Rising Cyber Threat Landscape

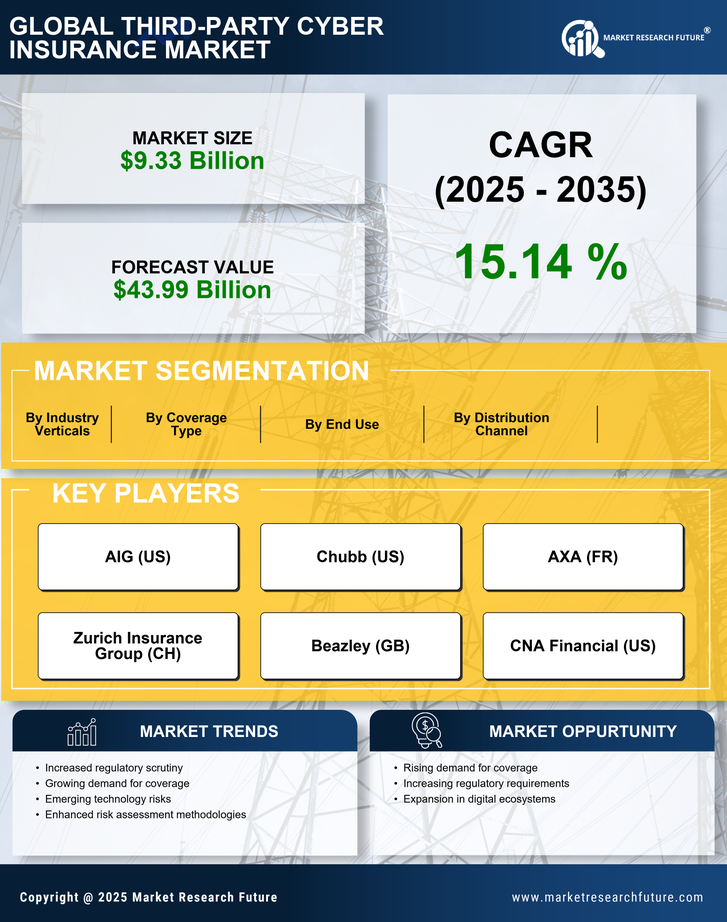

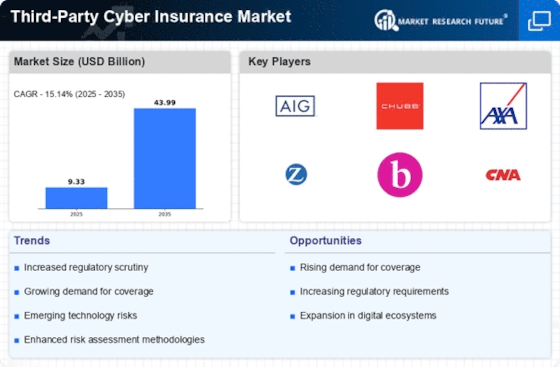

The Third-Party Cyber Insurance Market is experiencing heightened demand due to the escalating frequency and sophistication of cyber threats. Organizations are increasingly recognizing the necessity of safeguarding their operations against potential breaches. According to recent data, cyber incidents have surged by over 30% in the past year, prompting businesses to seek comprehensive insurance solutions. This trend indicates a growing awareness of the financial repercussions associated with data breaches, which can lead to significant losses. As a result, the market for third-party cyber insurance is likely to expand, driven by the imperative to mitigate risks and protect sensitive information. Insurers are responding by developing tailored policies that address specific vulnerabilities, thereby enhancing the appeal of cyber insurance products in the marketplace.

Regulatory Compliance Requirements

The Third-Party Cyber Insurance Market is significantly influenced by the evolving landscape of regulatory compliance. Governments and regulatory bodies are increasingly mandating that organizations implement robust cybersecurity measures to protect consumer data. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose stringent requirements on data handling and breach notification. Non-compliance can result in hefty fines, which may reach millions of dollars. Consequently, businesses are turning to third-party cyber insurance as a means to not only comply with these regulations but also to safeguard against potential financial penalties. This trend suggests that as regulatory frameworks continue to tighten, the demand for cyber insurance will likely increase, positioning it as a critical component of corporate risk management strategies.

Emergence of New Cybersecurity Technologies

The Third-Party Cyber Insurance Market is being shaped by the emergence of innovative cybersecurity technologies that enhance risk assessment and mitigation strategies. As organizations invest in advanced security solutions, such as artificial intelligence and machine learning, they are better equipped to identify and respond to cyber threats. This technological evolution not only reduces the likelihood of breaches but also influences the underwriting process for cyber insurance. Insurers are increasingly leveraging these technologies to assess risk profiles more accurately, leading to more competitive pricing and tailored coverage options. As the integration of cutting-edge cybersecurity technologies becomes more prevalent, the Third-Party Cyber Insurance Market is expected to expand, driven by the need for comprehensive protection in an increasingly complex threat landscape.

Increased Digital Transformation Initiatives

The Third-Party Cyber Insurance Market is witnessing a surge in demand driven by the rapid digital transformation initiatives undertaken by organizations across various sectors. As businesses increasingly adopt cloud computing, IoT devices, and digital platforms, they inadvertently expose themselves to a wider array of cyber risks. Data indicates that nearly 70% of companies have accelerated their digital strategies, leading to a corresponding rise in cyber vulnerabilities. This shift necessitates the implementation of comprehensive risk management solutions, including third-party cyber insurance, to protect against potential breaches and data loss. Insurers are adapting their offerings to cater to the unique needs of digitally transformed enterprises, thereby enhancing the relevance of cyber insurance in today’s technology-driven landscape.

Growing Awareness of Cyber Insurance Benefits

The Third-Party Cyber Insurance Market is benefiting from a growing awareness among businesses regarding the advantages of cyber insurance. Organizations are increasingly recognizing that traditional insurance policies may not adequately cover cyber-related risks, leading to a shift in perception. Recent surveys indicate that over 60% of businesses now view cyber insurance as an essential component of their risk management strategy. This heightened awareness is prompting companies to seek specialized coverage that addresses the unique challenges posed by cyber threats. As more organizations understand the potential financial and reputational damage associated with cyber incidents, the demand for tailored third-party cyber insurance solutions is likely to rise, further propelling market growth.