Third Party Cyber Insurance Market

Informe de investigación de mercado de seguros cibernéticos de terceros por tipo de cobertura (responsabilidad por vulneración de datos, responsabilidad por seguridad de la red, extorsión cibernética, interrupción del negocio, responsabilidad de los medios), por canal de distribución (en línea, corretaje, ventas directas, agentes), por uso final (pequeñas empresas, medianas empresas, grandes empresas), por sectores verticales (atención médica, finanzas, venta minorista, fabricación, transporte) y por región (América del Norte, Europa, América del Sur, Asia Pacífico, Medio Oriente y África): pronóstico para 2034

Descripción general del mercado de seguros cibernéticos de terceros

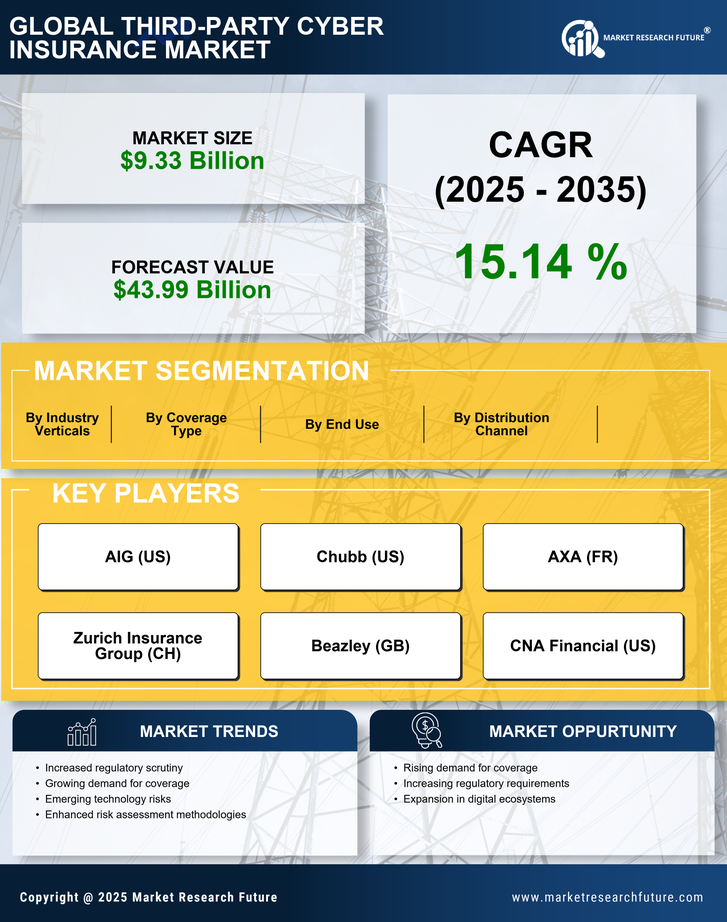

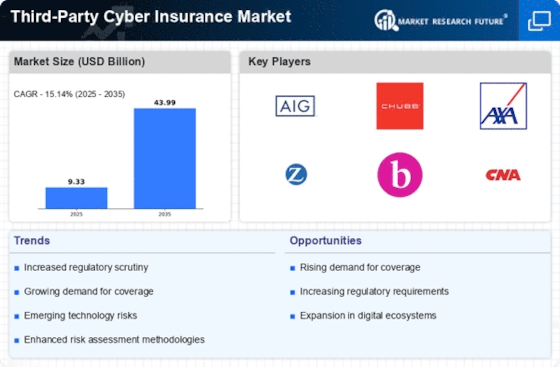

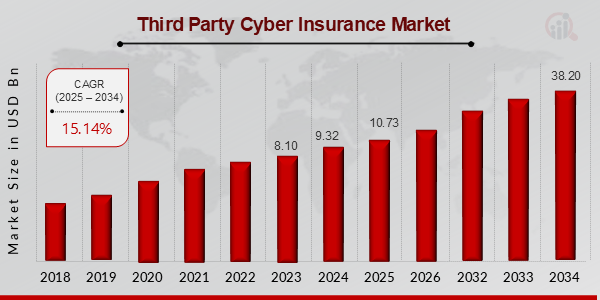

Según el análisis de MRFR, el tamaño del mercado de seguros cibernéticos de terceros se estimó en 6,11 (miles de millones de dólares) en 2022. Se espera que la industria del mercado de seguros cibernéticos de terceros crezca de 7,03 (miles de millones de dólares) en 2023 a 25,0 (miles de millones de dólares) en 2032. Se espera que la CAGR (tasa de crecimiento) del mercado de seguros cibernéticos de terceros sea alrededor del 15,14% durante el período previsto (2024 - 2032).

Se destacan las principales tendencias del mercado de seguros cibernéticos de terceros /

El mercado de seguros cibernéticos de terceros está experimentando un crecimiento significativo impulsado por las crecientes amenazas cibernéticas y la creciente conciencia de las implicaciones financieras de las violaciones de datos. A medida que las empresas se vuelven más dependientes de las plataformas digitales, los costos potenciales asociados con los ataques cibernéticos, incluidos honorarios legales, multas regulatorias y daños a la reputación, han llevado a las organizaciones a buscar cobertura. El impulso para el cumplimiento de las normas de protección de datos enfatiza aún más la necesidad de soluciones de seguros sólidas para mitigar los riesgos. Las aseguradoras están adaptando sus ofertas para enfrentar los desafíos únicos que enfrentan las diferentes industrias, lo que permite una cobertura personalizada que aborda vulnerabilidades específicas.

Este mercado tiene un considerable potencial sin explotar, especialmente porque empresas como las pymes, que durante mucho tiempo han estado contratando seguros cibernéticos a la ligera, están empezando a apreciar su necesidad. A medida que se generaliza la adopción de la IA y el aprendizaje automático en las soluciones de ciberseguridad, existen oportunidades para que las aseguradoras se asocien en la optimización de sus marcos de evaluación de riesgos. Además, dado que trabajar desde casa se está convirtiendo en la nueva normalidad, existe una fuerte demanda de colocación de riesgos gratuita con riesgos adicionales incorporados que vienen con un entorno operativo descentralizado. Las aseguradoras pueden aprovechar estos cambios desarrollando nuevos productos que aborden las necesidades de los clientes. necesidades cambiantes, creando así nuevas oportunidades de negocio.

Recientemente, los proveedores del mercado de seguros cibernéticos se han estado alineando más con los proveedores de seguridad cibernética y hay una tendencia visible hacia aumento de asociaciones. El objetivo de esta modalidad colaborativa es brindar soluciones óptimas, enfoques que brinden cobertura y agreguen valor a las medidas de protección. Por lo tanto, el énfasis en la gestión de riesgos y su prevención indica el énfasis en pasar de respuestas ex post a enfoques ex ante. A medida que el sector global de ciberseguros de terceros se adapta a través del cambio, un mejor conocimiento de las amenazas va de la mano con la necesidad de políticas más amplias y personalizadas para el futuro de este mercado.

Fuente: Investigación primaria, Investigación secundaria, Base de datos MRFR y revisión de analistas

Impulsores del mercado de seguros cibernéticos de terceros

Mayor frecuencia y sofisticación de los ataques cibernéticos

El aumento en la frecuencia y la sofisticación de los ciberataques es un factor fundamental para el seguro cibernético de terceros Industria del mercado. A medida que las empresas dependen cada vez más de plataformas digitales para sus operaciones, se vuelven más susceptibles a diversas amenazas cibernéticas, incluidos ransomware, filtraciones de datos y ataques de phishing. Esta escalada de incidentes cibernéticos no sólo pone en peligro los datos confidenciales de la empresa y la información personal de los clientes, sino que también plantea un riesgo significativo para la estabilidad financiera y la reputación. Las organizaciones están empezando a darse cuenta de que las pólizas de seguro tradicionales a menudo no protegen contra estos riesgos únicos, lo que lleva a un mayor riesgo. demanda de ciberseguros especializados. En los últimos años, ataques notables de alto perfil han mostrado las posibles consecuencias financieras de subestimar las vulnerabilidades de la ciberseguridad. Además, el costo promedio de estos incidentes está aumentando, lo que presiona a las entidades corporativas a buscar soluciones integrales para protegerse contra pérdidas financieras imprevistas asociadas con responsabilidades cibernéticas. A medida que crece la conciencia sobre estos riesgos, las empresas reconocen que invertir en ofertas del mercado de seguros cibernéticos de terceros ya no es opcional sino más bien un componente crítico de su estrategia de gestión de riesgos. En consecuencia, anticipamos un crecimiento sostenido en este mercado a medida que las organizaciones priorizan cada vez más la necesidad de contar con pólizas de seguro cibernético sólidas para mitigar los posibles daños derivados de las amenazas cibernéticas.

Requisitos de cumplimiento y presión regulatoria

La presión regulatoria y los requisitos de cumplimiento están impulsando cada vez más la industria del mercado de seguros cibernéticos de terceros. Dado que varios gobiernos y organismos reguladores exigen leyes de protección de datos y estándares de cumplimiento más estrictos, las empresas deben asegurarse de estar adecuadamente protegidas contra posibles responsabilidades cibernéticas. El incumplimiento de estas regulaciones puede dar lugar a graves sanciones financieras y daños a la reputación, lo que lleva a las organizaciones a buscar soluciones especializadas en seguros cibernéticos. Este creciente énfasis en el cumplimiento no solo mejora el valor percibido de los productos de seguros cibernéticos sino que también fomenta la confianza del consumidor en las empresas que demuestran una enfoque proactivo para gestionar los riesgos cibernéticos.

Creciente conciencia sobre los riesgos cibernéticos entre las empresas

La creciente conciencia sobre los riesgos cibernéticos entre las empresas está fomentando un enfoque proactivo para la gestión de riesgos, que sirve como clave impulsor de la industria del mercado de seguros cibernéticos de terceros. Los líderes empresariales están cada vez más informados sobre las posibles consecuencias de las amenazas cibernéticas y las consiguientes responsabilidades financieras en las que pueden incurrir. Este nuevo entendimiento conduce a la voluntad de explorar opciones de seguros cibernéticos dedicados que brinden cobertura contra filtraciones de datos inesperadas e incidentes cibernéticos. A medida que las organizaciones reconozcan la importancia de salvaguardar sus activos, se espera que la demanda de soluciones del mercado de seguros cibernéticos de terceros continúe a un ritmo acelerado. trayectoria ascendente.

Perspectivas del segmento de mercado de seguros cibernéticos de terceros Información sobre el tipo de cobertura del mercado de seguros cibernéticos de terceros

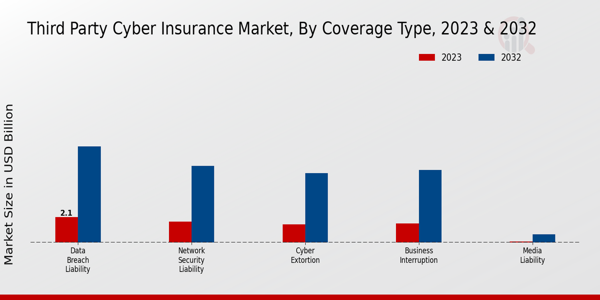

El mercado de seguros cibernéticos de terceros está experimentando un crecimiento significativo, impulsado principalmente por la creciente frecuencia y sofisticación de los Amenazas cibernéticas a las que se enfrentan las empresas hoy en día. A partir de 2023, el mercado está valorado en 7,03 mil millones de dólares y se prevé que alcance los 25,0 mil millones de dólares en 2032, exhibiendo una trayectoria de crecimiento convincente. Dentro de este panorama, el segmento de Tipo de Cobertura juega un papel vital en la definición del valor y la idoneidad de los productos de seguros para diversas empresas, reflejando riesgos específicos asociados con incidentes cibernéticos. Entre las diferentes áreas de cobertura, destaca Responsabilidad por Violación de Datos con una valoración de 2,1 mil millones de dólares en 2023, expandiéndose a 8,04 mil millones de dólares en 2032, manteniendo así una parte importante de la cuota de mercado.

Este subsegmento domina debido a la necesidad crítica de que las organizaciones gestionen las consecuencias financieras de las filtraciones de datos. lo que puede afectar la confianza del consumidor y generar costos legales sustanciales. De manera similar, la responsabilidad por la seguridad de la red asciende a 1,75 mil millones de dólares en 2023, y se prevé que crezca a 6,42 mil millones de dólares en 2032, lo que refleja las crecientes presiones sobre las empresas para salvaguardar sus redes contra ataques y accesos no autorizados. La ciberextorsión, valorada en 1,5 mil millones de dólares en 2023 y que se prevé que alcance los 5,8 mil millones de dólares en 2032, enfatiza la amenaza real que enfrentan las empresas debido a los ataques de ransomware, subrayando la necesidad de una cobertura en esta área que pueda proporcionar recursos esenciales para combatir tales amenazas. lapso

El segmento de Interrupción de Negocios, con un valor inicial de 1,6 mil millones de dólares en 2023, aumentará a 6,06 mil millones de dólares en 2032, es fundamental para las organizaciones, ya que protege contra posibles pérdidas de ingresos debido a incidentes cibernéticos que provocan tiempos de inactividad. Por último, la Responsabilidad de los Medios, aunque tiene una valoración menor de 0,08 mil millones de dólares en 2023 y un aumento a 0,68 mil millones de dólares en 2032, proporciona una protección vital en el panorama digital actual, donde prevalecen los riesgos de contenido, incluida la difamación y la infracción de derechos de autor. La distinción significativa en las valoraciones entre estos tipos de coberturas indica las diferentes percepciones de riesgo y requisitos que tienen las empresas con respecto a las amenazas cibernéticas, lo que evoluciona la segmentación general del mercado de seguros cibernéticos de terceros, lo que destaca la necesidad de productos de seguros personalizados que aborden riesgos cibernéticos específicos de una manera mundo cada vez más digital. Las tendencias subyacentes en este mercado muestran una demanda creciente no solo de una cobertura más amplia sino también de soluciones más especializadas que puedan seguir el ritmo del panorama de amenazas en constante evolución, presentando desafíos y oportunidades para las aseguradoras en el futuro.

Fuente: Investigación primaria, Investigación secundaria, Base de datos MRFR y revisión de analistas

Información sobre el canal de distribución del mercado de seguros cibernéticos de terceros

El mercado de seguros cibernéticos de terceros está experimentando un crecimiento sólido, con una valoración notable de 7.030 millones de dólares en 2023. Este crecimiento puede atribuirse a una creciente dependencia de la infraestructura digital y al mayor riesgo de amenazas cibernéticas, lo que impulsa la demanda de soluciones de seguros. Los canales de distribución desempeñan un papel fundamental a la hora de llegar eficazmente a los clientes potenciales. Los canales clave incluyen plataformas en línea, que ofrecen accesibilidad y conveniencia, obteniendo una participación significativa del mercado. Las corredurías también desempeñan un papel esencial a la hora de ofrecer un servicio y una experiencia personalizados.rtise a los clientes. Las ventas directas han ganado terreno a medida que las empresas buscan gestionar las relaciones directamente, mientras que los agentes ofrecen conocimientos localizados y un toque personal que muchos clientes aprecian. Cada canal atiende a las diferentes preferencias de los clientes, mejorando así el alcance y el impacto generales del mercado de seguros cibernéticos de terceros. Los conocimientos sobre estos canales de distribución revelan sus ventajas únicas, siendo los canales en línea los que lideran la penetración en el mercado debido a su eficiencia y facilidad de uso. La diversidad en las estrategias de distribución es crucial, ya que permite una mejor prestación de servicios y la adaptación a las diversas necesidades de los consumidores, reflejando la naturaleza dinámica del mercado.

Perspectivas sobre el uso final del mercado de seguros cibernéticos de terceros

Los ingresos del mercado de seguros cibernéticos de terceros reflejan tendencias de crecimiento significativas en varias categorías de uso final, con un valoración de mercado de 7.030 millones de dólares en 2023. En los próximos años, se espera que el mercado continúe su trayectoria ascendente, centrándose en las diversas necesidades de las pequeñas, medianas y grandes empresas. Las pequeñas empresas suelen buscar soluciones de seguros asequibles y personalizadas para mitigar los riesgos, lo que hace que su participación sea crucial en la dinámica general del mercado. Por el contrario, las medianas empresas suelen demostrar una mayor inversión en políticas integrales, dadas sus operaciones más extensas y su mayor exposición al riesgo. Las grandes empresas dominan el mercado debido a su compleja estructura y sus importantes activos de datos, lo que requiere un seguro cibernético sólido para protegerse contra posibles pérdidas financieras por infracciones o ataques. Las estadísticas del mercado de seguros cibernéticos de terceros resaltan la importancia de abordar los requisitos específicos de cada categoría, ya que la evolución continua de las amenazas cibernéticas impulsa la demanda en todos los segmentos, creando amplias oportunidades de crecimiento. Además, el crecimiento del mercado está impulsado por los crecientes avances regulatorios y la creciente frecuencia de los incidentes cibernéticos, que obligan a las empresas de todos los tamaños a comprender e invertir en sus medidas de ciberseguridad. Quedan desafíos, como la naturaleza cambiante de los riesgos cibernéticos y la necesidad de adaptaciones políticas continuas para seguir el ritmo de los cambios tecnológicos y las amenazas cibernéticas emergentes.

Perspectivas verticales de la industria del mercado de seguros cibernéticos de terceros

El mercado de seguros cibernéticos de terceros alcanzará una valoración de 7,03 mil millones de dólares en 2023, con contribuciones significativas de varios sectores verticales de la industria. El crecimiento del mercado está impulsado por el aumento de las amenazas cibernéticas en todos los sectores. En este marco, el sector sanitario ocupa una posición crítica debido a sus necesidades de datos sensibles, lo que lo convierte en un objetivo para los ciberdelincuentes. La industria financiera es igualmente importante, dada la necesidad de proteger las transacciones financieras y la información personal, lo que genera una mayor demanda de soluciones de seguros personalizadas. El segmento minorista, impulsado por el auge del comercio electrónico y las transacciones digitales, también ha sido testigo de una necesidad sustancial de seguros cibernéticos para contrarrestar las pérdidas por filtraciones de datos. La fabricación está evolucionando con las integraciones de IoT, amplificando así los riesgos donde el seguro cibernético se vuelve esencial. El transporte, caracterizado por una conectividad cada vez mayor, enfrenta desafíos únicos que requieren una cobertura cibernética sólida. Cada vertical ejemplifica un aspecto crucial de las estadísticas del mercado de seguros cibernéticos de terceros, lo que refleja la interacción dinámica entre los riesgos específicos de la industria y la creciente necesidad de soluciones de seguros integrales a medida que las organizaciones buscan mitigar las posibles pérdidas financieras derivadas de incidentes cibernéticos.

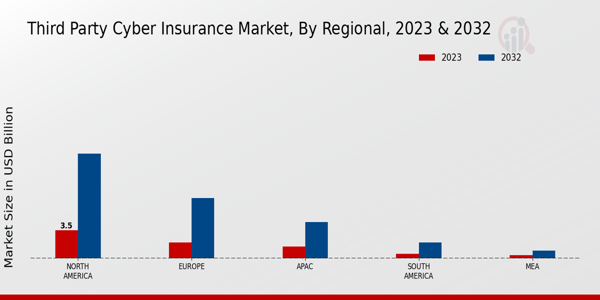

Perspectivas regionales del mercado de seguros cibernéticos de terceros lapso

El mercado de seguros cibernéticos de terceros ha mostrado un crecimiento significativo en varias regiones, con una valoración total de 7,03 Miles de millones de dólares en 2023 y expansión proyectada en los próximos años. América del Norte domina este mercado, valorado en 3.500 millones de dólares en 2023, principalmente debido a su panorama tecnológico avanzado y las crecientes amenazas cibernéticas, que impulsan la necesidad de mejores soluciones de gestión de riesgos. Le sigue Europa, con una valoración de 2.000 millones de dólares, beneficiándose de estrictas normas de protección de datos que instan a las empresas a invertir en seguros cibernéticos. En la región APAC, el mercado está valorado en 1,5 mil millones de dólares, lo que muestra una conciencia cada vez mayor sobre los riesgos de ciberseguridad entre las organizaciones, mientras que América del Sur y MEA están valorados en 600 millones de dólares y 0,4 mil millones de dólares, respectivamente, lo que refleja el potencial de los mercados emergentes, aunque estos Las regiones representan actualmente una porción menor del mercado total. El crecimiento general se atribuye al aumento de los ciberataques y a la necesidad de que las empresas mitiguen las posibles pérdidas financieras. Los datos indican una dinámica regional distinta impulsada por los avances tecnológicos, los marcos regulatorios y la creciente conciencia, con América del Norte manteniendo la participación de mercado mayoritaria y liderando el avance hacia un panorama de seguros cibernéticos más sólido.

Fuente: Investigación primaria, Investigación secundaria, Base de datos MRFR y revisión de analistas

Participantes clave del mercado de seguros cibernéticos de terceros e información competitiva

El mercado de seguros cibernéticos de terceros ha experimentado un crecimiento significativo a medida que las organizaciones reconocen cada vez más la necesidad de protegerse contra los riesgos asociados a los ciberincidentes. Este mercado se caracteriza por un panorama en rápida evolución moldeado por los avances tecnológicos y una frecuencia cada vez mayor de ataques cibernéticos, lo que lleva a una mayor conciencia entre las empresas sobre la necesidad de una cobertura de seguro integral. Los conocimientos competitivos dentro de este espacio destacan las innovaciones en curso, las asociaciones estratégicas y la diversificación de productos destinadas a satisfacer las necesidades dinámicas de las empresas. A medida que varios actores buscan mejorar su posición en el mercado, se están enfocando en adaptar sus ofertas para atender a diversos sectores y desarrollar mecanismos para mejorar el proceso de suscripción y agilizar la gestión de reclamaciones en respuesta a las demandas más amplias del mercado.

Zurich Insurance se ha establecido como un actor destacado en el mercado de seguros cibernéticos de terceros aprovechando su amplia Experiencia y presencia en el sector asegurador. La empresa tiene una base sólida basada en décadas de experiencia en gestión de riesgos, lo que le permite ofrecer soluciones de cobertura personalizadas que abordan los desafíos únicos que enfrentan las empresas en el panorama digital. Las fortalezas de Zurich Insurance residen en sus sólidas capacidades de suscripción, su profundo conocimiento de las necesidades específicas de la industria y su compromiso de brindar estrategias proactivas de mitigación de riesgos. Su presencia global permite a Zurich brindar soporte a clientes en todo el mundo, ayudándolos a navegar en un entorno regulatorio complejo y al mismo tiempo garantizar que tengan una cobertura adecuada para los riesgos cibernéticos de terceros. Al centrarse en soluciones centradas en el cliente e invertir en tecnología y análisis avanzados, Zurich Insurance sigue siendo competitiva y relevante en este mercado en continua evolución.

Swiss Re es otro competidor clave en el mercado de seguros cibernéticos de terceros, conocido por sus sólidas capacidades de reaseguro y un enfoque innovador para la evaluación del riesgo cibernético. La compañía opera con un conocimiento integral de las amenazas cibernéticas emergentes, lo que les permite ofrecer productos de seguros sofisticados diseñados para diversas industrias. Las fortalezas de Swiss Re se basan en sus amplios marcos de análisis de datos y capacidades de modelado de riesgos, que permiten una evaluación de riesgos y estrategias de fijación de precios precisas. Además, la empresa promueve la colaboración con los clientes para mejorar sus prácticas de gestión de riesgos, garantizando que estén mejor preparados para posibles incidentes cibernéticos. Al perfeccionar continuamente su oferta para adaptarse a las demandas únicas de los diferentes sectores y emplear tecnologías de vanguardia, Swiss Re se establece como líder en el suministro de soluciones sostenibles de ciberseguros, especialmente en el contexto de riesgos de terceros. Su compromiso con la innovación, junto con un enfoque en relaciones integrales con los clientes, ha posicionado favorablemente a Swiss Re en medio de la dinámica competitiva del mercado.

Las empresas clave en el mercado de seguros cibernéticos de terceros incluyen

Desarrollos de la industria del mercado de seguros cibernéticos de terceros

Los recientes desarrollos en el mercado de seguros cibernéticos de terceros reflejan una sólida trayectoria de crecimiento entre los actores clave. Grandes empresas como Zurich Insurance y AIG han estado ampliando sus ofertas cibernéticas en respuesta a la creciente demanda de seguros de ciberseguridad. En particular, Berkshire Hathaway también ha mejorado su conjunto de productos de seguros cibernéticos, atendiendo a una amplia gama de industrias. El mercado está siendo testigo de valoraciones significativas, con jugadores como Chubb e Hiscox reportando substituciones.crecimiento potencial en los ingresos por primas, impulsado en gran medida por la creciente frecuencia de los incidentes cibernéticos. Además, ha habido fusiones y adquisiciones notables, y Argo Group adquirió una plataforma líder en ciberseguridad para reforzar su oferta de productos y su alcance en el mercado. Mientras tanto, Liberty Mutual y Markel están colaborando en estrategias innovadoras de gestión de riesgos destinadas a reducir las vulnerabilidades de los clientes. Empresas como Munich Re y AXA mejoran continuamente sus procesos de suscripción para evaluar mejor los riesgos asociados con las amenazas cibernéticas. Esta oleada de actividad subraya la evolución del panorama de los seguros cibernéticos, donde las empresas establecidas se están posicionando de manera competitiva, lo que en última instancia conduce a un mercado más dinámico y resistente.

Perspectivas de segmentación del mercado de seguros cibernéticos de terceros - Perspectiva del tipo de cobertura del mercado de seguros cibernéticos de terceros /li

- Responsabilidad por violación de datos

- Responsabilidad de seguridad de la red

- Ciberextorsión

- Interrupción del negocio

- Responsabilidad de los medios

- Perspectiva del canal de distribución del mercado de seguros cibernéticos de terceros /li

- En línea

- Corretajes

- Ventas directas

- Agentes

- Perspectiva del uso final del mercado de seguros cibernéticos de terceros /li

- Pequeñas empresas

- Medianas empresas

- Grandes empresas

- Perspectivas verticales de la industria del mercado de seguros cibernéticos de terceros /li

- Cuidado de la salud

- Finanzas

- Venta minorista

- Fabricación

- Transporte

- Perspectiva regional del mercado de seguros cibernéticos de terceros

- América del Norte

- Europa

- América del Sur

- Asia Pacífico

- Medio Oriente y África

- Responsabilidad por violación de datos

- Responsabilidad de seguridad de la red

- Ciberextorsión

- Interrupción del negocio

- Responsabilidad de los medios

- En línea

- Corretajes

- Ventas directas

- Agentes

- Pequeñas empresas

- Medianas empresas

- Grandes empresas

- Cuidado de la salud

- Finanzas

- Venta minorista

- Fabricación

- Transporte

- América del Norte

- Europa

- América del Sur

- Asia Pacífico

- Medio Oriente y África

FAQs

What is the projected market valuation of the Third-Party Cyber Insurance Market by 2035?

The projected market valuation for the Third-Party Cyber Insurance Market is 43.99 USD Billion by 2035.

What was the market valuation of the Third-Party Cyber Insurance Market in 2024?

The overall market valuation was 9.327 USD Billion in 2024.

What is the expected CAGR for the Third-Party Cyber Insurance Market during the forecast period 2025 - 2035?

The expected CAGR for the Third-Party Cyber Insurance Market during the forecast period 2025 - 2035 is 15.14%.

Which companies are considered key players in the Third-Party Cyber Insurance Market?

Key players in the market include AIG, Chubb, AXA, Zurich Insurance Group, Beazley, CNA Financial, Liberty Mutual, Travelers, and Hiscox.

What are the main coverage types in the Third-Party Cyber Insurance Market and their valuations?

Main coverage types include Data Breach Liability valued at 12.0 USD Billion and Network Security Liability at 9.0 USD Billion by 2035.

How does the distribution channel impact the Third-Party Cyber Insurance Market?

The distribution channel shows Online sales projected at 12.0 USD Billion and Brokerages at 15.0 USD Billion by 2035.

What is the market segmentation by end use for the Third-Party Cyber Insurance Market?

Market segmentation by end use indicates Large Enterprises could reach 24.99 USD Billion by 2035.

Which industry verticals are expected to drive growth in the Third-Party Cyber Insurance Market?

Industry verticals such as Finance and Transportation are projected to reach 10.0 USD Billion and 15.5 USD Billion respectively by 2035.

What is the significance of the Business Interruption coverage in the market?

Business Interruption coverage is projected to grow to 10.0 USD Billion by 2035, indicating its critical role in the market.

How do small and medium enterprises contribute to the Third-Party Cyber Insurance Market?

Small Enterprises are expected to grow to 7.0 USD Billion and Medium Enterprises to 12.0 USD Billion by 2035, highlighting their contribution.

Complete el formulario a continuación para recibir una muestra gratuita de este informe

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”