Growth of 5G Infrastructure

The rollout of 5G infrastructure in France is set to revolutionize the internet of things market. With its high-speed connectivity and low latency, 5G technology enables a vast number of devices to connect seamlessly, enhancing the performance of IoT applications. This advancement is particularly beneficial for sectors such as transportation and healthcare, where real-time data transmission is critical. Analysts predict that the adoption of 5G could lead to a 50% increase in IoT device deployment by 2027. As 5G networks become more widespread, the internet of-things market is likely to experience unprecedented growth, facilitating the development of innovative solutions and applications.

Increased Focus on Data Security

As the internet of things market expands in France, concerns regarding data security and privacy have become paramount. With the proliferation of connected devices, the potential for cyber threats increases, prompting both consumers and businesses to prioritize security measures. Recent surveys indicate that over 70% of French consumers express concerns about the security of their personal data when using IoT devices. In response, companies are investing in advanced security protocols and solutions to safeguard user information. This heightened focus on data security not only builds consumer trust but also drives innovation within the internet of-things market, as firms seek to develop more secure and reliable products.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the internet of things market in France. The French government has launched various programs aimed at fostering innovation and supporting the development of IoT technologies. For example, the 'France 2030' plan emphasizes digital transformation across sectors, including smart cities and healthcare. This strategic focus is likely to attract investments, with an estimated €1 billion allocated to support IoT projects. Such initiatives not only enhance the technological landscape but also create a favorable environment for startups and established companies alike. Consequently, the internet of-things market is poised for accelerated growth, driven by these supportive policies.

Rising Demand for Smart Home Solutions

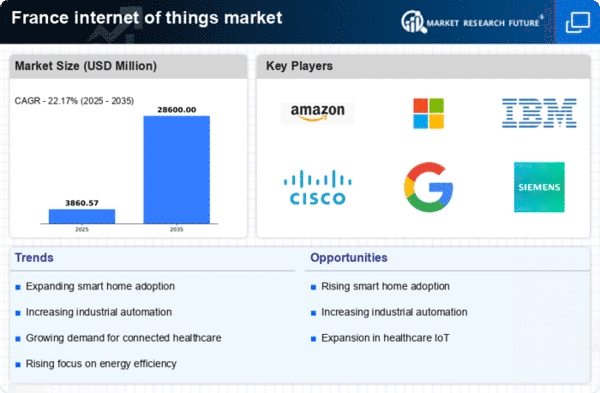

The internet of things market in France experiences a notable surge in demand for smart home solutions. This trend is driven by consumers' increasing desire for convenience, security, and energy efficiency. According to recent data, the smart home segment is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by advancements in technology, such as voice-activated devices and smart appliances, which enhance user experience. Furthermore, the integration of IoT devices in homes allows for better energy management, potentially reducing energy costs by up to 30%. As more households adopt these technologies, the internet of-things market continues to expand, reflecting a shift towards more connected living environments.

Expansion of Industrial IoT Applications

The industrial sector in France is increasingly adopting IoT technologies, which significantly impacts the internet of things market. Industries such as manufacturing, logistics, and agriculture are leveraging IoT solutions to enhance operational efficiency and reduce costs. For instance, predictive maintenance powered by IoT can decrease downtime by up to 20%, leading to substantial savings. The French government has also initiated programs to support digital transformation in industries, further driving the adoption of IoT applications. As a result, the internet of-things market is witnessing a robust growth trajectory, with industrial applications expected to account for a significant share of the overall market by 2026.