Technological Advancements

Technological advancements are significantly influencing the micro mobility market in France. Innovations in battery technology, GPS tracking, and mobile applications enhance the user experience and operational efficiency of micro mobility solutions. For instance, the introduction of smart e-scooters equipped with advanced features such as geofencing and real-time data analytics is transforming the landscape. The micro mobility market is likely to benefit from these advancements, as they improve safety and convenience for users. Moreover, the integration of artificial intelligence in fleet management systems could optimize operations, leading to reduced costs and increased service availability. This technological evolution suggests a promising future for the micro mobility market.

Urban Infrastructure Development

The development of urban infrastructure is a critical factor influencing the micro mobility market in France. Cities are increasingly investing in dedicated lanes and parking facilities for micro mobility vehicles, facilitating safer and more efficient travel. Recent reports indicate that cities like Paris have expanded their cycling lanes by over 30% in the past two years, creating a more conducive environment for micro mobility solutions. This infrastructure development not only enhances safety but also encourages the adoption of e-scooters and bikes among commuters. The micro mobility market stands to gain from these investments, as improved infrastructure is likely to lead to higher usage rates and greater acceptance of micro mobility options.

Urbanization and Population Density

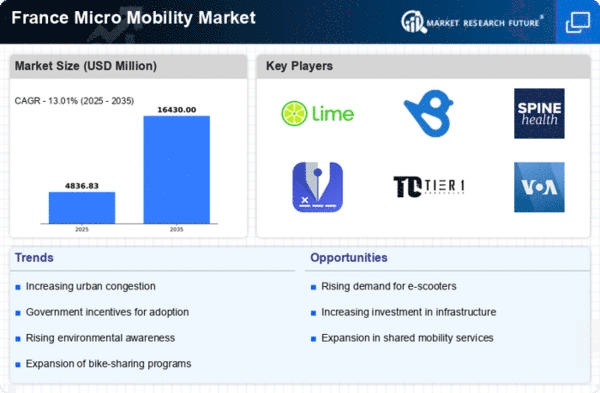

The increasing urbanization in France is a pivotal driver for the micro mobility market. As cities expand and population density rises, the demand for efficient transportation solutions intensifies. In urban areas, where traditional vehicles may face congestion, micro mobility options such as e-scooters and bikes provide a practical alternative. According to recent data, urban areas in France have seen a population growth of approximately 1.5% annually, leading to a greater need for accessible transport. This trend suggests that the micro mobility market could experience substantial growth as more individuals seek convenient and eco-friendly commuting options. The micro mobility market is thus positioned to capitalize on this urban shift, offering solutions that align with the evolving transportation needs of densely populated areas.

Government Initiatives and Regulations

Government initiatives in France play a crucial role in shaping the micro mobility market. Policies aimed at reducing carbon emissions and promoting sustainable transport are increasingly prevalent. For instance, the French government has introduced subsidies for electric vehicles and infrastructure investments to support micro mobility solutions. In 2025, the government allocated €100 million to enhance cycling infrastructure, which is expected to bolster the micro mobility market. Furthermore, regulations governing the use of e-scooters and bikes are being established to ensure safety and efficiency. These initiatives indicate a supportive environment for the micro mobility market, potentially leading to increased adoption and investment in innovative transport solutions.

Environmental Awareness and Consumer Preferences

Growing environmental awareness among consumers is a significant driver for the micro mobility market in France. As individuals become more conscious of their carbon footprint, there is a noticeable shift towards sustainable transportation options. Surveys indicate that approximately 70% of French consumers express a preference for eco-friendly transport solutions, which bodes well for the micro mobility market. This trend is further supported by the increasing availability of electric scooters and bikes, which align with consumer values. The micro mobility market is thus likely to see a surge in demand as more people opt for greener commuting alternatives, reflecting a broader societal shift towards sustainability.