Third Party Cyber Insurance Market

Marktforschungsbericht zu Cyber-Versicherungen Dritter nach Art der Deckung (Haftung wegen Datenschutzverletzung, Haftung für Netzwerksicherheit, Cyber-Erpressung, Betriebsunterbrechung, Medienhaftung), nach Vertriebskanal (Online, Makler, Direktvertrieb, Agenten), nach Endverwendung (kleine Unternehmen, mittlere Unternehmen, große Unternehmen), nach Branchen (Gesundheitswesen, Finanzen, Einzelhandel, Fertigung, Transport) und nach Regionen (Nordamerika, Europa, Südamerika, Asien-Pazifik, Naher Osten und Afrika) – Prognose bis 2034

Marktüberblick über Cyber-Versicherungen von Drittanbietern

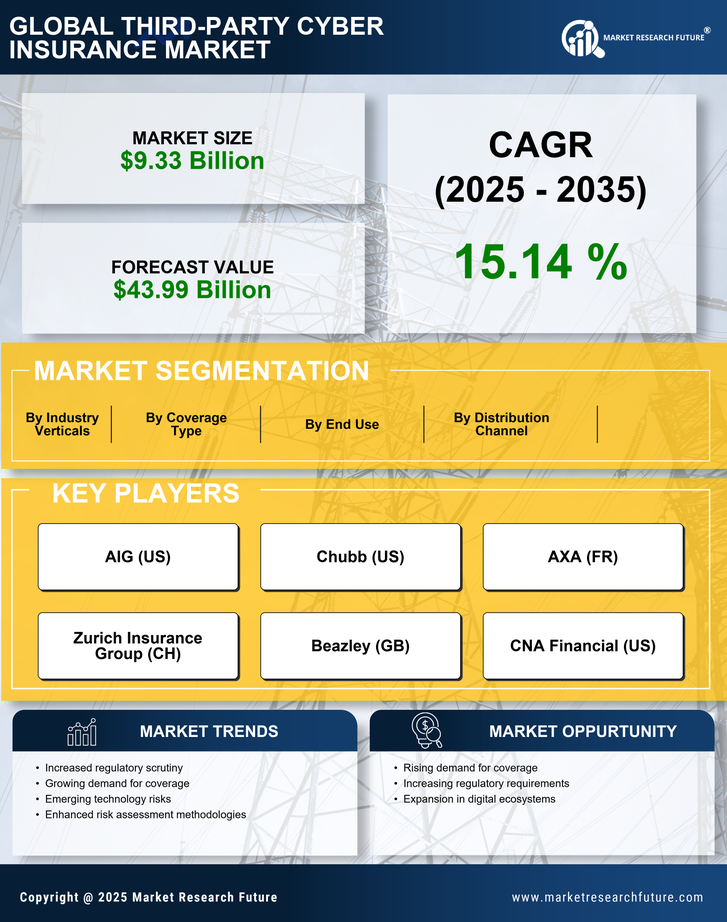

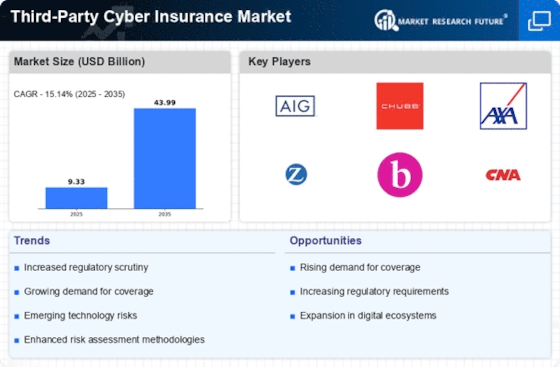

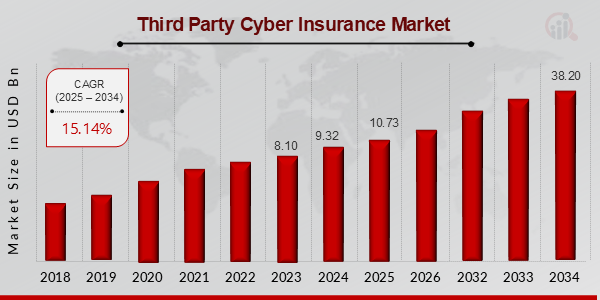

Laut MRFR-Analyse wurde die Marktgröße für Drittanbieter-Cyberversicherungen auf 6,11 (Milliarden US-Dollar) geschätzt. im Jahr 2022. Es wird erwartet, dass die Branche des Drittanbieter-Cyberversicherungsmarktes von 7,03 (Milliarden US-Dollar) im Jahr 2023 auf 25,0 (Milliarden US-Dollar) im Jahr 2032 wachsen wird. Die CAGR (Wachstumsrate) des Drittanbieter-Cyberversicherungsmarktes wird voraussichtlich betragen rund 15,14 % im Prognosezeitraum (2024 – 2032).

Wichtige Markttrends für Cyber-Versicherungen Dritter hervorgehoben /

Der Markt für Cyber-Drittversicherungen verzeichnet ein erhebliches Wachstum, das durch zunehmende Cyber-Bedrohungen und das steigende Bewusstsein dafür angetrieben wird die finanziellen Auswirkungen von Datenschutzverletzungen. Da Unternehmen zunehmend auf digitale Plattformen angewiesen sind, haben die potenziellen Kosten im Zusammenhang mit Cyberangriffen, darunter Anwaltskosten, Bußgelder und Reputationsschäden, dazu geführt, dass Unternehmen Versicherungsschutz in Anspruch nehmen. Das Streben nach Einhaltung der Datenschutzbestimmungen unterstreicht zusätzlich die Notwendigkeit robuster Versicherungslösungen zur Risikominderung. Versicherer passen ihre Angebote an die besonderen Herausforderungen verschiedener Branchen an und ermöglichen so einen maßgeschneiderten Versicherungsschutz, der spezifische Schwachstellen abdeckt.

Dieser Markt verfügt über ein erhebliches ungenutztes Potenzial, insbesondere da Unternehmen wie KMU seit langem Cyberversicherungen abschließen leichtfertig beginnen, seine Notwendigkeit zu erkennen. Mit der zunehmenden Verbreitung von KI und maschinellem Lernen in Cybersicherheitslösungen bieten sich für Versicherer Möglichkeiten, bei der Optimierung ihrer Risikobewertungsrahmen zusammenzuarbeiten. Da die Arbeit von zu Hause aus zur neuen Normalität wird, besteht außerdem eine starke Nachfrage nach kostenloser Risikoplatzierung mit eingebetteten zusätzlichen Risiken, die mit einer dezentralen Betriebsumgebung einhergehen. Diese Veränderungen können von den Versicherern genutzt werden, indem sie neue Produkte entwickeln, die sich an die Bedürfnisse der Kunden richten. sich ändernden Bedürfnissen gerecht zu werden und so neue Geschäftsmöglichkeiten zu schaffen.

In letzter Zeit haben sich die Anbieter des Cyber-Versicherungsmarkts stärker mit Anbietern von Cyber-Sicherheit abgeglichen, und es gibt einen sichtbaren Trend dazu verstärkte Partnerschaften. Ziel dieser kollaborativen Modalität ist die Bereitstellung optimaler Lösungen – Ansätze, die eine Abdeckung bieten und den Schutzmaßnahmen einen Mehrwert verleihen. Die Betonung des Risikomanagements und seiner Prävention zeigt also, dass der Schwerpunkt auf der Abkehr von Ex-post-Antworten und hin zu Ex-ante-Ansätzen liegt. Da sich der globale Drittanbieter-Cyberversicherungssektor durch Veränderungen anpasst, geht ein verbessertes Wissen über Bedrohungen mit der Notwendigkeit besserer und maßgeschneiderter Policen für die Zukunft dieses Marktes einher.

Quelle: Primärforschung, Sekundärforschung, MRFR-Datenbank und Analystenbewertung

Markttreiber für Cyberversicherungen von Drittanbietern

Erhöhte Häufigkeit und Komplexität von Cyber-Angriffen

Der Anstieg der Häufigkeit und Komplexität von Cyber-Angriffen ist ein entscheidender Treiber für die Third-Party-Cyber-Versicherung Marktindustrie. Da Unternehmen für ihre Geschäftsabläufe zunehmend auf digitale Plattformen angewiesen sind, werden sie anfälliger für verschiedene Cyber-Bedrohungen, darunter Ransomware, Datenschutzverletzungen und Phishing-Angriffe. Diese Eskalation von Cybervorfällen gefährdet nicht nur sensible Unternehmensdaten und persönliche Kundeninformationen, sondern stellt auch ein erhebliches Risiko für die Finanzstabilität und den Ruf dar. Unternehmen beginnen zu erkennen, dass herkömmliche Versicherungspolicen häufig nicht ausreichend gegen diese einzigartigen Risiken schützen, was zu einem erhöhten Risiko führt Nachfrage nach spezialisierten Cyberversicherungen. In den letzten Jahren haben bemerkenswerte, aufsehenerregende Angriffe die potenziellen finanziellen Folgen einer Unterschätzung von Cybersicherheitslücken deutlich gemacht. Darüber hinaus steigen die durchschnittlichen Kosten dieser Vorfälle, was Unternehmen unter Druck setzt, nach umfassenden Lösungen zu suchen, um sich vor unvorhergesehenen finanziellen Verlusten im Zusammenhang mit Cyber-Versicherungen zu schützen. Da das Bewusstsein für diese Risiken wächst, erkennen Unternehmen, dass es sinnvoll ist, in Angebote des Cyber-Versicherungsmarkts von Drittanbietern zu investieren ist nicht mehr optional, sondern ein entscheidender Bestandteil ihrer Risikomanagementstrategie. Daher rechnen wir mit einem anhaltenden Wachstum in diesem Markt, da Unternehmen der Notwendigkeit robuster Cyber-Versicherungspolicen zunehmend Priorität einräumen, um potenzielle Schäden durch Cyber-Bedrohungen abzumildern.

Regulierungsdruck und Compliance-Anforderungen

Regulierungsdruck und Compliance-Anforderungen treiben die Branche des Drittanbieter-Cyberversicherungsmarkts zunehmend voran. Da verschiedene Regierungen und Aufsichtsbehörden strengere Datenschutzgesetze und Compliance-Standards vorschreiben, müssen Unternehmen sicherstellen, dass sie angemessen vor potenziellen Cyberrisiken geschützt sind. Die Nichteinhaltung dieser Vorschriften kann zu schweren Geldstrafen und Reputationsschäden führen und Unternehmen dazu veranlassen, nach spezialisierten Cyber-Versicherungslösungen zu suchen. Diese zunehmende Betonung der Compliance steigert nicht nur den wahrgenommenen Wert von Cyber-Versicherungsprodukten, sondern stärkt auch das Vertrauen der Verbraucher in Unternehmen, die a nachweisen proaktiver Ansatz zur Bewältigung von Cyber-Risiken.

Steigendes Bewusstsein für Cyber-Risiken bei Unternehmen

Das zunehmende Bewusstsein für Cyber-Risiken in Unternehmen fördert einen proaktiven Ansatz für das Risikomanagement, der als Schlüsselelement dient Treiber für den Markt für Drittanbieter-Cyberversicherungen. Führungskräfte in der Wirtschaft werden immer besser über die potenziellen Folgen von Cyber-Bedrohungen und die daraus resultierenden finanziellen Verbindlichkeiten aufgeklärt. Dieses neue Verständnis führt zu der Bereitschaft, spezielle Cyber-Versicherungsoptionen zu erkunden, die Schutz vor unerwarteten Datenschutzverletzungen und Cyber-Vorfällen bieten. Da Unternehmen die Bedeutung des Schutzes ihrer Vermögenswerte erkennen, wird die Nachfrage nach Lösungen für den Cyber-Versicherungsmarkt von Drittanbietern voraussichtlich weiterhin anhalten Aufwärtsbewegung.

Einblicke in das Marktsegment für Cyber-Versicherungen von Drittanbietern Einblicke in die Art der Marktabdeckung von Cyber-Versicherungen Dritter

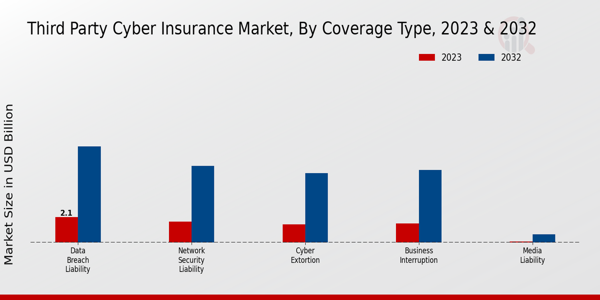

Der Markt für Drittanbieter-Cyberversicherungen verzeichnet ein erhebliches Wachstum, das vor allem auf die zunehmende Häufigkeit und Komplexität von Cyberversicherungen zurückzuführen ist Cyber-Bedrohungen, denen Unternehmen heute ausgesetzt sind. Ab 2023 hat der Markt einen Wert von 7,03 Milliarden US-Dollar und soll bis 2032 25,0 Milliarden US-Dollar erreichen, was einen überzeugenden Wachstumskurs darstellt. In dieser Landschaft spielt das Segment „Coverage Type“ eine entscheidende Rolle bei der Definition des Werts und der Eignung von Versicherungsprodukten für verschiedene Unternehmen, die spezifische Risiken im Zusammenhang mit Cyber-Vorfällen widerspiegeln. Unter den verschiedenen Deckungsbereichen sticht die Haftung für Datenschutzverletzungen mit einem Wert von 2,1 Milliarden US-Dollar im Jahr 2023 hervor, der bis 2032 auf 8,04 Milliarden US-Dollar ansteigt und damit einen erheblichen Marktanteil innehat.

Dieses Untersegment dominiert aufgrund der dringenden Notwendigkeit für Unternehmen, die finanziellen Folgen von Datenschutzverletzungen zu bewältigen. Dies kann das Vertrauen der Verbraucher beeinträchtigen und zu erheblichen Rechtskosten führen. Ebenso beläuft sich die Netzwerksicherheitshaftung im Jahr 2023 auf 1,75 Milliarden US-Dollar und soll bis 2032 auf 6,42 Milliarden US-Dollar ansteigen, was den zunehmenden Druck auf Unternehmen widerspiegelt, ihre Netzwerke vor unbefugtem Zugriff und Angriffen zu schützen. Cyber-Erpressung, deren Wert im Jahr 2023 auf 1,5 Milliarden US-Dollar geschätzt wird und bis 2032 voraussichtlich 5,8 Milliarden US-Dollar erreichen wird, verdeutlicht die tatsächliche Bedrohung, der Unternehmen durch Ransomware-Angriffe ausgesetzt sind, und unterstreicht die Notwendigkeit einer Abdeckung in diesem Bereich, die wesentliche Ressourcen zur Bekämpfung solcher Bedrohungen bereitstellen kann. span

Das Segment „Betriebsunterbrechung“ mit einem anfänglichen Wert von 1,6 Milliarden US-Dollar im Jahr 2023, der auf 6,06 Milliarden US-Dollar ansteigt im Jahr 2032 ist für Unternehmen von entscheidender Bedeutung, da es vor potenziellen Einkommensverlusten aufgrund von Cybervorfällen schützt, die zu Ausfallzeiten führen. Schließlich bietet die Medienhaftung zwar einen geringeren Wert von 0,08 Milliarden US-Dollar im Jahr 2023 und einen Anstieg auf 0,68 Milliarden US-Dollar bis 2032, bietet jedoch einen wichtigen Schutz in der heutigen digitalen Landschaft, in der Inhaltsrisiken, einschließlich Verleumdung und Urheberrechtsverletzung, vorherrschend sind. Die erheblichen Bewertungsunterschiede zwischen diesen Versicherungsarten weisen auf die unterschiedlichen Risikowahrnehmungen und Anforderungen von Unternehmen in Bezug auf Cyber-Bedrohungen hin und führen so zu einer Weiterentwicklung der Marktsegmentierung für Drittanbieter-Cyber-Versicherungen, die die Notwendigkeit maßgeschneiderter Versicherungsprodukte unterstreicht, die spezifische Cyber-Risiken adressieren zunehmend digitale Welt. Die zugrunde liegenden Trends in diesem Markt zeigen eine steigende Nachfrage nicht nur nach einer umfassenderen Deckung, sondern auch nach spezialisierteren Lösungen, die mit der sich ständig weiterentwickelnden Bedrohungslandschaft Schritt halten können, was für Versicherer in der Zukunft sowohl Herausforderungen als auch Chancen mit sich bringt.

Quelle: Primärforschung, Sekundärforschung, MRFR-Datenbank und Analystenbewertung

Einblicke in die Vertriebskanäle des Cyber-Versicherungsmarktes von Drittanbietern

Der Markt für Drittanbieter-Cyberversicherungen verzeichnet ein robustes Wachstum mit einer bemerkenswerten Bewertung von 7,03 Milliarden US-Dollar 2023. Dieses Wachstum ist auf die zunehmende Abhängigkeit von der digitalen Infrastruktur und das erhöhte Risiko von Cyber-Bedrohungen zurückzuführen, was die Nachfrage nach Versicherungslösungen ankurbelt. Die Vertriebskanäle spielen eine entscheidende Rolle, um potenzielle Kunden effektiv zu erreichen. Zu den wichtigsten Kanälen gehören Online-Plattformen, die Zugänglichkeit und Komfort bieten und einen erheblichen Marktanteil erobern. Maklerunternehmen spielen auch eine wesentliche Rolle bei der Bereitstellung personalisierter Dienstleistungen und Erfahrungrise an Kunden. Der Direktvertrieb hat an Bedeutung gewonnen, da Unternehmen ihre Beziehungen direkt verwalten möchten, während Agenten lokales Wissen und eine persönliche Note bieten, die viele Kunden zu schätzen wissen. Jeder Kanal geht auf unterschiedliche Kundenpräferenzen ein und erhöht so die Gesamtreichweite und Wirkung des Marktes für Drittanbieter-Cyberversicherungen. Einblicke in diese Vertriebskanäle offenbaren ihre einzigartigen Vorteile, wobei Online-Kanäle aufgrund ihrer Effizienz und Benutzerfreundlichkeit bei der Marktdurchdringung führend sind. Die Vielfalt der Vertriebsstrategien ist von entscheidender Bedeutung, da sie eine bessere Servicebereitstellung und Anpassung an verschiedene Verbraucherbedürfnisse ermöglicht und die dynamische Natur des Marktes widerspiegelt.

Einblicke in den Endverbrauchsmarkt für Cyber-Versicherungen von Drittanbietern

Der Umsatz des Drittanbieter-Cyberversicherungsmarktes spiegelt erhebliche Wachstumstrends in verschiedenen Endverbrauchskategorien wider, mit a Marktbewertung von 7,03 Milliarden USD im Jahr 2023. In den nächsten Jahren wird erwartet, dass der Markt seinen Aufwärtstrend fortsetzt und sich auf die unterschiedlichen Bedürfnisse kleiner, mittlerer und großer Unternehmen konzentriert. Kleine Unternehmen suchen oft nach erschwinglichen und maßgeschneiderten Versicherungslösungen, um Risiken zu mindern, weshalb ihre Beteiligung an der Gesamtmarktdynamik von entscheidender Bedeutung ist. Im Gegensatz dazu investieren mittlere Unternehmen aufgrund ihrer umfangreicheren Geschäftstätigkeit und ihrer erhöhten Risikoexposition in der Regel verstärkt in umfassende Policen. Große Unternehmen dominieren den Markt aufgrund ihrer komplexen Struktur und umfangreichen Datenbestände und erfordern eine robuste Cyber-Versicherung zum Schutz vor potenziellen finanziellen Verlusten durch Sicherheitsverletzungen oder Angriffe. Die Marktstatistik für Cyber-Versicherungen von Drittanbietern unterstreicht, wie wichtig es ist, auf die spezifischen Anforderungen jeder Kategorie einzugehen, da die kontinuierliche Weiterentwicklung von Cyber-Bedrohungen die Nachfrage in allen Segmenten ankurbelt und zahlreiche Wachstumschancen schafft. Darüber hinaus wird das Marktwachstum durch zunehmende regulatorische Entwicklungen und die zunehmende Häufigkeit von Cybervorfällen vorangetrieben, die Unternehmen jeder Größe dazu zwingen, ihre Cybersicherheitsmaßnahmen zu verstehen und in sie zu investieren. Es bleiben Herausforderungen bestehen, wie die sich weiterentwickelnde Natur der Cyberrisiken und die Notwendigkeit kontinuierlicher politischer Anpassungen, um mit technologischen Veränderungen und aufkommenden Cyberbedrohungen Schritt zu halten.

Einblicke in die Marktbranche für Cyber-Versicherungen von Drittanbietern

Der Markt für Drittanbieter-Cyberversicherungen wird im Jahr 2023 voraussichtlich einen Wert von 7,03 Milliarden US-Dollar erreichen bedeutende Beiträge aus verschiedenen Branchen. Das Marktwachstum wird durch zunehmende Cyber-Bedrohungen in allen Sektoren vorangetrieben. In diesem Rahmen nimmt der Gesundheitssektor aufgrund seiner sensiblen Datenanforderungen eine kritische Position ein und ist somit ein Ziel für Cyberkriminelle. Die Finanzbranche ist gleichermaßen wichtig, da sie Finanztransaktionen und persönliche Daten schützen muss, was zu einer erhöhten Nachfrage nach maßgeschneiderten Versicherungslösungen führt. Auch im Einzelhandelssegment besteht aufgrund der Zunahme des E-Commerce und digitaler Transaktionen ein erheblicher Bedarf an Cyber-Versicherungen, um Verlusten durch Datenschutzverletzungen vorzubeugen. Die Fertigung entwickelt sich durch IoT-Integrationen weiter und erhöht dadurch die Risiken, bei denen eine Cyberversicherung unerlässlich wird. Der Transportbereich, der sich durch zunehmende Konnektivität auszeichnet, steht vor besonderen Herausforderungen, die eine robuste Cyber-Abdeckung erfordern. Jede Branche veranschaulicht einen entscheidenden Aspekt der Marktstatistik für Cyberversicherungen von Drittanbietern und spiegelt das dynamische Zusammenspiel zwischen branchenspezifischen Risiken und dem wachsenden Bedarf an umfassenden Versicherungslösungen wider, da Unternehmen versuchen, potenzielle finanzielle Verluste durch Cybervorfälle zu mindern.

Regionale Einblicke in den Cyber-Versicherungsmarkt von Drittanbietern

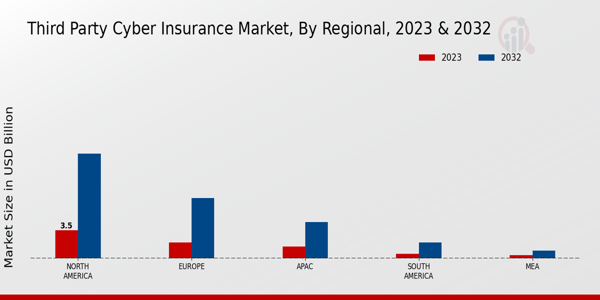

Der Markt für Drittanbieter-Cyberversicherungen verzeichnete in verschiedenen Regionen ein deutliches Wachstum mit einer Gesamtbewertung von 7,03 Milliarden US-Dollar im Jahr 2023 und prognostizierte Expansion in den kommenden Jahren. Nordamerika dominiert diesen Markt mit einem Wert von 3,5 Milliarden US-Dollar im Jahr 2023, vor allem aufgrund seiner fortschrittlichen Technologielandschaft und der zunehmenden Cyber-Bedrohungen, die den Bedarf an verbesserten Risikomanagementlösungen erhöhen. Europa folgt mit einem Wert von 2,0 Milliarden US-Dollar und profitiert von strengen Datenschutzbestimmungen, die Unternehmen dazu drängen, in Cyberversicherungen zu investieren. In der APAC-Region wird der Markt auf 1,5 Milliarden US-Dollar geschätzt, was ein schnell wachsendes Bewusstsein für Cybersicherheitsrisiken bei Unternehmen zeigt, während Südamerika und MEA auf 0,6 Milliarden US-Dollar bzw. 0,4 Milliarden US-Dollar geschätzt werden, was das Potenzial der Schwellenländer widerspiegelt, obwohl diese Regionen stellen derzeit einen kleineren Anteil am Gesamtmarkt dar. Das Gesamtwachstum ist auf die zunehmenden Cyberangriffe und die Notwendigkeit zurückzuführen, dass Unternehmen potenzielle finanzielle Verluste abmildern müssen. Die Daten deuten auf eine ausgeprägte regionale Dynamik hin, die durch technologische Fortschritte, regulatorische Rahmenbedingungen und wachsendes Bewusstsein angetrieben wird, wobei Nordamerika den größten Marktanteil hält und den Weg zu einer robusteren Cyber-Versicherungslandschaft anführt.

Quelle: Primärforschung, Sekundärforschung, MRFR-Datenbank und Analystenbewertung

Hauptakteure und Wettbewerbseinblicke auf dem Cyber-Versicherungsmarkt von Drittanbietern

Der Markt für Drittanbieter-Cyberversicherungen verzeichnet ein erhebliches Wachstum, da Unternehmen zunehmend die Notwendigkeit erkennen, sich selbst zu schützen gegen die Risiken, die mit Cyber-Vorfällen einhergehen. Dieser Markt zeichnet sich durch eine sich schnell entwickelnde Landschaft aus, die durch technologische Fortschritte und eine zunehmende Häufigkeit von Cyberangriffen geprägt ist, was zu einem erhöhten Bewusstsein bei Unternehmen für die Notwendigkeit eines umfassenden Versicherungsschutzes führt. Wettbewerbseinblicke in diesem Bereich verdeutlichen die laufenden Innovationen, strategischen Partnerschaften und die Produktdiversifizierung, die darauf abzielen, den dynamischen Anforderungen von Unternehmen gerecht zu werden. Da verschiedene Akteure ihre Marktposition ausbauen wollen, konzentrieren sie sich darauf, ihre Angebote auf unterschiedliche Sektoren zuzuschneiden und Mechanismen zu entwickeln, um den Underwriting-Prozess zu verbessern und das Schadenmanagement als Reaktion auf die breiteren Marktanforderungen zu rationalisieren.

Zurich Insurance hat sich durch die Nutzung seines umfangreichen Angebots als bedeutender Akteur auf dem Markt für Cyber-Drittversicherungen etabliert Expertise und Präsenz in der Versicherungsbranche. Das Unternehmen verfügt über ein starkes Fundament, das auf jahrzehntelanger Erfahrung im Risikomanagement aufbaut und es ihm ermöglicht, maßgeschneiderte Versicherungslösungen anzubieten, die den einzigartigen Herausforderungen gerecht werden, mit denen Unternehmen in der digitalen Landschaft konfrontiert sind. Die Stärken von Zurich Insurance liegen in ihren robusten Underwriting-Fähigkeiten, ihrer umfassenden Kenntnis der branchenspezifischen Bedürfnisse und ihrem Engagement für die Bereitstellung proaktiver Risikominderungsstrategien. Dank seiner globalen Präsenz kann Zurich Kunden weltweit unterstützen und ihnen dabei helfen, sich in einem komplexen regulatorischen Umfeld zurechtzufinden, während gleichzeitig sichergestellt wird, dass sie über eine angemessene Absicherung gegen Cyber-Risiken Dritter verfügen. Durch die Konzentration auf kundenorientierte Lösungen und Investitionen in fortschrittliche Analysen und Technologie bleibt Zurich Insurance in diesem sich ständig weiterentwickelnden Markt wettbewerbsfähig und relevant.

Swiss Re ist ein weiterer wichtiger Konkurrent auf dem Markt für Cyber-Drittversicherungen und bekannt für seine starken Rückversicherungskapazitäten und innovativer Ansatz zur Cyber-Risikobewertung. Das Unternehmen verfügt über ein umfassendes Verständnis neuer Cyber-Bedrohungen und ist daher in der Lage, anspruchsvolle Versicherungsprodukte anzubieten, die auf verschiedene Branchen zugeschnitten sind. Die Stärken von Swiss Re basieren auf ihren umfangreichen Datenanalyse-Frameworks und Risikomodellierungsfunktionen, die eine genaue Risikobewertung und Preisstrategien ermöglichen. Darüber hinaus fördert das Unternehmen die Zusammenarbeit mit Kunden, um deren Risikomanagementpraktiken zu verbessern und sicherzustellen, dass sie besser auf potenzielle Cybervorfälle vorbereitet sind. Durch die kontinuierliche Weiterentwicklung ihrer Angebote zur Anpassung an die besonderen Anforderungen verschiedener Branchen und den Einsatz modernster Technologien etabliert sich Swiss Re als führender Anbieter nachhaltiger Cyber-Versicherungslösungen, insbesondere im Zusammenhang mit Risiken Dritter. Sein Engagement für Innovation und sein Fokus auf umfassende Kundenbeziehungen haben Swiss Re in der Wettbewerbsdynamik des Marktes gut positioniert.

Zu den wichtigsten Unternehmen im Markt für Drittanbieter-Cyberversicherungen gehören

- Zurich Insurance

- Swiss Re

- Argo-Gruppe

- Markel

- Liberty Mutual

- Berkshire Hathaway

- Lloyd's

- AIG

- CNA

- Hiscox

- AXA

- Munich Re

- Beazley

- Reisende

- Chubb

Entwicklungen in der Cyber-Versicherungsmarktbranche von Drittanbietern

Die jüngsten Entwicklungen im Markt für Drittanbieter-Cyberversicherungen spiegeln einen robusten Wachstumskurs bei den wichtigsten Akteuren wider. Große Unternehmen wie Zurich Insurance und AIG haben ihr Cyber-Angebot als Reaktion auf die steigende Nachfrage nach Cybersicherheitsversicherungen erweitert. Bemerkenswert ist, dass Berkshire Hathaway auch seine Produktpalette für Cyberversicherungen erweitert hat, um eine breite Palette von Branchen abzudecken. Der Markt erlebt erhebliche Bewertungen, wobei Spieler wie Chubb und Hiscox Subs meldenein erhebliches Wachstum der Prämieneinnahmen, das vor allem auf die zunehmende Häufigkeit von Cyber-Vorfällen zurückzuführen ist. Darüber hinaus kam es zu bemerkenswerten Fusionen und Übernahmen, wobei die Argo Group eine führende Cybersicherheitsplattform erwarb, um ihr Produktangebot und ihre Marktreichweite zu stärken. Unterdessen arbeiten Liberty Mutual und Markel gemeinsam an innovativen Risikomanagementstrategien, die darauf abzielen, die Schwachstellen der Kunden zu verringern. Unternehmen wie Munich Re und AXA verbessern ihre Underwriting-Prozesse kontinuierlich, um Risiken im Zusammenhang mit Cyber-Bedrohungen besser einschätzen zu können. Diese Hektik an Aktivitäten unterstreicht die sich entwickelnde Landschaft der Cyber-Versicherung, in der sich etablierte Unternehmen wettbewerbsfähig positionieren, was letztendlich zu einem dynamischeren und widerstandsfähigeren Markt führt.

Einblicke in die Marktsegmentierung von Cyber-Versicherungen Dritter - Aussicht auf den Marktabdeckungstyp für Cyber-Versicherungen von Drittanbietern /li

- Haftung für Datenschutzverletzungen

- Haftung zur Netzwerksicherheit

- Cyber-Erpressung

- Geschäftsunterbrechung

- Medienhaftung

- Ausblick auf den Vertriebskanal des Drittanbieter-Cyberversicherungsmarktes /li

- Online

- Brokerages

- Direktvertrieb

- Agenten

- Endverwendungsausblick für den Markt für Cyberversicherungen von Drittanbietern /li

- Kleine Unternehmen

- Mittelgroße Unternehmen

- Große Unternehmen

- Ausblick auf die Branche der Drittanbieter-Cyberversicherungsmärkte /li

- Gesundheitswesen

- Finanzen

- Einzelhandel

- Herstellung

- Transportation

- Regionaler Ausblick für den Cyber-Versicherungsmarkt von Drittanbietern

- Nordamerika

- Europa

- Südamerika

- Asien-Pazifik

- Naher Osten und Afrika

- Haftung für Datenschutzverletzungen

- Haftung zur Netzwerksicherheit

- Cyber-Erpressung

- Geschäftsunterbrechung

- Medienhaftung

- Online

- Brokerages

- Direktvertrieb

- Agenten

- Kleine Unternehmen

- Mittelgroße Unternehmen

- Große Unternehmen

- Gesundheitswesen

- Finanzen

- Einzelhandel

- Herstellung

- Transportation

- Nordamerika

- Europa

- Südamerika

- Asien-Pazifik

- Naher Osten und Afrika

FAQs

What is the projected market valuation of the Third-Party Cyber Insurance Market by 2035?

The projected market valuation for the Third-Party Cyber Insurance Market is 43.99 USD Billion by 2035.

What was the market valuation of the Third-Party Cyber Insurance Market in 2024?

The overall market valuation was 9.327 USD Billion in 2024.

What is the expected CAGR for the Third-Party Cyber Insurance Market during the forecast period 2025 - 2035?

The expected CAGR for the Third-Party Cyber Insurance Market during the forecast period 2025 - 2035 is 15.14%.

Which companies are considered key players in the Third-Party Cyber Insurance Market?

Key players in the market include AIG, Chubb, AXA, Zurich Insurance Group, Beazley, CNA Financial, Liberty Mutual, Travelers, and Hiscox.

What are the main coverage types in the Third-Party Cyber Insurance Market and their valuations?

Main coverage types include Data Breach Liability valued at 12.0 USD Billion and Network Security Liability at 9.0 USD Billion by 2035.

How does the distribution channel impact the Third-Party Cyber Insurance Market?

The distribution channel shows Online sales projected at 12.0 USD Billion and Brokerages at 15.0 USD Billion by 2035.

What is the market segmentation by end use for the Third-Party Cyber Insurance Market?

Market segmentation by end use indicates Large Enterprises could reach 24.99 USD Billion by 2035.

Which industry verticals are expected to drive growth in the Third-Party Cyber Insurance Market?

Industry verticals such as Finance and Transportation are projected to reach 10.0 USD Billion and 15.5 USD Billion respectively by 2035.

What is the significance of the Business Interruption coverage in the market?

Business Interruption coverage is projected to grow to 10.0 USD Billion by 2035, indicating its critical role in the market.

How do small and medium enterprises contribute to the Third-Party Cyber Insurance Market?

Small Enterprises are expected to grow to 7.0 USD Billion and Medium Enterprises to 12.0 USD Billion by 2035, highlighting their contribution.

Bitte füllen Sie das folgende Formular aus, um ein kostenloses Muster dieses Berichts zu erhalten

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”