits-all policies. In response, insurers are likely to develop customizable plans that allow individuals to select coverage options based on their unique circumstances. This trend may also encourage the integration of wellness programs and preventive care services into insurance offerings, further enhancing the appeal of personalized products. As competition intensifies, health insurance providers must prioritize customer-centric strategies to capture and retain market share.