Rising Awareness of Blood Disorders

Public awareness regarding blood disorders is on the rise in France, contributing to the growth of the hematology diagnostics market. Educational campaigns and health initiatives are informing the population about the importance of early detection and regular screening for hematological conditions. This heightened awareness is likely to lead to increased testing rates, as individuals seek proactive healthcare measures. Consequently, the hematology diagnostics market is expected to experience growth, driven by the demand for accessible and reliable diagnostic services that cater to an informed public.

Advancements in Diagnostic Technologies

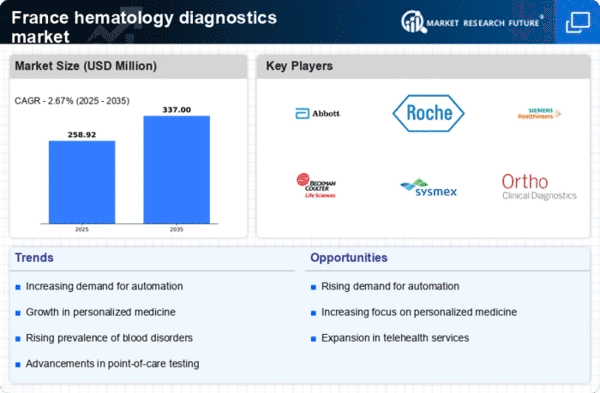

Technological innovations are significantly influencing the hematology diagnostics market. The introduction of automated analyzers and point-of-care testing devices has transformed traditional diagnostic methods, enhancing accuracy and efficiency. In France, the market for hematology analyzers is projected to reach €500 million by 2026, reflecting a compound annual growth rate (CAGR) of 6%. These advancements not only improve diagnostic capabilities but also reduce turnaround times, which is crucial in clinical settings. As healthcare facilities increasingly adopt these technologies, the hematology diagnostics market is expected to expand, catering to the evolving needs of healthcare providers.

Regulatory Support for Diagnostic Innovations

Regulatory bodies in France are increasingly supportive of innovations in the hematology diagnostics market. Streamlined approval processes for new diagnostic technologies are encouraging manufacturers to invest in research and development. This regulatory environment fosters innovation, allowing for the introduction of novel diagnostic tools that meet the evolving needs of healthcare providers. As a result, the hematology diagnostics market is likely to benefit from a surge in new product launches, enhancing the overall landscape of diagnostic solutions available to clinicians.

Growing Investment in Healthcare Infrastructure

The French government is investing heavily in healthcare infrastructure, which is likely to benefit the hematology diagnostics market. Initiatives aimed at modernizing laboratories and enhancing diagnostic capabilities are underway, with funding allocations exceeding €1 billion in recent years. This investment is expected to facilitate the adoption of advanced diagnostic technologies and improve access to hematology testing across the country. As healthcare facilities upgrade their equipment and expand their services, the hematology diagnostics market stands to gain from increased demand for comprehensive diagnostic solutions.

Increasing Prevalence of Hematological Disorders

The rising incidence of hematological disorders in France is a primary driver for the hematology diagnostics market. Conditions such as anemia, leukemia, and lymphoma are becoming more prevalent, necessitating advanced diagnostic solutions. According to recent health statistics, approximately 3 million individuals in France are affected by various blood disorders, leading to a heightened demand for effective diagnostic tools. This trend is likely to propel the market forward, as healthcare providers seek innovative technologies to enhance patient outcomes. The hematology diagnostics market is thus positioned to grow, driven by the need for accurate and timely diagnosis of these conditions.