Rising Environmental Concerns

Rising environmental concerns are driving the growth of the li ion-battery-recycling market in France. With increasing awareness of the environmental impact of battery waste, consumers and businesses are seeking sustainable solutions for battery disposal. The French public is becoming more conscious of the need to recycle batteries to prevent soil and water contamination. This shift in consumer behavior is prompting manufacturers to adopt more sustainable practices, including the use of recycled materials in new battery production. As a result, the market is likely to expand, with projections indicating a potential increase in recycling rates to 60% by 2025. This heightened focus on sustainability is a key driver for the li ion-battery-recycling market.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the li ion-battery-recycling market in France. The French government has implemented various initiatives aimed at promoting recycling and reducing waste. For instance, the introduction of subsidies for recycling facilities and tax breaks for companies engaged in battery recycling has stimulated market growth. Additionally, the European Union's directives on waste management and recycling are influencing national policies, encouraging investments in recycling technologies. As a result, the market is expected to witness a surge in new recycling plants, potentially increasing the recycling rate of lithium-ion batteries to over 50% by 2030. This supportive regulatory environment is likely to enhance the attractiveness of the li ion-battery-recycling market.

Increasing Demand for Electric Vehicles

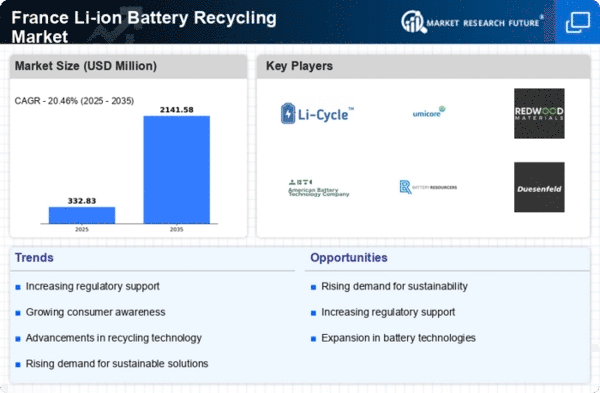

The rising demand for electric vehicles (EVs) in France is a pivotal driver for the li ion-battery-recycling market. As the French government aims to have 1 million EVs on the road by 2025, the need for efficient recycling solutions becomes paramount. With EV batteries containing valuable materials such as lithium, cobalt, and nickel, the recycling industry is poised to benefit significantly. The market is projected to grow at a CAGR of approximately 20% over the next five years, driven by the increasing number of EVs and the subsequent need for battery disposal and recycling. This trend not only supports environmental sustainability but also aligns with France's commitment to reducing carbon emissions, thereby enhancing the overall viability of the li ion-battery-recycling market.

Collaboration Between Industry Stakeholders

Collaboration between industry stakeholders is emerging as a vital driver for the li ion-battery-recycling market. Partnerships among battery manufacturers, recycling companies, and research institutions are fostering innovation and improving recycling efficiencies. In France, initiatives such as joint ventures and consortia are being established to share knowledge and resources, which could lead to the development of more effective recycling technologies. This collaborative approach is expected to enhance the overall capacity of the recycling infrastructure, potentially doubling the recycling output by 2027. As stakeholders work together to address challenges in the recycling process, the li ion-battery-recycling market is likely to experience robust growth.

Technological Advancements in Recycling Processes

Technological advancements in recycling processes are significantly impacting the li ion-battery-recycling market. Innovations such as hydrometallurgical and pyrometallurgical methods are improving the efficiency of material recovery from spent batteries. These technologies enable the extraction of critical materials with higher purity and lower environmental impact. In France, research institutions and private companies are collaborating to develop more sustainable recycling methods, which could reduce processing costs by up to 30%. As these technologies become more widely adopted, they are expected to enhance the competitiveness of the li ion-battery-recycling market, making it a more attractive option for manufacturers and consumers alike.