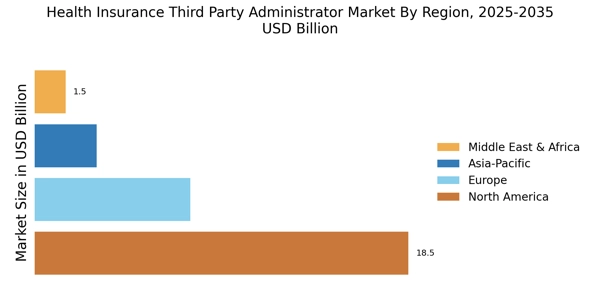

North America : Market Leader in Health Insurance

North America is the largest market for Health Insurance Third Party Administrators (TPAs), holding approximately 60% of the global market share. Key growth drivers include an increasing aging population, rising healthcare costs, and regulatory support for managed care. The U.S. is the largest market, followed by Canada, which contributes around 15% to the overall market. Regulatory catalysts such as the Affordable Care Act have further propelled demand for TPAs in the region. The competitive landscape is dominated by major players like UnitedHealth Group, Anthem, and Aetna, which have established strong networks and innovative service offerings. The presence of these key players ensures a robust market environment, with a focus on improving patient outcomes and reducing costs. The ongoing trend towards value-based care is also shaping the strategies of these organizations, making them more competitive in the evolving healthcare landscape.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the Health Insurance TPA market, driven by increasing healthcare expenditures and a shift towards managed care models. The region holds approximately 25% of the global market share, with Germany and the UK being the largest contributors. Regulatory frameworks, such as the European Union's Solvency II directive, are encouraging the adoption of TPAs, enhancing operational efficiencies and compliance among insurers. Leading countries like Germany, France, and the UK are experiencing a surge in demand for TPAs, as insurers seek to streamline operations and improve customer service. The competitive landscape features both local and international players, with a focus on digital transformation and customer-centric solutions. Companies are increasingly investing in technology to enhance service delivery and meet the evolving needs of policyholders, positioning themselves for future growth.

Asia-Pacific : Rapid Growth and Innovation

Asia-Pacific is rapidly emerging as a significant player in the Health Insurance TPA market, accounting for approximately 10% of the global share. The region's growth is fueled by rising disposable incomes, increasing health awareness, and government initiatives aimed at expanding healthcare access. Countries like China and India are leading this growth, with China holding the largest market share in the region, driven by its vast population and expanding middle class. The competitive landscape is characterized by a mix of local and international players, with companies focusing on innovative solutions to cater to diverse consumer needs. The presence of key players such as AIA Group and Ping An Insurance highlights the region's potential. Additionally, regulatory support for health insurance reforms is encouraging the adoption of TPAs, making the market more attractive for investment and growth.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the Health Insurance TPA market, holding around 5% of the global market share. Key growth drivers include increasing healthcare investments, a rising population, and government initiatives aimed at improving healthcare infrastructure. Countries like South Africa and the UAE are at the forefront, with the UAE implementing mandatory health insurance policies that are driving demand for TPAs in the region. The competitive landscape is still developing, with a mix of local and international players entering the market. The presence of key players such as Discovery Limited and Sanlam is notable, as they focus on expanding their service offerings. The region's unique challenges, including regulatory complexities and varying healthcare standards, present both challenges and opportunities for TPAs looking to establish a foothold in this emerging market.